Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Allowance to Reduce Deferred Tax Asset to Expected Realizable Value Benefit Due to Loss Carryback Benefit Due to Loss Carryforward Deferred Tax Asset Deferred Tax

Allowance to Reduce Deferred Tax Asset to Expected Realizable Value Benefit Due to Loss Carryback Benefit Due to Loss Carryforward Deferred Tax Asset Deferred Tax Liability Income Tax Expense Income Tax Payable Income Tax Refund Receivable No Entry

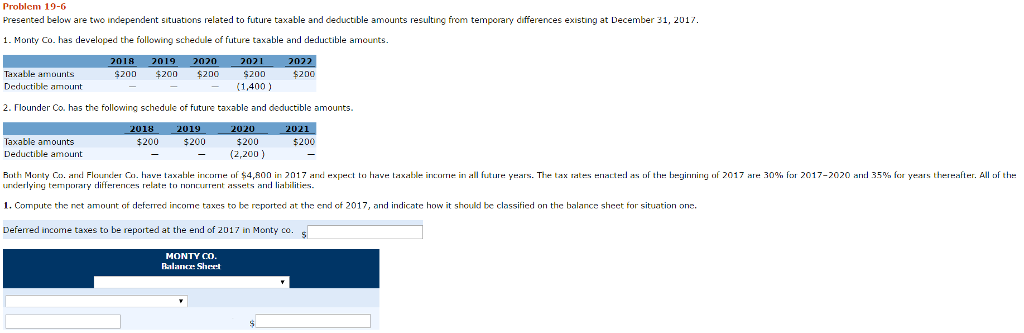

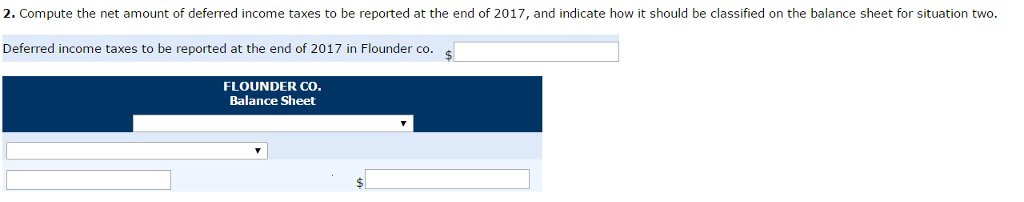

Problem 19-6 Presented below are two independent situations related to future taxable and deductible amounts resulting from temporary differences existing at December 31, 2011. 1. Monty Co. has developed the following schedule of future taxable and deductible amounts. 019 020 02 02 axable am $200 $200 $200 $200 $200 Deductible amount 1,400 2. Flounder Co. has the following schedule of future taxable and deductible amounts. 2018 019 020 02 $200 $200 $200 Taxable am $200 ounts Deductible amount 2,200 both Monty Co. and Flourder Co. hav taxable income of $4,800 in 2017 and expect to have taxable in ormer inall future YHars. The tax rates Hract das Dith b yinring of 2017 are 30% 017-2020 and 35% for ye Is ther after All Di the underlying temporary differerces relate to nonrurrert assets and liabilities. 1. Compute the net amount of detemed income taxes to be reported at the end of 2017, and indicate how it should be classified on the balance sheet for situation one. Deferred income taxes to be reported at the end of 2017 in Monty co MONTY CO SherStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started