Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alphonso purchased an office building in 2010 for $650,000 and machinery (7-year property) in September of 2015 for $60,000 (assume these were business-use assets,

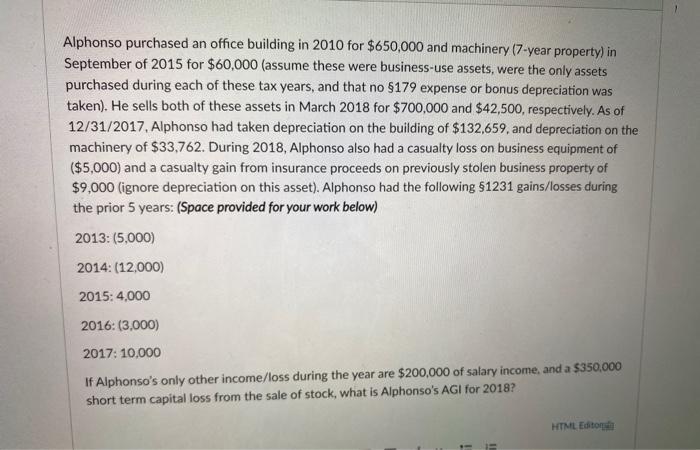

Alphonso purchased an office building in 2010 for $650,000 and machinery (7-year property) in September of 2015 for $60,000 (assume these were business-use assets, were the only assets purchased during each of these tax years, and that no $179 expense or bonus depreciation was taken). He sells both of these assets in March 2018 for $700,000 and $42,500, respectively. As of 12/31/2017, Alphonso had taken depreciation on the building of $132,659, and depreciation on the machinery of $33,762. During 2018, Alphonso also had a casualty loss on business equipment of ($5,000) and a casualty gain from insurance proceeds on previously stolen business property of $9,000 (ignore depreciation on this asset). Alphonso had the following $1231 gains/losses during the prior 5 years: (Space provided for your work below) 2013: (5,000) 2014: (12,000) 2015: 4,000 2016: (3,000) 2017: 10,000 If Alphonso's only other income/loss during the year are $200,000 of salary income, and a $350,000 short term capital loss from the sale of stock, what is Alphonso's AGI for 2018? HTML Editor

Step by Step Solution

★★★★★

3.46 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

In the above question we have to calculate Adjusted Gross Income for 2018 for Alphonso with the help ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started