Answered step by step

Verified Expert Solution

Question

1 Approved Answer

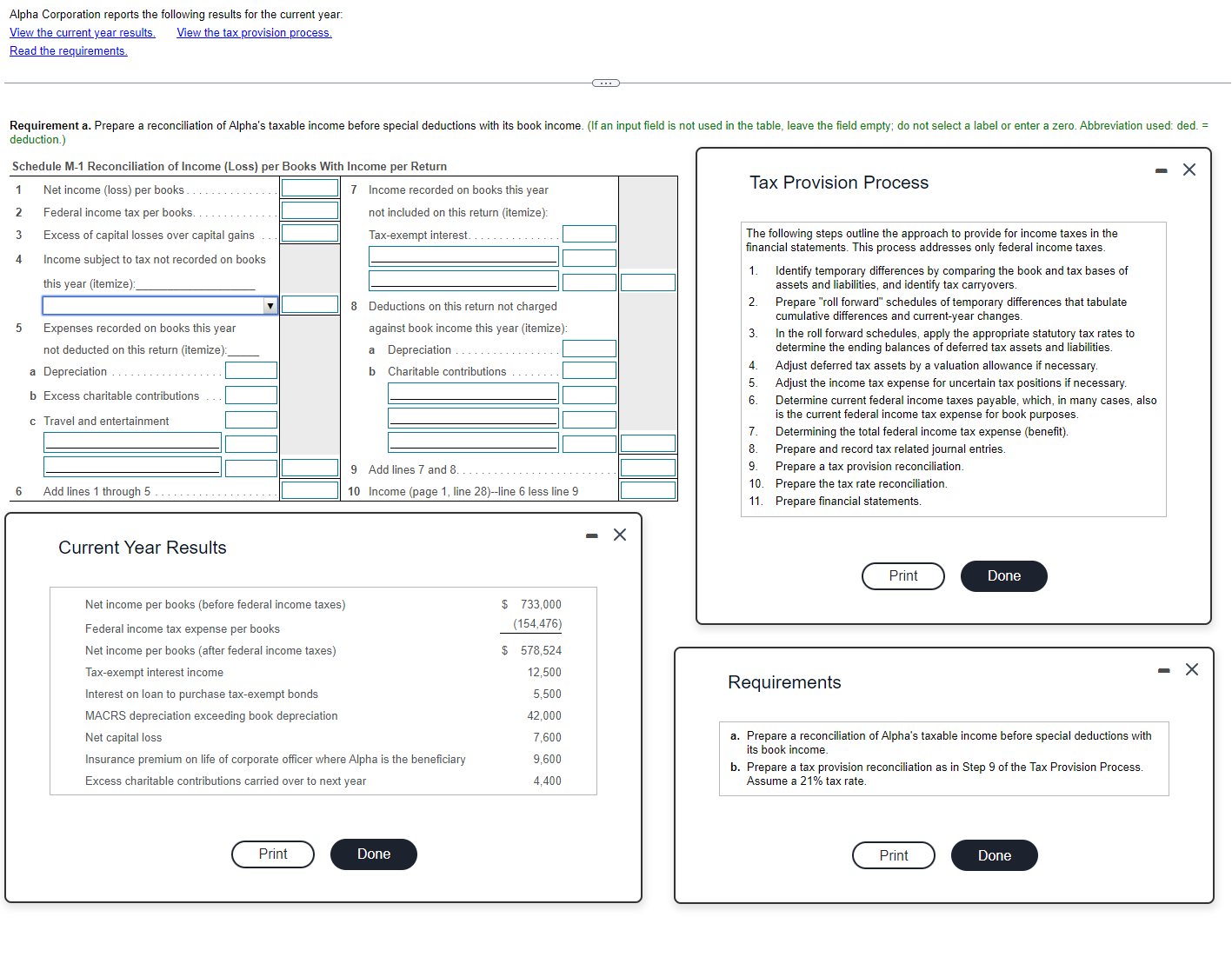

Alpha Corporation reports the following results for the current year: View the current year results. Read the requirements. View the tax provision process. Requirement

Alpha Corporation reports the following results for the current year: View the current year results. Read the requirements. View the tax provision process. Requirement a. Prepare a reconciliation of Alpha's taxable income before special deductions with its book income. (If an input field is not used in the table, leave the field empty; do not select a label or enter a zero. Abbreviation used: ded. = deduction.) Schedule M-1 Reconciliation of Income (Loss) per Books With Income per Return 1 Net income (loss) per books 2 Federal income tax per books. 3 Excess of capital losses over capital gains 4 Income subject to tax not recorded on books this year (itemize): 7 Income recorded on books this year not included on this return (itemize): Tax-exempt interest. Tax Provision Process The following steps outline the approach to provide for income taxes in the financial statements. This process addresses only federal income taxes. 1. Identify temporary differences by comparing the book and tax bases of assets and liabilities, and identify tax carryovers. 5 Expenses recorded on books this year not deducted on this return (itemize) a Depreciation b Excess charitable contributions c Travel and entertainment 8 Deductions on this return not charged 2. Prepare "roll forward" schedules of temporary differences that tabulate cumulative differences and current-year changes. a against book income this year (itemize): Depreciation 3. In the roll forward schedules, apply the appropriate statutory tax rates to determine the ending balances of deferred tax assets and liabilities. 4. Adjust deferred tax assets by a valuation allowance if necessary. b Charitable contributions 5. Adjust the income tax expense for uncertain tax positions if necessary. 6. Determine current federal income taxes payable, which, in many cases, also 6 Add lines 1 through 5 Current Year Results 9 Add lines 7 and 8. 10 Income (page 1, line 28)--line 6 less line 9 Net income per books (before federal income taxes) Federal income tax expense per books $ 733,000 (154,476) Net income per books (after federal income taxes) Tax-exempt interest income $ 578,524 12,500 Interest on loan to purchase tax-exempt bonds 5,500 MACRS depreciation exceeding book depreciation 42,000 Net capital loss 7,600 Insurance premium on life of corporate officer where Alpha is the beneficiary Excess charitable contributions carried over to next year 9,600 4,400 Print Done 7. is the current federal income tax expense for book purposes. Determining the total federal income tax expense (benefit). 8. Prepare and record tax related journal entries. 9. Prepare a tax provision reconciliation. 10. Prepare the tax rate reconciliation. 11. Prepare financial statements. Requirements Print Done a. Prepare a reconciliation of Alpha's taxable income before special deductions with its book income. b. Prepare a tax provision reconciliation as in Step 9 of the Tax Provision Process. Assume a 21% tax rate. Print Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started