Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alpha, Inc. acquires 60 percent of Beta for $414,000 cash on January 1, 2014. The remaining 40 percent of Beta traded near a total

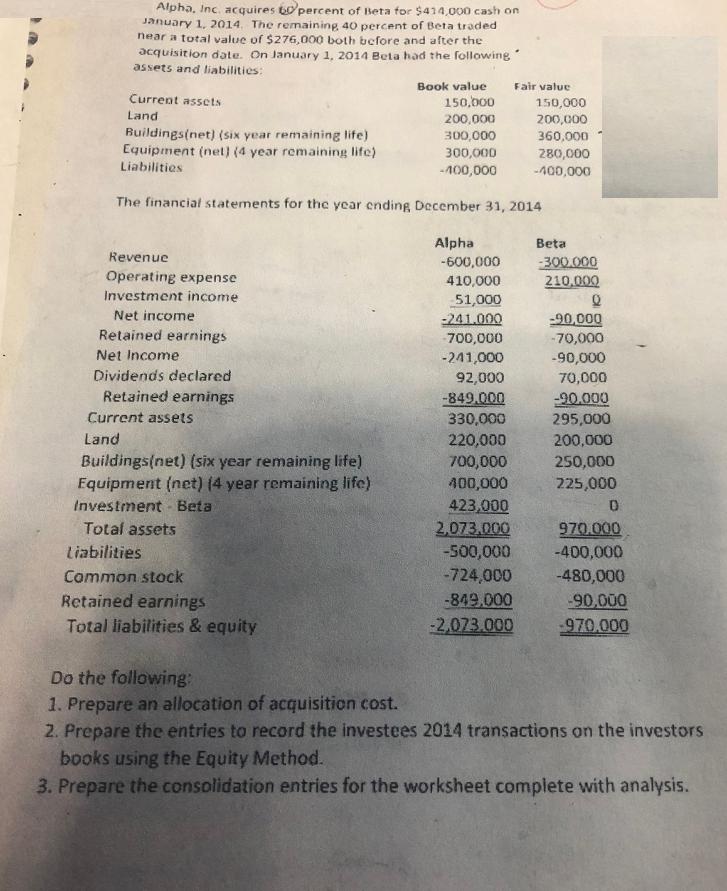

Alpha, Inc. acquires 60 percent of Beta for $414,000 cash on January 1, 2014. The remaining 40 percent of Beta traded near a total value of $276,000 both before and after the acquisition date. On January 1, 2014 Beta had the following assets and liabilities: Current assets Land Buildings(net) (six year remaining life) Equipment (net) (4 year remaining life) Liabilities Revenue Operating expense Investment income Net income Retained earnings Net Income Dividends declared Retained earnings Current assets Land The financial statements for the year ending December 31, 2014 Buildings(net) (six year remaining life) Equipment (net) (4 year remaining life) Investment - Beta Total assets Book value Liabilities Common stock Retained earnings Total liabilities & equity 150,000 200,000 300,000 300,000 -400,000 Fair value Alpha -600,000 410,000 51,000 -241.000 700,000 -241,000 92,000 -849.000 330,000 220,000 700,000 400,000 423,000 2,073.000 -500,000 -724,000 -849,000 -2,073.000 150,000 200,000 360,000 280,000 -400,000 Beta -300.000 210,000 Q -90,000 -70,000 -90,000 70,000 -90,000 295,000 200,000 250,000 225,000 D 970.000 -400,000 -480,000 -90,000 -970,000 Do the following: 1. Prepare an allocation of acquisition cost. 2. Prepare the entries to record the investees 2014 transactions on the investors books using the Equity Method. 3. Prepare the consolidation entries for the worksheet complete with analysis.

Step by Step Solution

★★★★★

3.53 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

Cash cash equivalents Total current assets account receivables in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started