Answered step by step

Verified Expert Solution

Question

1 Approved Answer

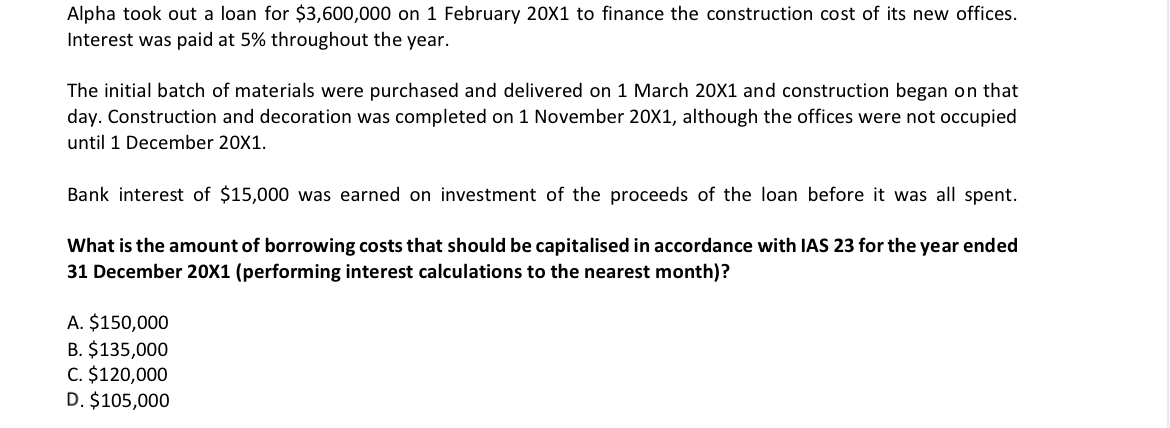

Alpha took out a loan for $ 3 , 6 0 0 , 0 0 0 on 1 February 2 0 1 to finance the

Alpha took out a loan for $ on February to finance the construction cost of its new offices. Interest was paid at throughout the year.

The initial batch of materials were purchased and delivered on March X and construction began on that day. Construction and decoration was completed on November X although the offices were not occupied until December X

Bank interest of $ was earned on investment of the proceeds of the loan before it was all spent.

What is the amount of borrowing costs that should be capitalised in accordance with IAS for the year ended December Xperforming interest calculations to the nearest month

A $

B $

C $

D $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started