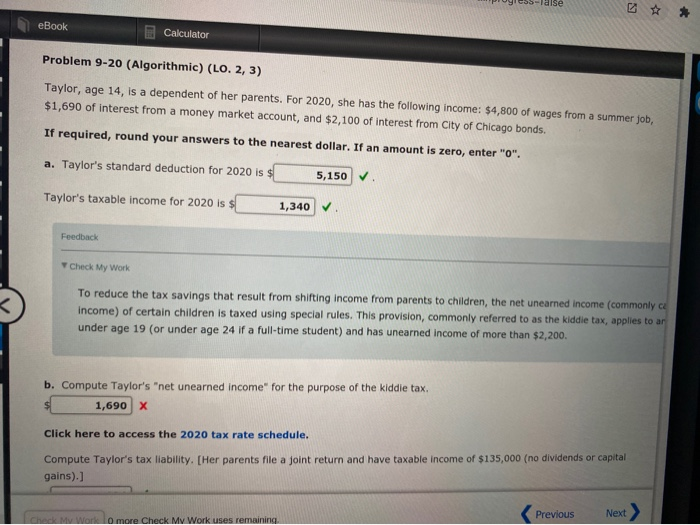

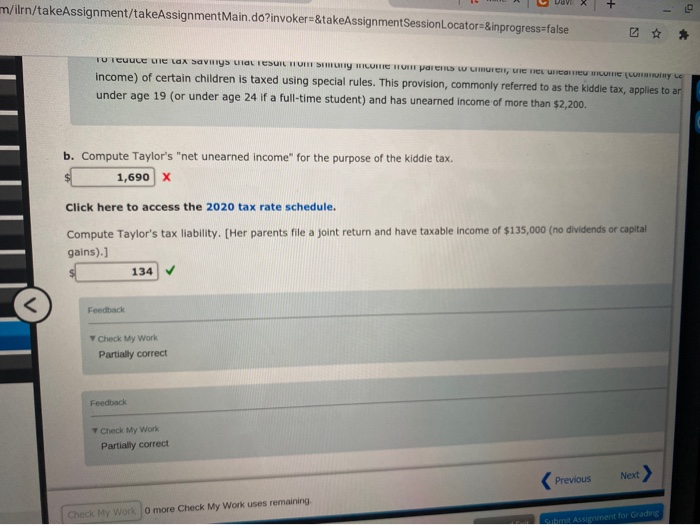

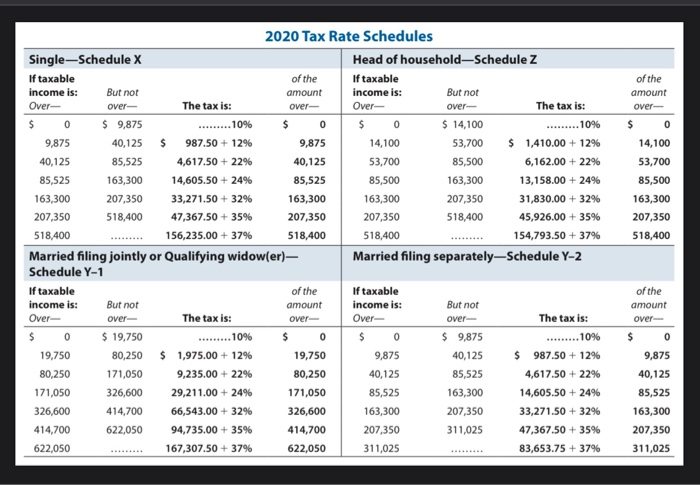

alse eBook Calculator Problem 9-20 (Algorithmic) (LO. 2, 3) Taylor, age 14, is a dependent of her parents. For 2020, she has the following income: $4,800 of wages from a summer job, $1,690 of interest from a money market account, and $2,100 of interest from City of Chicago bonds. If required, round your answers to the nearest dollar. If an amount is zero, enter "o". a. Taylor's standard deduction for 2020 is s 5,150 Taylor's taxable income for 2020 is $ 1,340 Feedback Check My Work To reduce the tax savings that result from shifting income from parents to children, the net unearned income (commonly ce income) of certain children is taxed using special rules. This provision, commonly referred to as the kiddie tax, applies to ar under age 19 (or under age 24 if a full-time student) and has unearned income of more than $2,200. b. Compute Taylor's "net unearned income" for the purpose of the kiddie tax. 1,690 x Click here to access the 2020 tax rate schedule. Compute Taylor's tax liability. (Her parents file a joint return and have taxable income of $135,000 (no dividends or capital gains).] Previous Next check My Worleomore Check My Work uses remaining, m/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSession Locator=&inprogress=false TU TEULE une Lax Savings LIDL TESUIL TRITT SINY MICE IT parents wren, en Care UTE CON LE income) of certain children is taxed using special rules. This provision, commonly referred to as the kiddie tax, applies to an under age 19 (or under age 24 if a full-time student) and has unearned income of more than $2,200. b. Compute Taylor's "net unearned Income" for the purpose of the kiddie tax. 1,690 X $ Click here to access the 2020 tax rate schedule. Compute Taylor's tax liability. [Her parents file a joint return and have taxable income of $135,000 (no dividends or capital gains).) 134 Check My Work O more Check My Work uses remaining Assignment for Grading of the amount over $ 0 2020 Tax Rate Schedules Single-Schedule X Head of household-Schedule z If taxable of the If taxable income is: But not amount income is: But not Over- over- The tax is: over Over- over- The tax is: $ 0 $ 9,875 ..... 10% $ 0 $ 0 $ 14,100 .... 10% 9,875 40,125 $ 987.50 + 12% 9,875 14,100 53,700 $ 1,410.00 +12% 40,125 85,525 4,617.50 + 22% 40,125 53,700 85,500 6,162.00 + 22% 85,525 163,300 14,605.50 +24% 85,525 85,500 163,300 13,158.00 + 24% 163,300 207,350 33,271.50 + 32% 163,300 163,300 207,350 31,830.00 + 32% 207,350 518,400 47,367.50 + 35% 207,350 207,350 518,400 45,926.00 + 35% 518,400 156,235.00 + 37% 518,400 518,400 154,793.50 + 37% Married filing jointly or Qualifying widow(er) Married filing separatelySchedule Y-2 Schedule Y-1 If taxable of the If taxable income is: But not amount income is: But not Over- over The tax is: over Over- over The tax is: $ 0 $ 19,750 .... 