Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Allowance for Credit Loss Cash Credit Loss Discount on Bond Dividend receivable Dividend revenue Equity in earnings of XYZ Fair Value Adjustment Interest Revenue Investment

Allowance for Credit Loss

Cash

Credit Loss

Discount on Bond

Dividend receivable

Dividend revenue

Equity in earnings of XYZ

Fair Value Adjustment

Interest Revenue

Investment in Bond

Investment in XYZ common stock

Loss on Impairment (NI)

Premium on Bond

Realized Gain on Sale of Bond

Realized Gain on Sale of Stock

Realized Loss on Sale of Bond

Reclassification adjustment - OCI

Unrealized Holding Gain - NI

Unrealized Holding Gain - OCI

Unrealized Holding Loss - NI

Unrealized Holding Loss - OCI

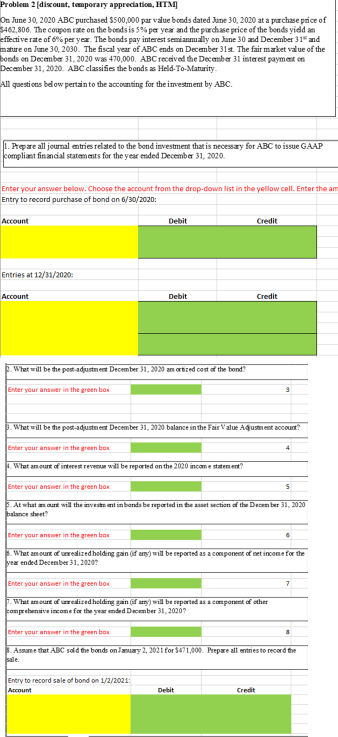

Problem 2 (discount, temporary appreciation, HTM On June 30, 2020 ABC purchased $500,000 par value bonds dated June 30, 2020 at a purchase price of 5462,806. The coupon rate on the bonds is 5% per yex and the purchase price of the bonds yidde effective rate of 6% per yex The bonds pay interest semiannually on June 30 and December 31" and nature on June 30, 2030. The fiscal year of ABC ends on December 31st. The fair market value of the bonds on December 31, 2020 was 470,000. ABC received the December 31 interest payment on December 31, 2020. ABC classifies the bonds as Held-To-Maturity All questions below pertain to the accounting for the investment by ABC. 1. Prepare all journal entries related to the band investment that is necessary for ABC to issue GAAP compliant financial statements for the year ended December 31, 2020 Enter your answer below. Choose the account from the drop-down list in the yellow cell. Enter the am Entry to record purchase of bond on 6/30/2020: Account Debit Credit Entries at 12/31/2020: Account Debit Credit What will be the post adjustment December 31, 2020 anortized cost of the bond Enter your answer in the green box 3. What will be the post-adjustment December 31, 2020 balance in the Far Value Austent account? Enter your answer in the green box What amount of interest revenge will be reported on the 2020 income statement? Enter your answer in the green box 5 At what curt will the investmt in bonds be reported in the set section of the December 31, 2020 balance sheet? Enter your answer in the green box Whet nourt of realized holding gain if any) will be reported as a component of net income for the year ended December 31, 2020? 7 Enter your answer in the green box 7. What amount of wiedhelding ganon will be reported as a component of other comprehensive income for the year ended December 31, 2020? Enter your answer in the green box Assame the ABC sold the bonds on/anuary 2, 2021 for $471,000. Prepare all entries to record the sale. Entry to record sale of bond on 1/2/2021: Account Debit CreditStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started