Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Along with pschyological rewards, homeownership also provides financial payoffs. From a buyer's perspective, the interest against the mortgage on the property an can be the

Along with pschyological rewards, homeownership also provides financial payoffs. From a buyer's perspective, the interest

against the

mortgage on the property an

can be

the tasable incoms

the homeowner's tax liability. The tax shelter is provided only if the

The standard deduction for mortgage interest under the US tax code is:

$ for single individuals and $ for married couples filing jointly

$ for single individuals and $ for married couples filing jointly

$ for single individuals and $ for married couples filing jointly

True or False: As a result of the Jobs Act of and changes to tax laws in the relative attractiveness of buying a home versus renting

decreased due to an changes in standard deductions.

This statement is false, which means that most homeowners are better off itemizing their deductions rather than taking the standard

deduction.

This statement is false, which means that most taxpayers in this situation are better off itemizing their deductions rather than taking the

standard deduction:

This statement is true, which means that most taxpayers in this situstion are better off taking the standard deduction rather than

itemizing their deductions.

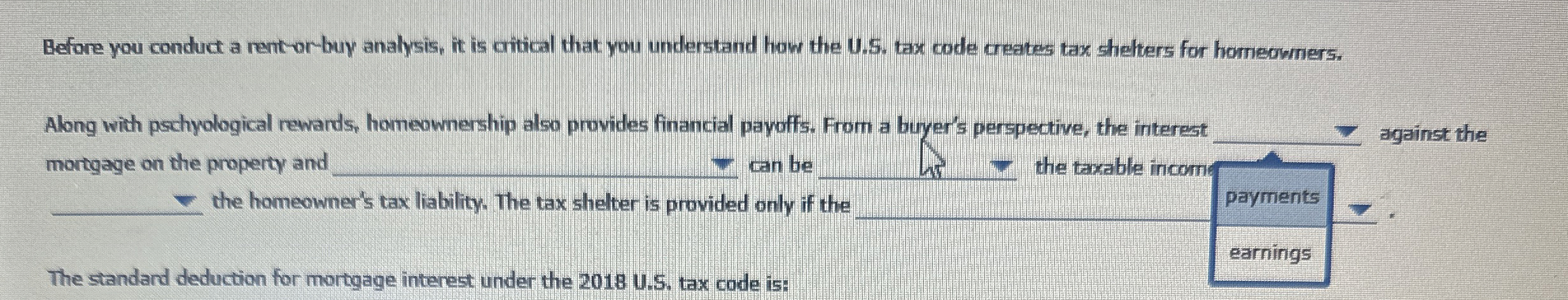

Before you conduct a rentorbuy analysis, it is critical that you understand how the US tax code creates tax shehers for homeowners.

Along with pschyological rewards, homeownership also provides financial payoffs. From a buyer's perspective, the interest

against the

mortgage on the property and

can be

the taxable incom?

the homeowner's tax liability. The tax shelter is provided only if the

payments

The standard deduction for mortgage interest under the US tax code is:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started