10% $ 0 $ 0 $ 9,875 10% 19,750 80,250 $ 1,975.00 + 12% 19,750 9,875 40,125 $ 987.50 + 12% 80,250 171,050 9,235.00 + 22% 80,250 40,125 85,525 4,617.50 + 22% 171,050 326,600 29,211.00 + 24% 171,050 85,525 163,300 14,605.50 +24% 326,600 414,700 66,543.00 + 32% 326,600 163,300 207,350 33,271.50 + 32% 414,700 622,050 94,735.00 + 35% 414,700 207,350 311,025 47,367.50 + 35% 622,050 167,307.50 + 37% 622,050 311,025 83,653.75 + 37% 14,100 53,700 85,500 163,300 207,350 518,400 of the amount over- $ 0 9,875 40,125 85,525 163,300 207,350 311,025 alse eBook Calculator Problem 9-20 (Algorithmic) (LO. 2, 3) Taylor, age 14, is a dependent of her parents. For 2020, she has the following income: $4,800 of wages from a summer job, $1,690 of interest from a money market account, and $2,100 of interest from City of Chicago bonds. If required, round your answers to the nearest dollar. If an amount is zero, enter "o". a. Taylor's standard deduction for 2020 is s 5,150 Taylor's taxable income for 2020 is $ 1,340 Feedback Check My Work To reduce the tax savings that result from shifting income from parents to children, the net unearned income (commonly ce income) of certain children is taxed using special rules. This provision, commonly referred to as the kiddie tax, applies to ar under age 19 (or under age 24 if a full-time student) and has unearned income of more than $2,200. b. Compute Taylor's "net unearned income" for the purpose of the kiddie tax. 1,690 x Click here to access the 2020 tax rate schedule. Compute Taylor's tax liability. (Her parents file a joint return and have taxable income of $135,000 (no dividends or capital gains).] Previous Next check My Worleomore Check My Work uses remaining, m/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSession Locator=&inprogress=false TU TEULE une Lax Savings LIDL TESUIL TRITT SINY MICE IT parents wren, en Care UTE CON LE income) of certain children is taxed using special rules. This provision, commonly referred to as the kiddie tax, applies to an under age 19 (or under age 24 if a full-time student) and has unearned income of more than $2,200. b. Compute Taylor's "net unearned Income" for the purpose of the kiddie tax. 1,690 X $ Click here to access the 2020 tax rate schedule. Compute Taylor's tax liability. [Her parents file a joint return and have taxable income of $135,000 (no dividends or capital gains).) 134 Check My Work O more Check My Work uses remaining Assignment for Grading of the amount over $ 0 2020 Tax Rate Schedules Single-Schedule X Head of household-Schedule z If taxable of the If taxable income is: But not amount income is: But not Over- over- The tax is: over Over- over- The tax is: $ 0 $ 9,875 ..... 10% $ 0 $ 0 $ 14,100 .... 10% 9,875 40,125 $ 987.50 + 12% 9,875 14,100 53,700 $ 1,410.00 +12% 40,125 85,525 4,617.50 + 22% 40,125 53,700 85,500 6,162.00 + 22% 85,525 163,300 14,605.50 +24% 85,525 85,500 163,300 13,158.00 + 24% 163,300 207,350 33,271.50 + 32% 163,300 163,300 207,350 31,830.00 + 32% 207,350 518,400 47,367.50 + 35% 207,350 207,350 518,400 45,926.00 + 35% 518,400 156,235.00 + 37% 518,400 518,400 154,793.50 + 37% Married filing jointly or Qualifying widow(er) Married filing separatelySchedule Y-2 Schedule Y-1 If taxable of the If taxable income is: But not amount income is: But not Over- over The tax is: over Over- over The tax is: $ 0 $ 19,750 .... 10% $ 0 $ 0 $ 9,875 10% 19,750 80,250 $ 1,975.00 + 12% 19,750 9,875 40,125 $ 987.50 + 12% 80,250 171,050 9,235.00 + 22% 80,250 40,125 85,525 4,617.50 + 22% 171,050 326,600 29,211.00 + 24% 171,050 85,525 163,300 14,605.50 +24% 326,600 414,700 66,543.00 + 32% 326,600 163,300 207,350 33,271.50 + 32% 414,700 622,050 94,735.00 + 35% 414,700 207,350 311,025 47,367.50 + 35% 622,050 167,307.50 + 37% 622,050 311,025 83,653.75 + 37% 14,100 53,700 85,500 163,300 207,350 518,400 of the amount over- $ 0 9,875 40,125 85,525 163,300 207,350 311,025