Answered step by step

Verified Expert Solution

Question

1 Approved Answer

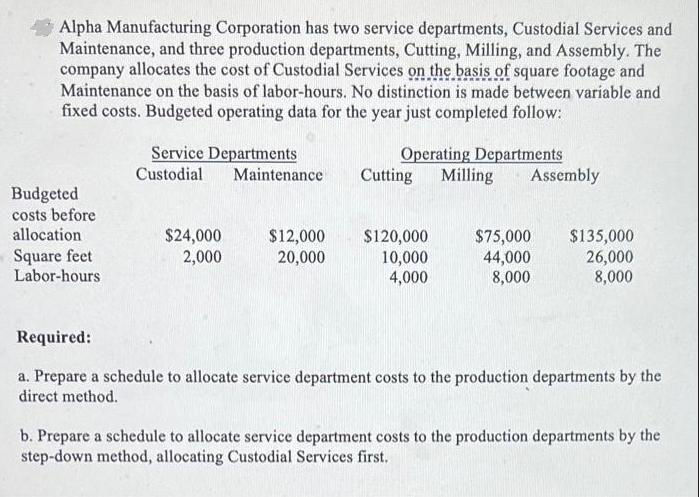

Alpha Manufacturing Corporation has two service departments, Custodial Services and Maintenance, and three production departments, Cutting, Milling, and Assembly. The company allocates the cost

