Question

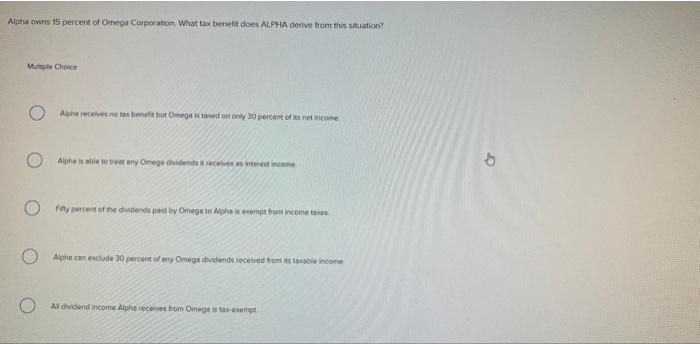

Alpha owns 15 percent of Omega Corporation What tax benefit does ALPHA derive from this situation? Multiple Choice Alpha recetves no tex benefit but

Alpha owns 15 percent of Omega Corporation What tax benefit does ALPHA derive from this situation? Multiple Choice Alpha recetves no tex benefit but Omega i taxed on only 30 percent of its net income Alphe is eble to treat eny Omega dividends it receives as interest income Fifty percent of the dividends paid by Omega to Alpha is evempt bom income tanes O Aphe can exclude 30 percent of any Omegs dividends received trom its tasable income Al dividend income Alpha receives from Ornega is tax-exempt

Step by Step Solution

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Al phe can exclude 30 percent of any O me gs dividends received from its taxable income G...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Advanced Accounting

Authors: Joe Ben Hoyle, Thomas Schaefer, Timothy Doupnik

6th edition

0-07-786223-6, 101259095592, 13: 978-0-07-7, 13978125909559, 978-0077862237

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App