Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alpha Corp is a calendar year accrual method entity for financial reporting and tax purposes. In 2 0 2 4 , Alpha Corp completed a

Alpha Corp is a calendar year accrual method entity for financial reporting and tax purposes. In Alpha Corp completed a number of transactions involving the sale of assets and pays a flat tax rate. Prior to considering these asset sale transactions, Alpha Corp recorded $ in net incomefor tax purposes. In addition, Alpha Corp incurred $ of losses on the sale of Section property last year and $ in net capital losses two years ago. The information below provides additional details about the asset sale transactions during the year.

On January rd the board of directors of Omega Corp announced that the company was bankrupt and owners of the stock should consider it worthless. Alpha Corp owns of the outstanding shares of Omega Corp, which it purchased for $more than a year ago

On April th Alpha Corp sold Truck for $ The purchaser also agreed to take over the note on Truck which had in principal payments remaining. Alpha corp paid for truck more than a year ago and had accumulated in depreciation by the date of sale. The truck was actively used in operation of alpha corp

On May th Alpha Corp sold Truck for plus $ worth of industrial cleaning supplies to a person wha owns of all Alpha Corp stock. Alpha Corp paid $ for the truck more than a year ago and had accumulated $ in depreciation by the date of the sale. The truck was actively used in the operation of Alpha Corp.

On June th Alpha Corp sold Building a warehouse and Land for a total of $ Alpha had paid a total of $ for the two assets morethan a year ago For this assignment, treat the transaction as it it is two separate sales as described below:

The buyer paid for Building Alpha Corp originally paid $ for Building and had accumulated $ in MACRS straight line depreciation by the date of the sale. The building was actively used in the operation of Alpha Carp.

The buyer paid $ for Land Alpha Corp originally paid $ for the land. The land was actively used in the operation of Alpha corp

On October nd Alpha Corp sold Machine for $ Dueto a shortage in the chips used to make Machine Alpha Corp was able to sell the machine for more than it had originally paid even though it is a depreciable asset. Alpha Company used the proceeds from the sale to pay off the $ note it had on Machine

Alpha Corp originally paid $ for Machine more than a year ago and had accumulated $ in depreciation by the date of the sale. Machine was actively used in the operation of Alpha Corp.

On December rd Alpha Corp sold Land for $ The land was purchased years ago for $ in the hopes it would appreciate in value.

In April, an intern had accidentally purchased cases of paper instead of due to a typing error and the paper company would not accept a return. On December st Alpha Corp sold cases of printer paper for $ Alpha agreed to receive $ up front and the rest of the purchase price in months, with no interest. The cases of paper were originally purchased at $ per case. For tax purposes, Alpha Corp capitalizes the costs of supplies and expenses them as used ie these cases of paper were capitalized with a basis equal to their original purchase price

Required:

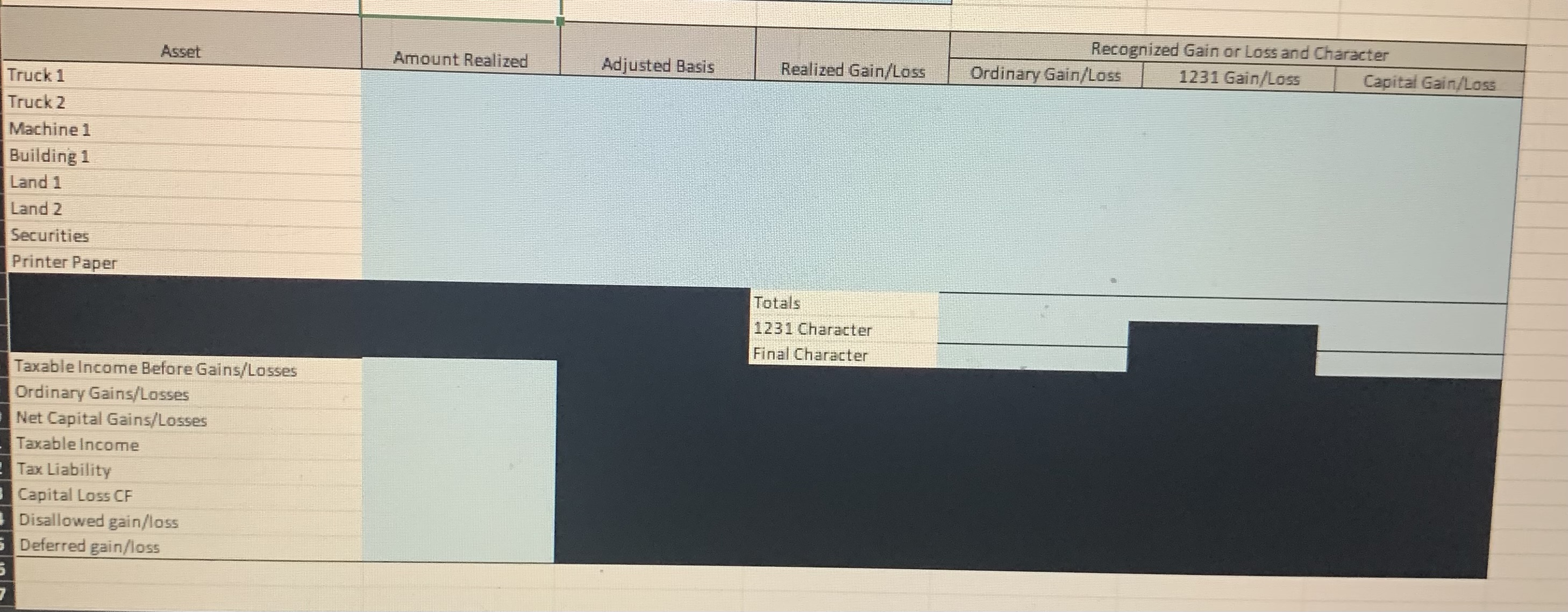

a For each of the transactions, calculate the amount realized on the disposition of the asset, the adjusted basis of the asset, and the total realized gain or loss on the disposition of the asset. Finally, determine the amount of recognized gain or loss and classify the recognized gain or loss as ordinary, section or capital. Do not characterize section gains or losses as ordinary or capital unless depreciation recapture applies.

b Calculate the current year net section gain or loss and determine the final character of that gain or loss ie ordinary or capital

c Calculate the total amount of current yearordinary and net capital gain or loss ie do not include any capital loss carryforwards

d Calculate current year taxable income and tax liability for Alpha Corp including the impact of the asset dispositions and any carryforwards.

e Calculate the net capital loss carryforward if any

f Determine the amount of any unrecognized gain or loss resulting from the related party transactions if any

g Determine the amount of any gain or loss deferred to the next tax year resulting from the installment sale of paper if any

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started