Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alpha Company owns 80% of Bravo. During the year, Alpha generates net income of $225,000 and has 200,000 shares of stock outstanding. Bravo generates

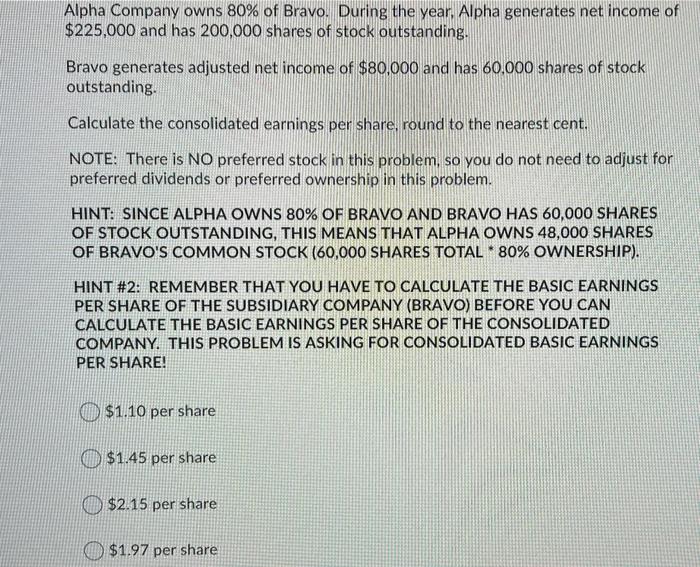

Alpha Company owns 80% of Bravo. During the year, Alpha generates net income of $225,000 and has 200,000 shares of stock outstanding. Bravo generates adjusted net income of $80,000 and has 60.000 shares of stock outstanding. Calculate the consolidated earnings per share, round to the nearest cent. NOTE: There is NO preferred stock in this problem, so you do not need to adjust for preferred dividends or preferred ownership in this problem. HINT: SINCE ALPHA OWNS 80% OF BRAVO AND BRAVVO HAS 60,000 SHARES OF STOCK OUTSTANDING, THIS MEANS THAT ALPHA OWNS 48,000 SHARES OF BRAVO'S COMMON STOCK (60,000 SHARES TOTAL 80% OWNERSHIP). HINT #2: REMEMBER THAT YOU HAVE TO CALCULATE THE BASIC EARNINGS PER SHARE OF THE SUBSIDIARY COMPANY (BRAVO) BEFORE YOU CAN CALCULATE THE BASIC EARNINGS PER SHARE OF THE CONSOLIDATED COMPANY. THIS PROBLEM IS ASKING FOR CONSOLIDATED BASIC EARNINGS PER SHARE! O $1.10 per share $1.45 per share O $2.15 per share $1.97 per share

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

1 Total earnings Bravo80000 2 Total shares60000 3 EPS1333333333 4of h...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started