Also need help with these. its greatly appriecated!!!

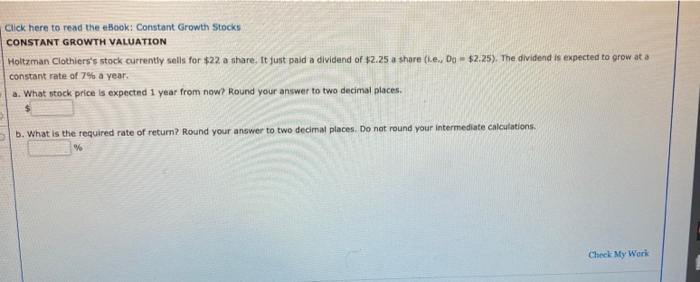

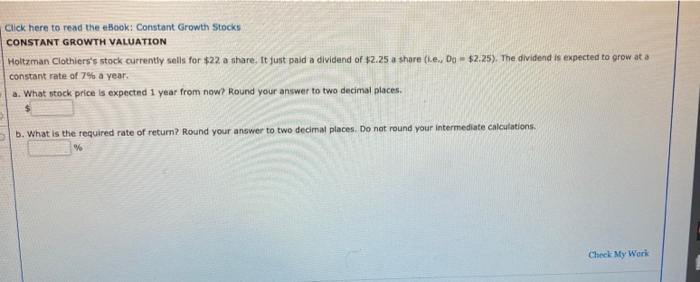

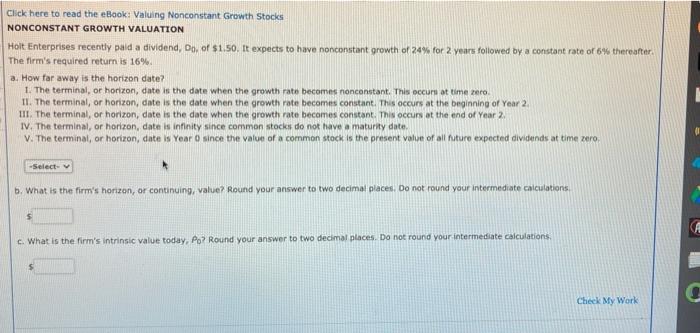

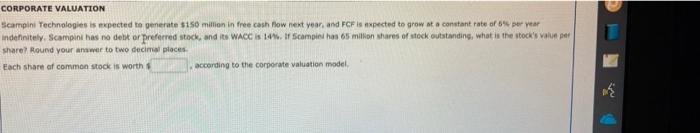

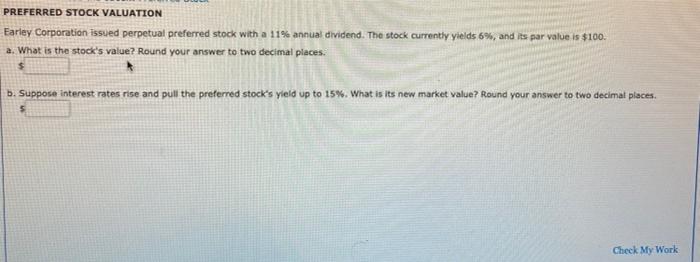

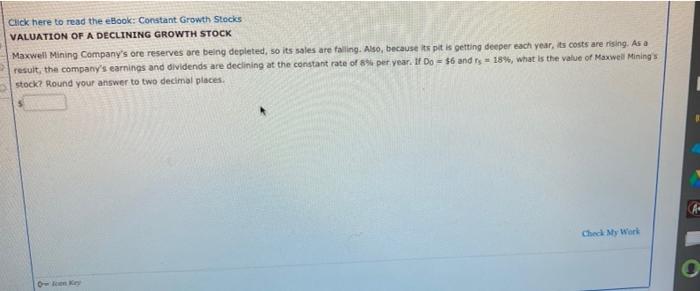

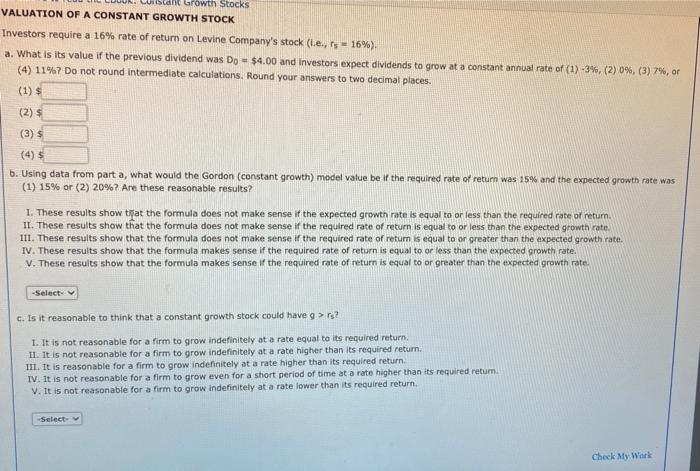

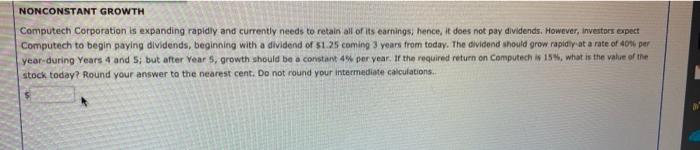

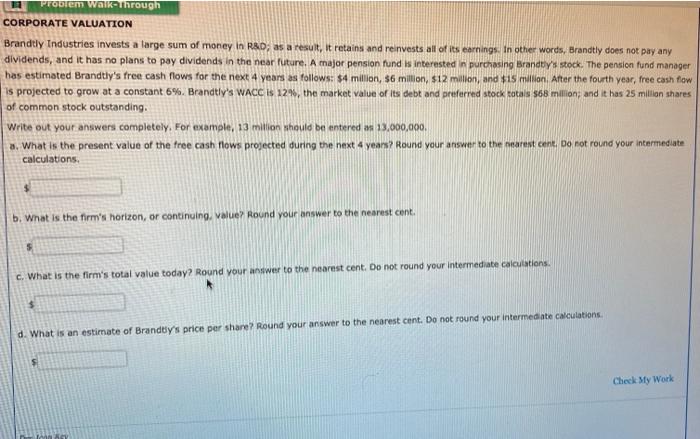

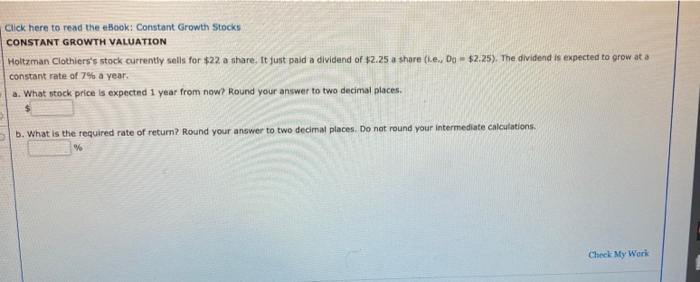

Click here to read the eBook: Constant Growth Stocks CONSTANT GROWTH VALUATION Holtzman Clothiers's stock currently sells for $22. a share. It just paid a dividend of $2.25 a shore (le, Do - $2.25). The dividend is expected to grow at a constant rate of 7% a year a. What stock price is expected 1 year from now? Round your answer to two decimal places. b. What is the required rate of return? Round your answer to two decimal places. Do not round your intermediate calculations, Check My Work Click here to read the eBook: Valuing Nonconstant Growth Stocks NONCONSTANT GROWTH VALUATION Holt Enterprises recently paid a dividend, Do, of $1.50. It expects to have nonconstant growth of 24% for 2 years followed by a constant rate of 6% thereafter The firm's required return is 16% a. How far away is the horizon date? 1. The terminal, or horizon, dat is the date when the growth rate becomes nonconstant. This occur at time zero II. The terminal, or horizon, date is the date when the growth rate becomes constant. This occurs at the beginning of Year 2 III. The terminal, or horizon, date is the date when the growth rate becomes constant. This occurs at the end of Year 2 IV. The terminal, or horizon, date is infinity since common stocks do not have a maturity date. V. The terminal, or horizon, date is Year O since the value of a common stock is the present value of all futuro expected dividends at time zero -Select- b. What is the firm's horizon, or continuing, value Round your answer to two decimal places. Do not round your intermediate calculations c. What is the firm's intrinsic value today, Po? Round your answer to two decimal places. Do not round your intermediate calculations Check My Work CORPORATE VALUATION Scampini Technologies is expected to generate 150 million in free cash flow next year, and FCF is expected to grow at a constant rate of 5 per year indefinitely. Scampinhas no del or preferred stock, and its WACC I 14%. If Scampinhas 65 million shares of stock outstanding, what is the stock valut per share? Round your answer to two decimal places Each share of common stock is worth according to the corporate valuation model, PREFERRED STOCK VALUATION Farley Corporation issued perpetual preferred stock with a 11% annual dividend. The stock currently yields 6%, and its par value is $100. 