Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Already done questions (i) and (ii), plz solve the rest of questions. (i) Calculate monthly returns to the S&P/GSCI Commodity Index, over the last 10

Already done questions (i) and (ii), plz solve the rest of questions.

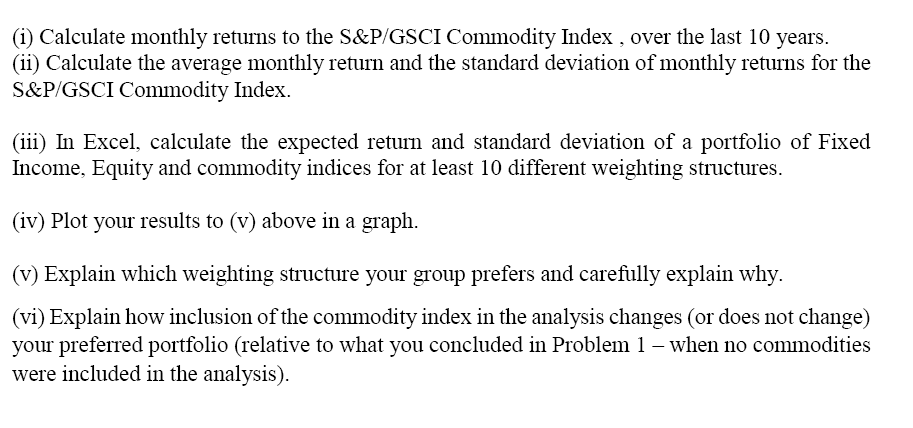

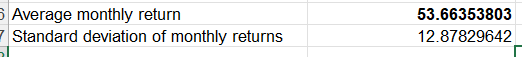

(i) Calculate monthly returns to the S&P/GSCI Commodity Index, over the last 10 years. (ii) Calculate the average monthly return and the standard deviation of monthly returns for the S&P/GSCI Commodity Index. (iii) In Excel, calculate the expected return and standard deviation of a portfolio of Fixed Income, Equity and commodity indices for at least 10 different weighting structures. (iv) Plot your results to (v) above in a graph. (v) Explain which weighting structure your group prefers and carefully explain why. (vi) Explain how inclusion of the commodity index in the analysis changes (or does not change) your preferred portfolio (relative to what you concluded in Problem 1 - when no commodities were included in the analysis). 5 Average monthly return 7 Standard deviation of monthly returns 53.66353803 12.87829642 (i) Calculate monthly returns to the S&P/GSCI Commodity Index, over the last 10 years. (ii) Calculate the average monthly return and the standard deviation of monthly returns for the S&P/GSCI Commodity Index. (iii) In Excel, calculate the expected return and standard deviation of a portfolio of Fixed Income, Equity and commodity indices for at least 10 different weighting structures. (iv) Plot your results to (v) above in a graph. (v) Explain which weighting structure your group prefers and carefully explain why. (vi) Explain how inclusion of the commodity index in the analysis changes (or does not change) your preferred portfolio (relative to what you concluded in Problem 1 - when no commodities were included in the analysis). 5 Average monthly return 7 Standard deviation of monthly returns 53.66353803 12.87829642Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started