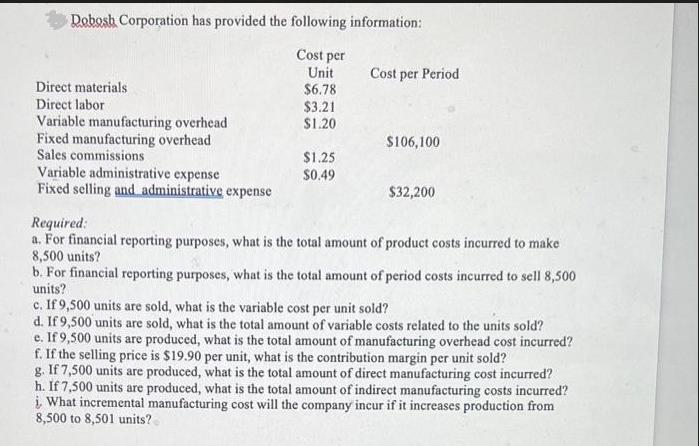

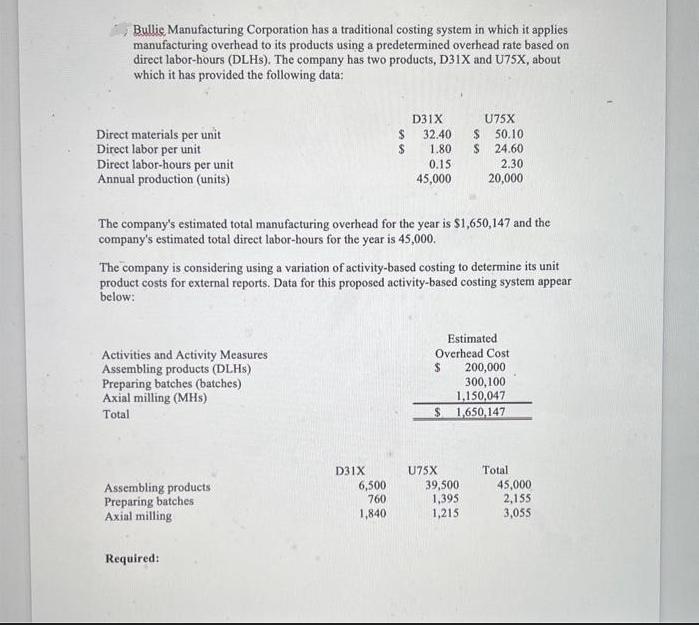

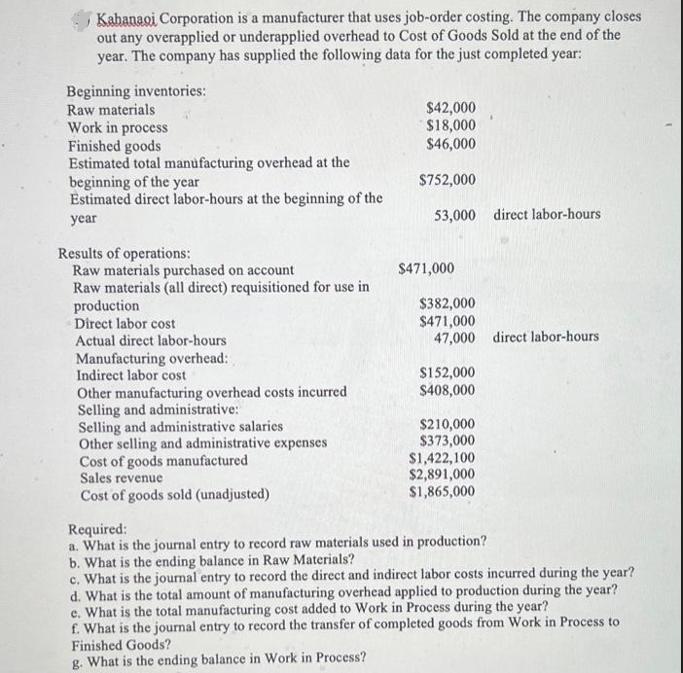

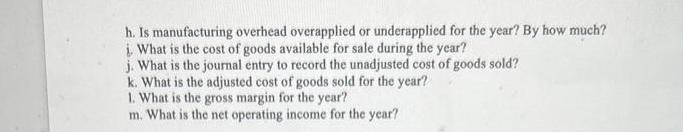

Alpha Manufacturing Corporation has two service departments, Custodial Services and Maintenance, and three production departments, Cutting, Milling, and Assembly. The company allocates the cost of Custodial Services on the basis of square footage and Maintenance on the basis of labor-hours. No distinction is made between variable and fixed costs. Budgeted operating data for the year just completed follow: Budgeted costs before allocation Square feet Labor-hours Service Departments Custodial Maintenance $24,000 2,000 $12,000 20,000 Operating Departments Cutting Milling Assembly $120,000 10,000 4,000 $75,000 $135,000 44,000 26,000 8,000 8,000 Required: a. Prepare a schedule to allocate service department costs to the production departments by the direct method. b. Prepare a schedule to allocate service department costs to the production departments by the step-down method, allocating Custodial Services first. Dobosh Corporation has provided the following information: Cost per Unit $6.78 $3.21 $1.20 Direct materials Direct labor Variable manufacturing overhead Fixed manufacturing overhead Sales commissions Variable administrative expense Fixed selling and administrative expense $1.25 $0.49 Cost per Period $106,100 $32,200 Required: a. For financial reporting purposes, what is the total amount of product costs incurred to make 8,500 units? b. For financial reporting purposes, what is the total amount of period costs incurred to sell 8,500 units? c. If 9,500 units are sold, what is the variable cost per unit sold? d. If 9,500 units are sold, what is the total amount of variable costs related to the units sold? e. If 9,500 units are produced, what is the total amount of manufacturing overhead cost incurred? f. If the selling price is $19.90 per unit, what is the contribution margin per unit sold? g. If 7,500 units are produced, what is the total amount of direct manufacturing cost incurred? h. If 7,500 units are produced, what is the total amount of indirect manufacturing costs incurred? i. What incremental manufacturing cost will the company incur if it increases production from 8,500 to 8,501 units? Bullic Manufacturing Corporation has a traditional costing system in which it applies manufacturing overhead to its products using a predetermined overhead rate based on direct labor-hours (DLHS). The company has two products, D31X and U75X, about which it has provided the following data: Direct materials per unit Direct labor per unit Direct labor-hours per unit Annual production (units) The company's estimated total manufacturing overhead for the year is $1,650,147 and the company's estimated total direct labor-hours for the year is 45,000. Activities and Activity Measures Assembling products (DLHs) Preparing batches (batches) Axial milling (MHs) Total The company is considering using a variation of activity-based costing to determine its unit product costs for external reports. Data for this proposed activity-based costing system appear below: Assembling products Preparing batches Axial milling Required: D31X 32.40 1.80 0.15 45,000 D31X 6,500 760 1,840 U75X $ 50.10 $ 24.60 2.30 20,000 Estimated Overhead Cost $ 200,000 300,100 1,150,047 $1,650,147 U75X 39,500 1,395 1,215 Total 45,000 2,155 3,055 a. Determine the manufacturing overhead cost per unit of each of the company's two products under the traditional costing system. b. Determine the manufacturing overhead cost per unit of each of the company's two products under activity-based costing system. Kahanaoi Corporation is a manufacturer that uses job-order costing. The company closes out any overapplied or underapplied overhead to Cost of Goods Sold at the end of the year. The company has supplied the following data for the just completed year: Beginning inventories: Raw materials Work in process Finished goods Estimated total manufacturing overhead at the beginning of the year Estimated direct labor-hours at the beginning of the year Results of operations: Raw materials purchased on account Raw materials (all direct) requisitioned for use in production Direct labor cost Actual direct labor-hours Manufacturing overhead: Indirect labor cost Other manufacturing overhead costs incurred Selling and administrative: Selling and administrative salaries Other selling and administrative expenses Cost of goods manufactured Sales revenue Cost of goods sold (unadjusted) $42,000 $18,000 $46,000 $752,000 53,000 direct labor-hours $471,000 $382,000 $471,000 47,000 direct labor-hours $152,000 $408,000 $210,000 $373,000 $1,422,100 $2,891,000 $1,865,000 Required: a. What is the journal entry to record raw materials used in production? b. What is the ending balance in Raw Materials? c. What is the journal entry to record the direct and indirect labor costs incurred during the year? d. What is the total amount of manufacturing overhead applied to production during the year? e. What is the total manufacturing cost added to Work in Process during the year? f. What is the journal entry to record the transfer of completed goods from Work in Process to Finished Goods? g. What is the ending balance in Work in Process? h. Is manufacturing overhead overapplied or underapplied for the year? By how much? i. What is the cost of goods available for sale during the year? j. What is the journal entry to record the unadjusted cost of goods sold? k. What is the adjusted cost of goods sold for the year? 1. What is the gross margin for the year? m. What is the net operating income for the year?

Step by Step Solution

★★★★★

3.56 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a Journal Entry Debit Raw Materials Credit Cost of Goods Sold Amount 382000 b Ending balance ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started