Answered step by step

Verified Expert Solution

Question

1 Approved Answer

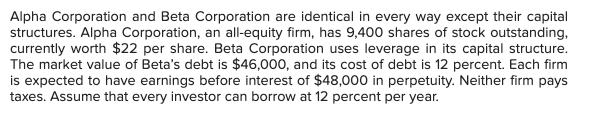

Alpha Corporation and Beta Corporation are identical in every way except their capital structures. Alpha Corporation, an all-equity firm, has 9,400 shares of stock

Alpha Corporation and Beta Corporation are identical in every way except their capital structures. Alpha Corporation, an all-equity firm, has 9,400 shares of stock outstanding, currently worth $22 per share. Beta Corporation uses leverage in its capital structure. The market value of Beta's debt is $46,000, and its cost of debt is 12 percent. Each firm is expected to have earnings before interest of $48,000 in perpetuity. Neither firm pays taxes. Assume that every investor can borrow at 12 percent per year. Requirement 1: What is the value of Alpha Corporation? (Do not include the dollar sign ($).) Value of Alpha Requirement 2: What is the value of Beta Corporation? (Do not include the dollar sign ($).) Value of Beta Requirement 3: What is the market value of Beta Corporation's equity? (Do not include the dollar sign ($).) Value of Beta's equity Requirement 4: How much will it cost to purchase 18 percent of each firm's equity? (Do not include the dollar signs ($).) Cost for Alpha Cost for Beta LA LA Requirement 5: Assuming each firm meets its earnings estimates, what will be the dollar return to each position in requirement 4 over the next year? (Do not include the dollar signs ($). Round your answers to the nearest whole dollar amount. (e.g., 32)) Return on Alpha Return on Beta 69 69

Step by Step Solution

★★★★★

3.44 Rating (157 Votes )

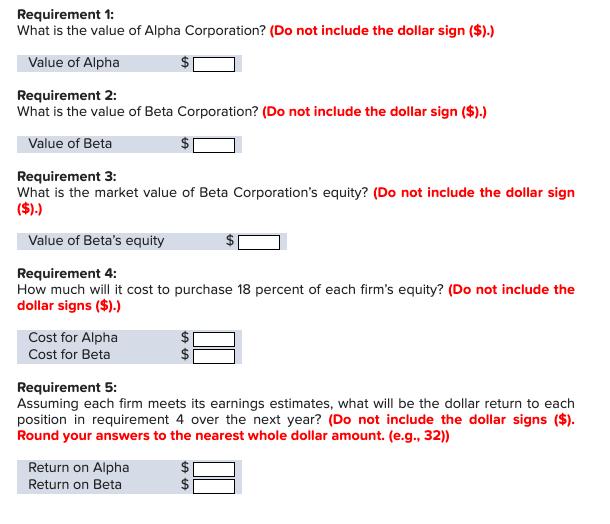

There are 3 Steps involved in it

Step: 1

To solve these requirements well follow the steps using the information given in the first image Requirement 1 What is the value of Alpha Corporation Alpha Corporation is an allequity firm so its valu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started