Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alpha Technologies is considering a capital project about which the following information is available: The investment outlay on the project will be $100 million.

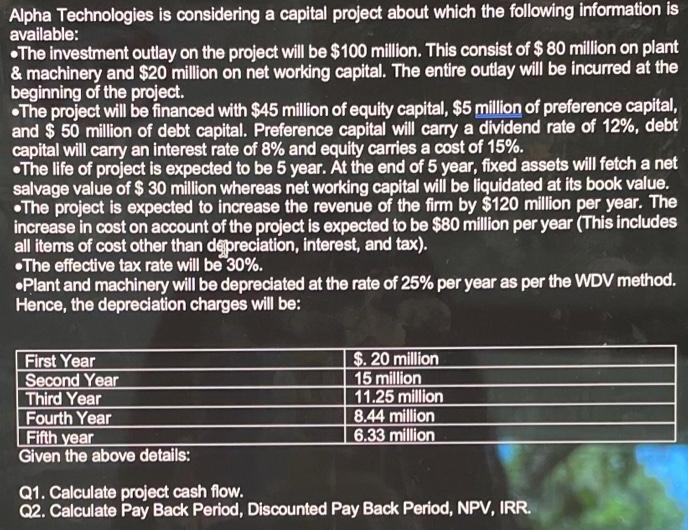

Alpha Technologies is considering a capital project about which the following information is available: The investment outlay on the project will be $100 million. This consist of $ 80 million on plant & machinery and $20 million on net working capital. The entire outlay will be incurred at the beginning of the project. The project will be financed with $45 million of equity capital, $5 million of preference capital, and $ 50 million of debt capital. Preference capital will carry a dividend rate of 12%, debt capital will carry an interest rate of 8% and equity carries a cost of 15%. The life of project is expected to be 5 year. At the end of 5 year, fixed assets will fetch a net salvage value of $ 30 million whereas net working capital will be liquidated at its book value. The project is expected to increase the revenue of the firm by $120 million per year. The increase in cost on account of the project is expected to be $80 million per year (This includes all items of cost other than depreciation, interest, and tax). The effective tax rate will be 30%. Plant and machinery will be depreciated at the rate of 25% per year as per the WDV method. Hence, the depreciation charges will be: First Year Second Year Third Year Fourth Year Fifth year Given the above details: $. 20 million 15 million 11.25 million 8.44 million 6.33 million Q1. Calculate project cash flow. Q2. Calculate Pay Back Period, Discounted Pay Back Period, NPV, IRR.

Step by Step Solution

★★★★★

3.54 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

Q1 Project Cash Flow Year 0 Investment 100 million Year 1 Revenue 120 million Depreciation 20 millio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started