Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Allowance for Uncollectible Accounts - Percentage of Sales Method On January 1, the Sell-U-Anything Company had a beginning balance in Accounts Receivable of $40,000

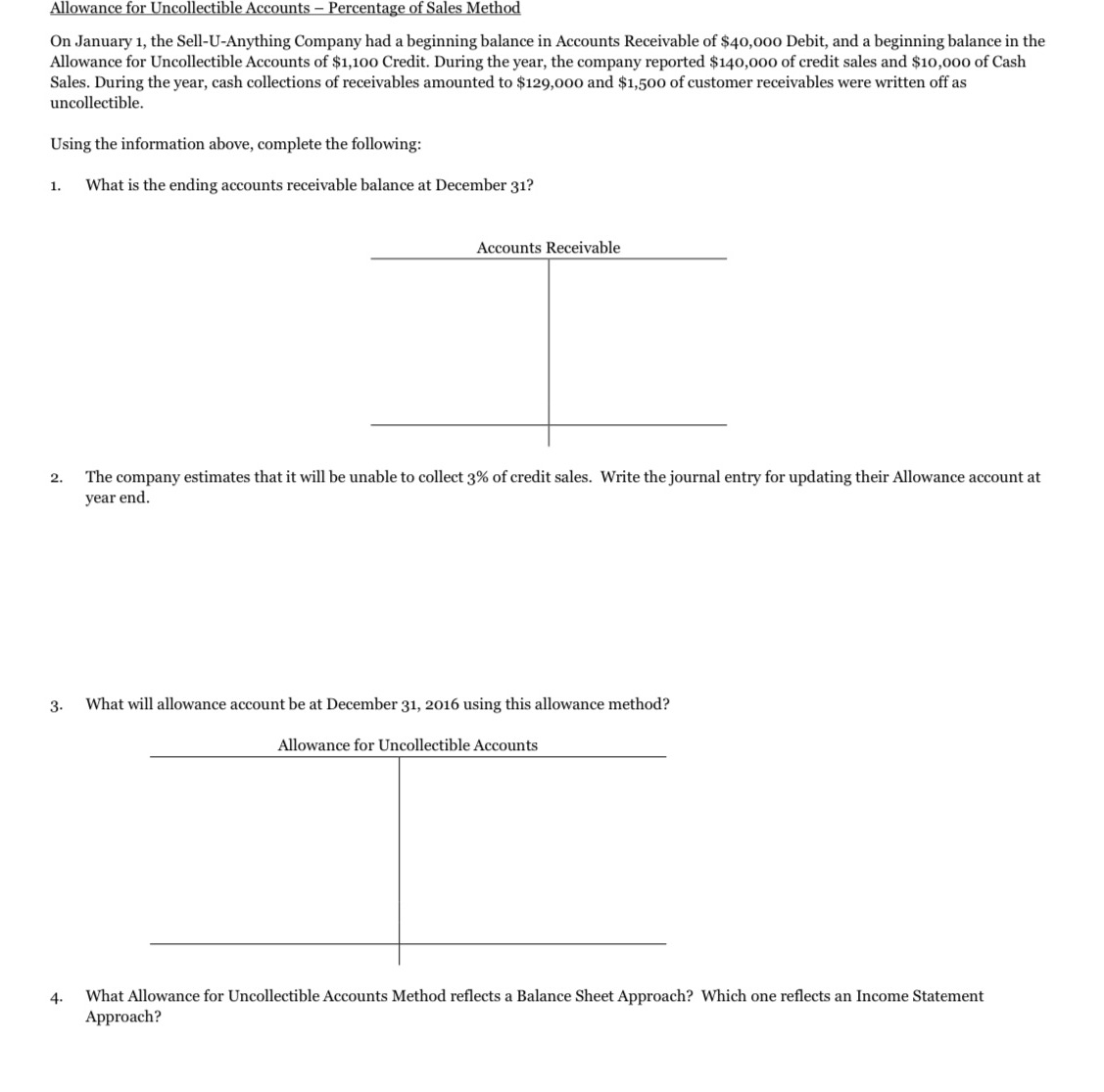

Allowance for Uncollectible Accounts - Percentage of Sales Method On January 1, the Sell-U-Anything Company had a beginning balance in Accounts Receivable of $40,000 Debit, and a beginning balance in the Allowance for Uncollectible Accounts of $1,100 Credit. During the year, the company reported $140,000 of credit sales and $10,000 of Cash Sales. During the year, cash collections of receivables amounted to $129,000 and $1,500 of customer receivables were written off as uncollectible. Using the information above, complete the following: 1. What is the ending accounts receivable balance at December 31? Accounts Receivable 2. The company estimates that it will be unable to collect 3% of credit sales. Write the journal entry for updating their Allowance account at year end. 3. 4. What will allowance account be at December 31, 2016 using this allowance method? Allowance for Uncollectible Accounts What Allowance for Uncollectible Accounts Method reflects a Balance Sheet Approach? Which one reflects an Income Statement Approach?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started