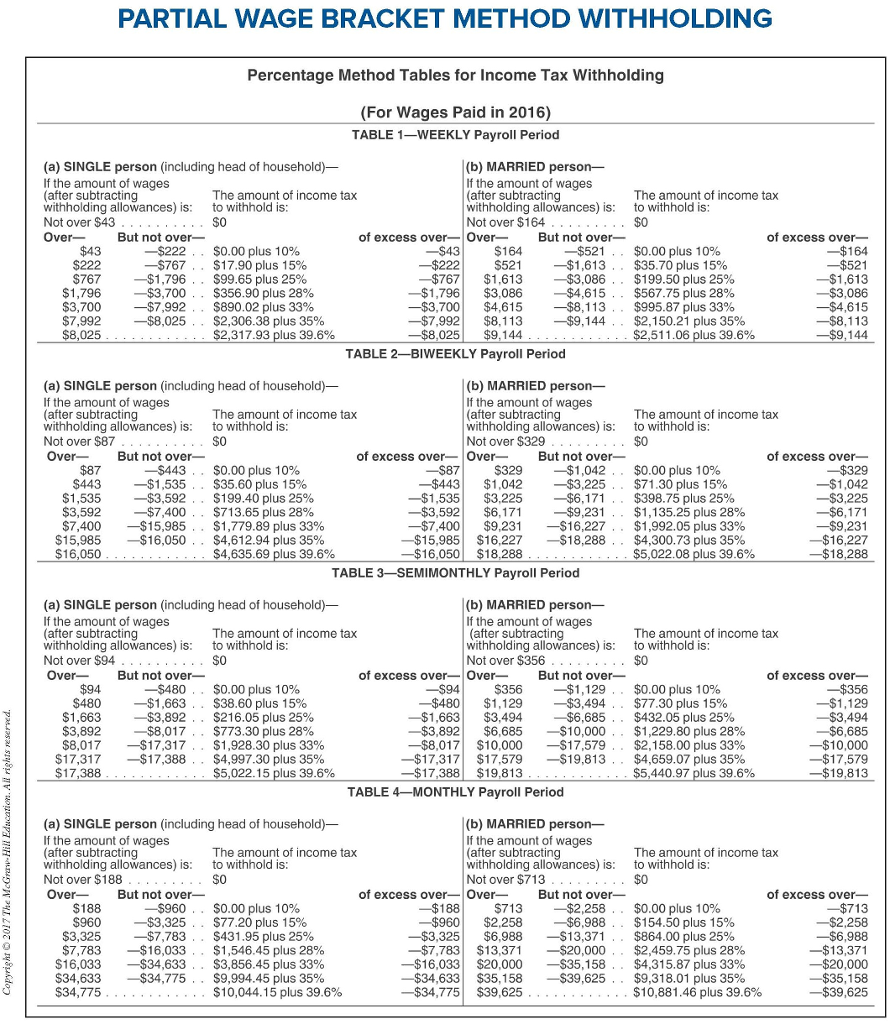

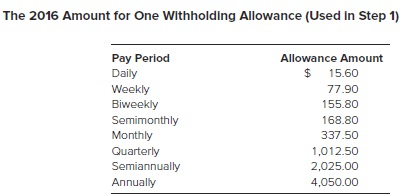

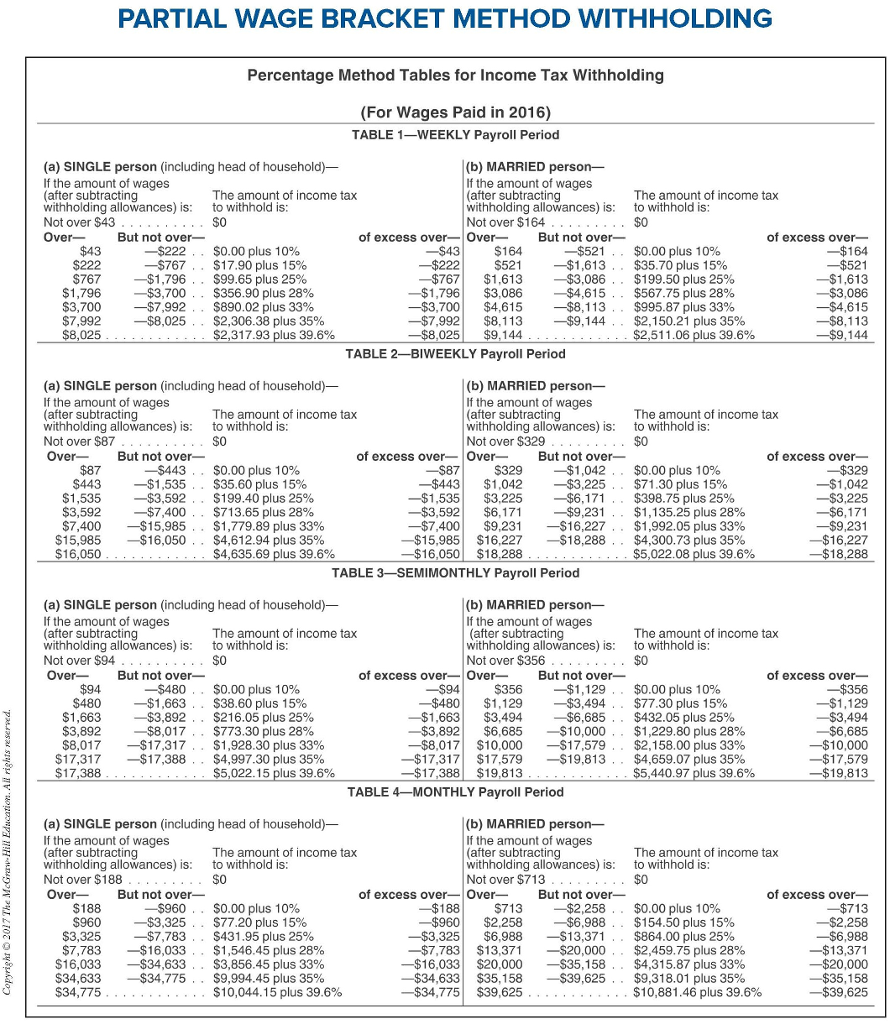

Allison is paid $2,475 per week. What is the amount of federal income tax withheld from Allisons paycheck under the following conditions? Assume that her employer uses the percentage method of withholding. Use withholding allowance and percentage method tables. (Round your intermediate computations and final answers to 2 decimal places.)

a. Allison is single and claims two withholding allowances. Federal withholding = ?

b. Allison is married and claims two withholding allowances. Federal withholding = ?

c. Allison is single and claims no withholding allowance. Federal withholding = ?

Please show work, Im having a hardtime understanding where all the numbers come from. thank

