Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alpine Township contracts with Dragoon Environmental Services (DES) to provide solid waste collection to households and businesses. Until recently, DES had an exclusive franchise

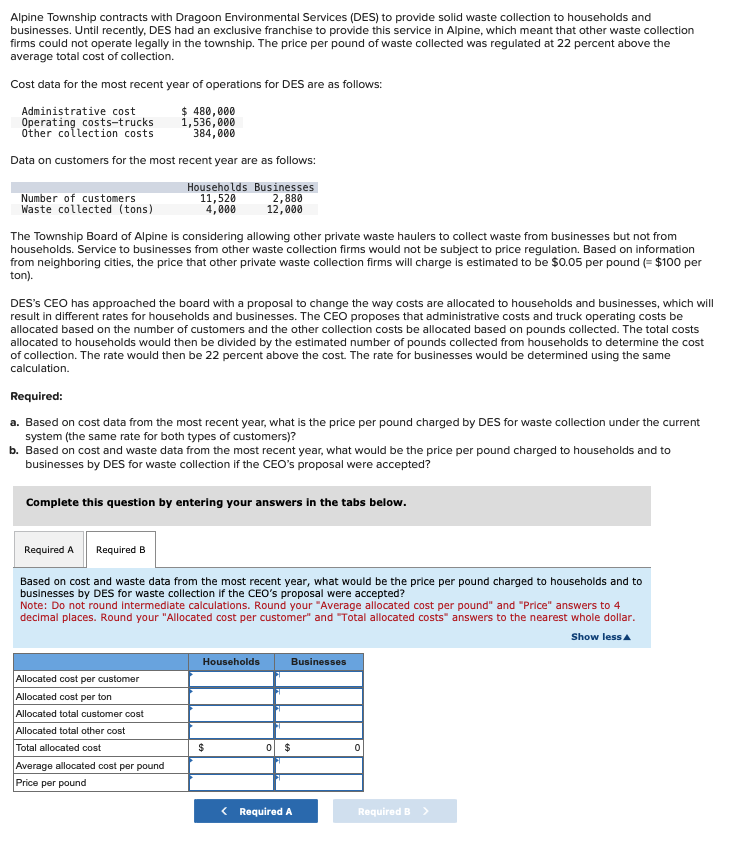

Alpine Township contracts with Dragoon Environmental Services (DES) to provide solid waste collection to households and businesses. Until recently, DES had an exclusive franchise to provide this service in Alpine, which meant that other waste collection firms could not operate legally in the township. The price per pound of waste collected was regulated at 22 percent above the average total cost of collection. Cost data for the most recent year of operations for DES are as follows: Administrative cost Operating costs-trucks Other collection costs $480,000 1,536,000 384,000 Data on customers for the most recent year are as follows: Number of customers Waste collected (tons) Households Businesses 2,880 12,000 11,520 4,000 The Township Board of Alpine is considering allowing other private waste haulers to collect waste from businesses but not from households. Service to businesses from other waste collection firms would not be subject to price regulation. Based on information from neighboring cities, the price that other private waste collection firms will charge is estimated to be $0.05 per pound (= $100 per ton). DES's CEO has approached the board with a proposal to change the way costs are allocated to households and businesses, which will result in different rates for households and businesses. The CEO proposes that administrative costs and truck operating costs be allocated based on the number of customers and the other collection costs be allocated based on pounds collected. The total costs allocated to households would then be divided by the estimated number of pounds collected from households to determine the cost of collection. The rate would then be 22 percent above the cost. The rate for businesses would be determined using the same calculation. Required: a. Based on cost data from the most recent year, what is the price per pound charged by DES for waste collection under the current system (the same rate for both types of customers)? b. Based on cost and waste data from the most recent year, what would be the price per pound charged to households and to businesses by DES for waste collection if the CEO's proposal were accepted? Complete this question by entering your answers in the tabs below. Required A Required B Based on cost and waste data from the most recent year, what would be the price per pound charged to households and to businesses by DES for waste collection if the CEO's proposal were accepted? Note: Do not round intermediate calculations. Round your "Average allocated cost per pound" and "Price" answers to 4 decimal places. Round your "Allocated cost per customer" and "Total allocated costs" answers to the nearest whole dollar. Households Businesses Allocated cost per customer Allocated cost per ton Allocated total customer cost Allocated total other cost Total allocated cost $ 0 $ 0 Average allocated cost per pound Price per pound < Required A Required B > Show less

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Required A Price per pound charged by DES for waste collection under the current system 10169 per to...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started