Answered step by step

Verified Expert Solution

Question

1 Approved Answer

alpha corporation Alpha Corporation and Beta Corporation are identical in every way except their capital structures. Alpha Corporation, an all-equity firm, has 11,500 shares of

alpha corporation

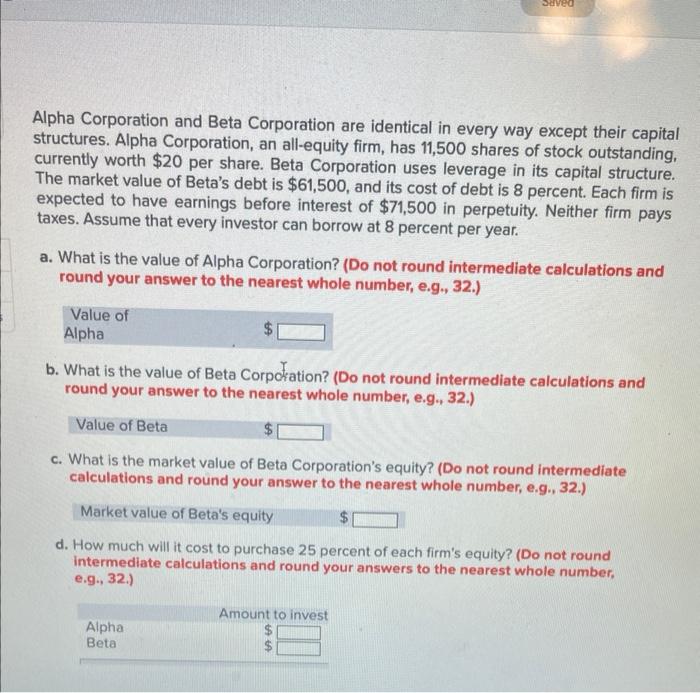

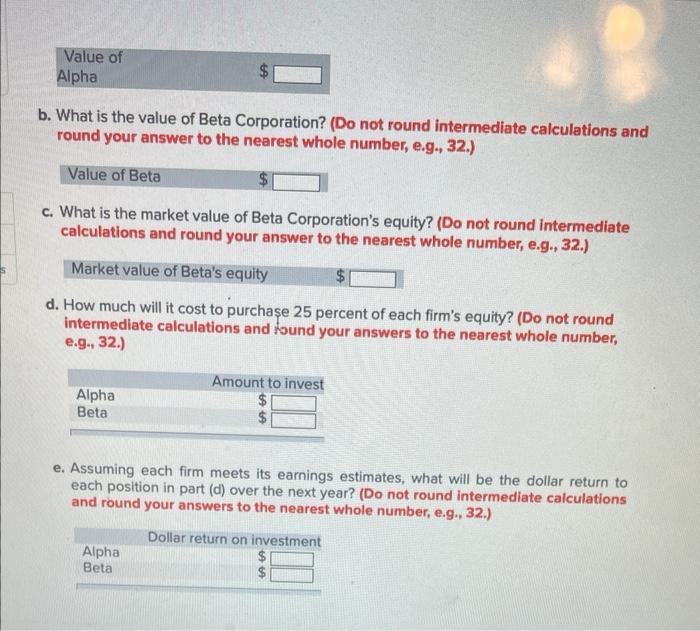

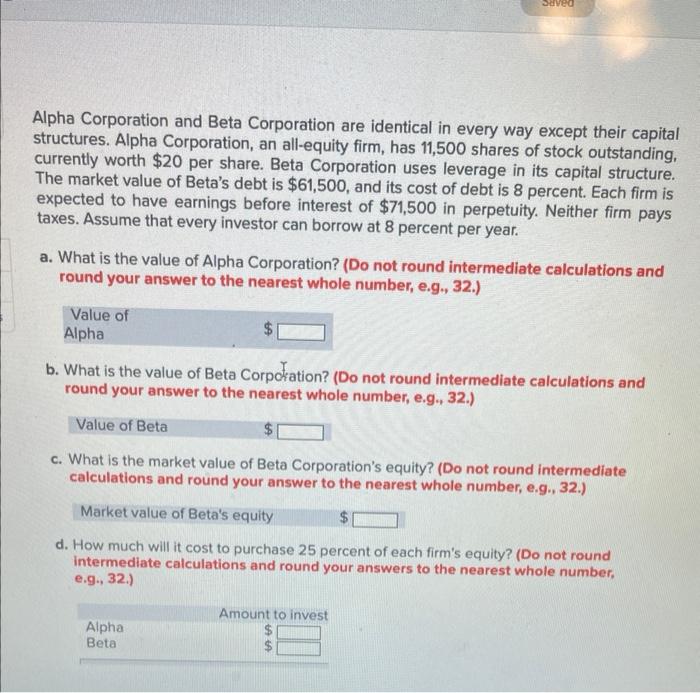

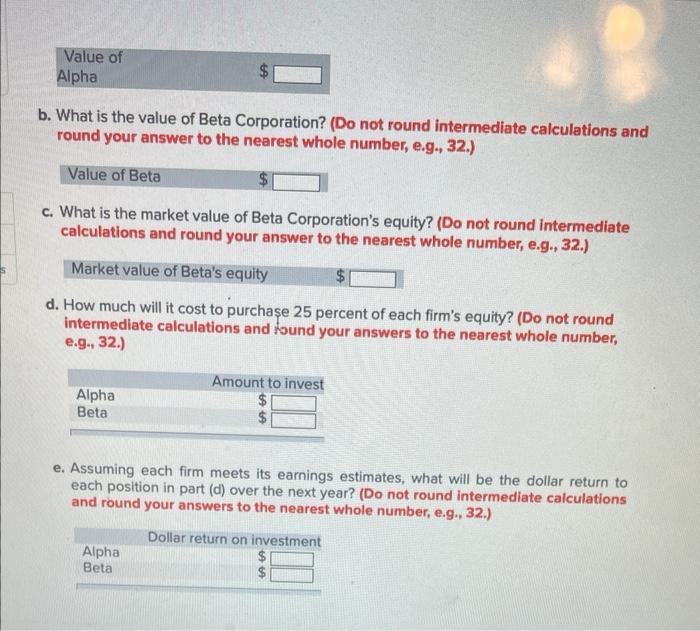

Alpha Corporation and Beta Corporation are identical in every way except their capital structures. Alpha Corporation, an all-equity firm, has 11,500 shares of stock outstanding, currently worth $20 per share. Beta Corporation uses leverage in its capital structure. The market value of Beta's debt is $61,500, and its cost of debt is 8 percent. Each firm is expected to have earnings before interest of $71,500 in perpetuity. Neither firm pays taxes. Assume that every investor can borrow at 8 percent per year. a. What is the value of Alpha Corporation? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) b. What is the value of Beta Corpockation? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) c. What is the market value of Beta Corporation's equity? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) d. How much will it cost to purchase 25 percent of each firm's equity? (Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.) b. What is the value of Beta Corporation? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) c. What is the market value of Beta Corporation's equity? (Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.) d. How much will it cost to purchase 25 percent of each firm's equity? (Do not round intermediate calculations and hound your answers to the nearest whole number, e.g., 32.) e. Assuming each firm meets its earnings estimates, what will be the dollar return to each position in part (d) over the next year? (Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started