Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alpha Co will purchase a car for its business. The car costs $60,000 and is expected to last 5 years. After 5 years, Alpha expects

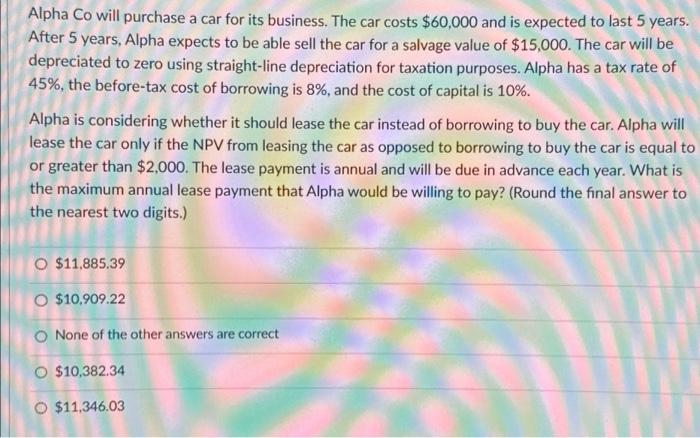

Alpha Co will purchase a car for its business. The car costs $60,000 and is expected to last 5 years. After 5 years, Alpha expects to be able sell the car for a salvage value of $15,000. The car will be depreciated to zero using straight-line depreciation for taxation purposes. Alpha has a tax rate of 45%, the before-tax cost of borrowing is 8%, and the cost of capital is 10%. Alpha is considering whether it should lease the car instead of borrowing to buy the car. Alpha will lease the car only if the NPV from leasing the car as opposed to borrowing to buy the car is equal to or greater than $2,000. The lease payment is annual and will be due in advance each year. What is the maximum annual lease payment that Alpha would be willing to pay? (Round the final answer to the nearest two digits.) O $11,885.39 O $10,909.22 O None of the other answers are correct O $10,382.34 O $11,346.03

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started