Question

Also, assume that the company was founded on January 1 with a contribution by owners of $200,000 in cash credited to capital stocks. Required 1.

Also, assume that the company was founded on January 1 with a contribution by owners of $200,000 in cash credited to capital stocks.

Required

1. Record the journal entry on 1/1 for the $200,000 contribution by owners.

2. Suppose the securities were purchased on Jan 2. Record the journal entry.

3. Record the journal entry for fair value adjustment.

4. Explain why net income and retained earnings are zero (assume no additional transactions)

5. Prepare a statement of comprehensive income.

6. Prepare a complete balance sheet considering all the facts above

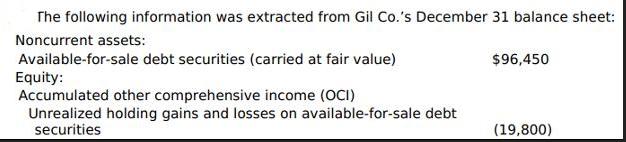

The following information was extracted from Gil Co.'s December 31 balance sheet: Noncurrent assets: Available-for-sale debt securities (carried at fair value) Equity: Accumulated other comprehensive income (OCI) Unrealized holding gains and losses on available-for-sale debt securities $96,450 (19,800)

Step by Step Solution

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

1 The journal entry on 11 for the 200000 contribution by owners would be Debit Cash Ac 200000 Credit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started