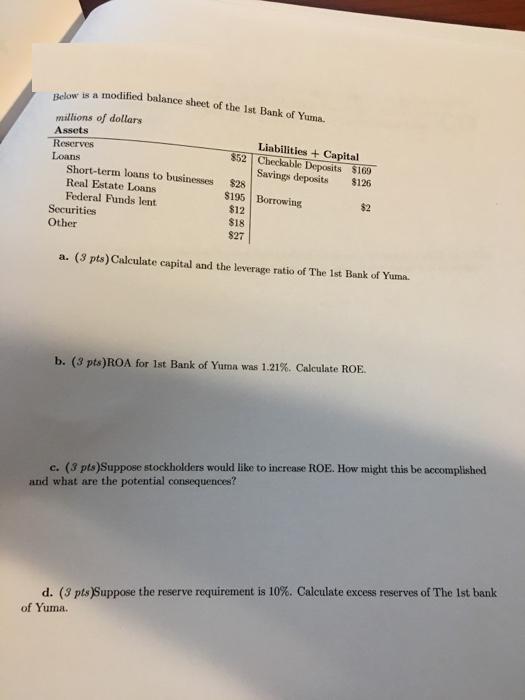

Below is a modified balance sheet of the 1st Bank of Yuma. millions of dollars Assets Reserves Loans Short-term loans to businesses Real Estate

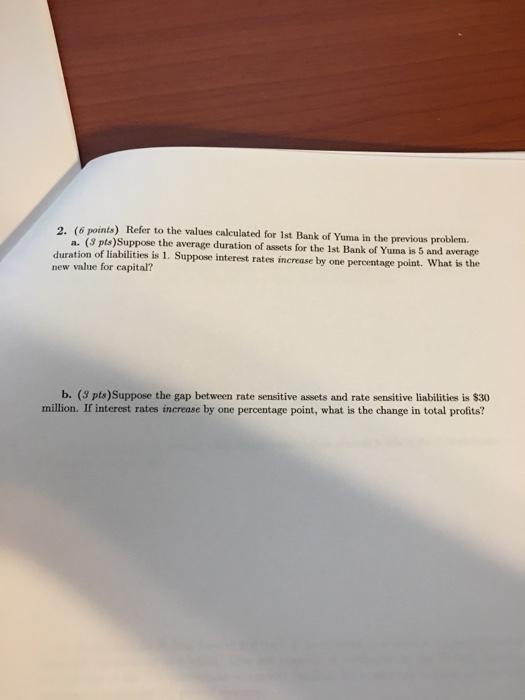

Below is a modified balance sheet of the 1st Bank of Yuma. millions of dollars Assets Reserves Loans Short-term loans to businesses Real Estate Loans Federal Funds lent Securities Other Liabilities + Capital $52 Checkable Deposits $169 Savings deposits $126 Borrowing $28 $195 $12 $18 $27 $2 a. (3 pts) Calculate capital and the leverage ratio of The 1st Bank of Yuma. b. (3 pts)ROA for 1st Bank of Yuma was 1.21%. Calculate ROE. c. (3 pts)Suppose stockholders would like to increase ROE. How might this be accomplished and what are the potential consequences? d. (3 pts)Suppose the reserve requirement is 10%. Calculate excess reserves of The 1st bank of Yuma. 2. (6 points) Refer to the values calculated for 1st Bank of Yuma in the previous problem. a. (3 pts)Suppose the average duration of assets for the 1st Bank of Yuma is 5 and average duration of liabilities is 1. Suppose interest rates increase by one percentage point. What is the new value for capital? b. (3 pts) Suppose the gap between rate sensitive assets and rate sensitive liabilities is $30 million. If interest rates increase by one percentage point, what is the change in total profits?

Step by Step Solution

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started