Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alphonse Bona carries on a business as a sole proprietor in which a single product is sold to retail customers. During his first year

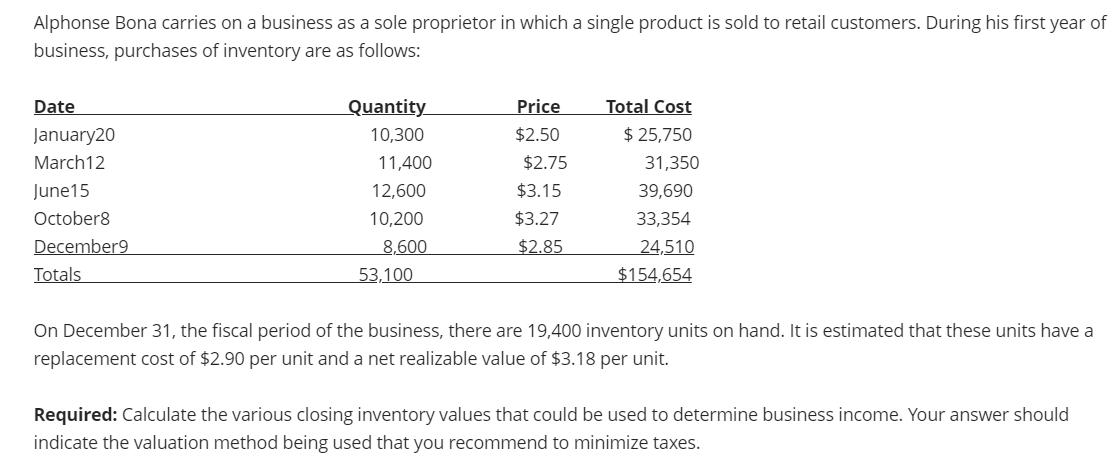

Alphonse Bona carries on a business as a sole proprietor in which a single product is sold to retail customers. During his first year of business, purchases of inventory are as follows: Date January20 March12 June15 October8 December9 Totals Quantity 10,300 11,400 12,600 10,200 8,600 53,100 Price $2.50 $2.75 $3.15 $3.27 $2.85 Total Cost $ 25,750 31,350 39,690 33,354 24,510 $154,654 On December 31, the fiscal period of the business, there are 19,400 inventory units on hand. It is estimated that these units have a replacement cost of $2.90 per unit and a net realizable value of $3.18 per unit. Required: Calculate the various closing inventory values that could be used to determine business income. Your answer should indicate the valuation method being used that you recommend to minimize taxes.

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

To calculate the various closing inventory values and determine the business income we need to consi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started