Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Allison has a golden goose that will lay an egg every year until forever. The first egg will be out next year, and each egg

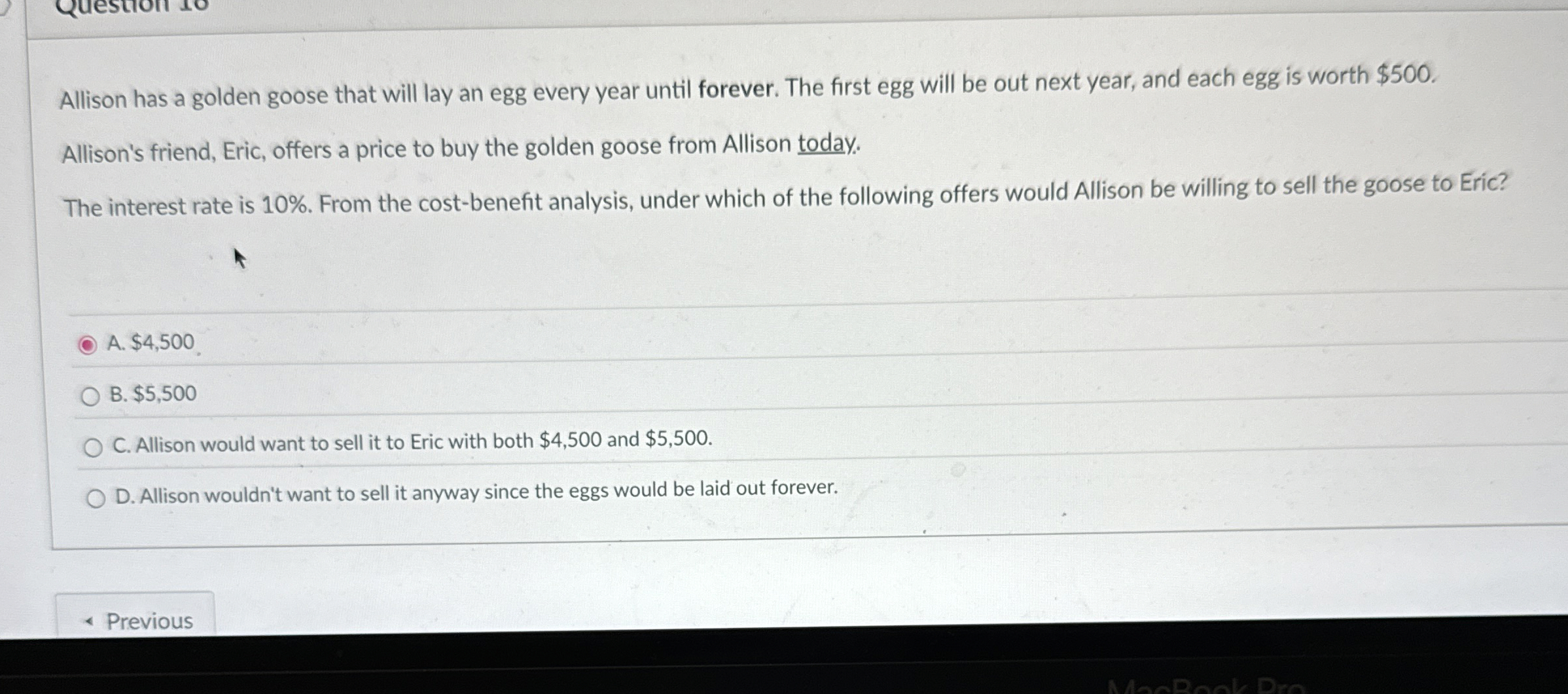

Allison has a golden goose that will lay an egg every year until forever. The first egg will be out next year, and each egg is worth $

Allison's friend, Eric, offers a price to buy the golden goose from Allison today.

The interest rate is From the costbenefit analysis, under which of the following offers would Allison be willing to sell the goose to Eric?

A $

B $

C Allison would want to sell it to Eric with both $ and $

D Allison wouldn't want to sell it anyway since the eggs would be laid out forever.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started