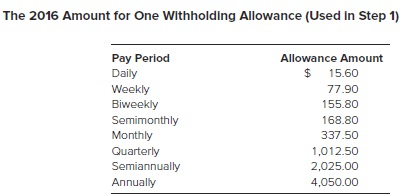

PARTIAL WAGE BRACKET METHOD WITHHOLDING Percentage Method Tables for Income Tax Withholding (For Wages Paid in 2016) TABLE 1-WEEKLY Payroll Period (a) SINGLE person (including head of household)- If the amount of wages after subtracting withholding allowances) is: to withhold is (b) MARRIED person- If the amount of wages after subtracting withholding allowances) is: Not over $164 The amount of income tax The amount of income tax to withhold is $0 ver of excess over- Over But not over- of excess over- $0.00 plus 10% $17.90 plus 15% $99.65 plus 25% $356.90 plus 28% $890.02 plus 33% $2,306.38 plus 35% -$521 -$222 -$767 $767-$1.796 $1.796-$3,700 -$7,992 $7,992-$8,025 $0.00 plus 10% $35.70 plus 15% $199.50 plus 25% $567.75 plus 28% $995.87 plus 33% $2,150.21 plus 35% , . . . -$222| -$767| $521-$1,613 .. $1.613-$3.086.. 615 , - $4.615-$8,113.. $8,113-59,144 .. , . . .. _$3,700| -$7,992| . . TABLE 2-BIWEEKLY Payroll Period (a) SINGLE person (including head of household)- If the amount of wages (b) MARRIED person- If the amount of wages after subtracting withholding allowances) is: withholding allowances) is: Not over $87 The amount of income tax to withhold is The amount of income tax to withhold is $0 of excess over- Over But not over- of excess over_ -$443 , . $443-$1,535.. $1.535-$3,592.. $3,592-$7,400 . . -$15,985.. $15,985-$16,050.. $0.00 plus 10% $35.60 plus 15% $199.40 plus 25% $713.65 plus 28% $1,779.89 plus 33% $4,612.94 plus 35% $329-$1,042 . . $0.00 plus 10% $71.30 plus 15% $398.75 plus 25% $1,135.25 plus 28% $1,992.05 plus 33% $4,300.73 plus 35% $5,022.08 plus 39.6% -$443| -$1,535| -$3,592| $1,042-$3,225.. $3.225-$6,171 . . $6,171-$9,231 .. $16,227 , . $16.227-$18,288.. -$3,225 --$9,231 16,227 -$15, 985| TABLE 3 SEMIMONTHLY Payroll Period (a) SINGLE person (including head of household)- If the amount of wages (b) MARRIED person- If the amount of wages (after subtracting withholding allowances) is: The amount of income tax to withhold is The amount of income tax to withhold is $0 in withholding allowances) is: Not over of excess over- Over- But not over- $356-$1,129 . . $1.129-$3,494 .. $3.494-$6,685 , . $6,685-$10,000,- $10,000-$17,579 .. $17,579-$19,813,- But not over- of excess over_ -$94 -$480| -$1,663| -$3,892| -$8,017| -$17,317| $17,388| $94 $0.00 plus 10% $38.60 plus 15% $216.05 plus 25% $773.30 plus 28% $1,928.30 plus 33% $4,997.30 plus 35% $5,022.15 plus 39.6% $0.00 plus 10% $77.30 plus 15% $432.05 plus 25% $1,229.80 plus 28% $2,158.00 plus 33% $4,659.07 plus 35% $5,440.97 plus 39.6% -$480 $480-$1,663.. $1,663-$3,892 . . $3,892-$8,017 , , $8,017-$17317.. $17,317-$17,388 , . -$6,685 -$17,579 $19,813 TABLE 4-MONTHLY Payroll Period (b) MARRIED person- If the amount of wages (after subtracting withholding allowances) is: Not over (a) SINGLE person (including head of household)- If the amount of wages The amount of income tax to withhold is The amount of income tax to withhold is $0 in withholding allowances) is: $713 t over- $713-$2,258.. $2.258-$6.988 . . $6.988-$13.371.. $13.371-$20,000 . . $20,000-$35,158.. $35.158-$39,625.. But not over of excess over-lover of excess over_ -$960.. $960--$3,325 . . $3,325-$7,783 . . $7,783-$ 16,033 . . $34,633 , . --$34,775 , . $0.00 plus 10% $77.20 plus 15% $431.95 plus 25% $1,546.45 plus 28% $3,856.45 plus 33% $9,994.45 plus 35% $10,044.15 plus 39.6% -$188| -$960| -$3.325| -$7,783| -$16,033| $34,633| -$34,775 $0.00 plus 10% $154.50 plus 15% $864.00 plus 25% $2,459.75 plus 28% $4,315.87 plus 33% $9,318.01 plus 35% $10,881.46 plus 39.6% $713 $6,988 -$20,000 $39,625 $34,633 $39,625