Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alpha plc, a pharmaceutical company, has spent 5 million developing and patenting a new drug, ARG, which is currently being clinically tested. The cost of

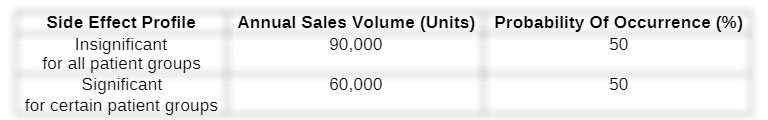

Alpha plc, a pharmaceutical company, has spent £5 million developing and patenting a new drug, ARG, which is currently being clinically tested. The cost of £1.5 million for the clinical trial, results of which will be determined in 12 months, was paid for at the start of the trial. The on-going trials have raised concerns about potential side effects of ARG for certain groups of patients. Senior management recognise that demand for the drug may be influenced by this potential for side effects of ARG and have therefore revised their sales predictions as follows:

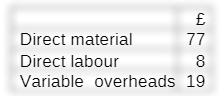

Sales will commence once the clinical trials are complete, that is, 12 months from now. Management expect that the annual sales pattern above will persist throughout the life of the production equipment used to manufacture ARG. This production equipment will cost the company £6 million in 12 months, when it is required and will be paid for on receipt. It will have a manufacturing capacity of 100,000 units per annum. The equipment has a useful life of 8 years, after which it will be worthless. ARG will be sold for £130 per unit and the estimated unit costs of production are:

In addition, fixed overheads associated with the manufacture of ARG (and inclusive of straight line depreciation on the production equipment), have been estimated at £1m per annum. A competitor firm, Beta plc, has just learnt about the development of ARG and has offered to purchase the patent for ARG from Alpha plc for a price of £2.3 million, payable immediately. If Alpha plc sells the patent, it will not be able to manufacture ARG. The average cost of capital at Alpha is 12%.

Required:

(a) Determine the best course of action for the board of directors from an economic perspective. Support your advice with appropriate computations.

(b) Beta plc, the competitor firm, has indicated that it is willing to pay a much higher price of £4.3 million for the patent in 12 months if the results of the completed trials are positive, that is, confirm that the side effect profile of ARG is an insignificant concern for all patient groups. The company will not, however, purchase the patent if the trial results are negative. Given that Beta plc wants Alpha plc to make its decision now, determine whether Alpha plc should wait for the clinical trial results to be confirmed.

Side Effect Profile Annual Sales Volume (Units) Probability Of Occurrence (%) Insignificant for all patient groups Significant for certain patient groups 90,000 50 60,000 50

Step by Step Solution

★★★★★

3.30 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

ARG is a new drug manufactured by Alpha Inc of which sales will begin next year The company has an offer to sell the patent to another company Beta pl...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

60990d58abb70_210640.pdf

180 KBs PDF File

60990d58abb70_210640.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started