2. What is the stock's value? Round your answer to two decimal places. b. Suppose interest rates rise and pull the preferred stock's yield up to 15%. What is its new market value? Round your answer to two decimat pieces. Check My Work Click here to read the eBook: Constant Growth Stocks VALUATION OF A DECLINING GROWTH STOCK Maxwell Mining Company's ore reserves are being depleted, so its sales are falling. Also, because its pit is getting deeper each year, its costs are rising. As a result, the company's earnings and dividends are declining at the constant rate of 8 per year. It Do - $6 andrs 18%, what is the value of Maxwell Minings stock? Round your answer to two decimal places. Check My Work Olen Constant Growth Stocks VALUATION OF A CONSTANT GROWTH STOCK Investors require a 16% rate of return on Levine Company's stock (.e., 's -16%). a. What is its value if the previous dividend was Do = $4.00 and Investors expect dividends to grow at a constant annual rate of (1) -3%. (2) 0%, (3) 7%, or (4) 11%? Do not round intermediate calculations. Round your answers to two decimal places. (1) $ (2) $ (3) $ (4) 5 b. Using data from part a, what would the Gordon (constant growth) model value be if the required rate of return was 15% and the expected growth rate was (1) 15% or (2) 20%? Are these reasonable results? 1. These results show tiat the formula does not make sense if the expected growth rate is equal to or less than the required rate or return. IL. These results show that the formula does not make sense of the required rate of return is equal to or less than the expected growth rate 111. These results show that the formula does not make sense if the required rate of return is equal to or greater than the expected growth rate. IV. These results show that the formula makes sense if the required rate of return is equal to or less than the expected growth rate. V. These results show that the formula makes sense if the required rate of return is equal to or greater than the expected growth rate. -Select- c. Is it reasonable to think that a constant growth stock could have 9 > 3? 1. It is not reasonable for a firm to grow indefinitely at a rate equal to its required return II. It is not reasonable for a firm to grow indefinitely at a rate higher than its required return III. It is reasonable for a firm to grow indefinitely at a rate higher than its required return TV. It is not reasonable for a firm to grow even for a short period of time at a rate higher than its required return V. It is not reasonable for a firm to grow indefinitely at a rate lower than its required return Select- Check My Work NONCONSTANT GROWTH Computech Corporation is expanding rapidly and currently needs to retain all or its earnings, hence, It does not pay dividends. However, investors expect Computech to begin paying dividends, beginning with a dividend of 1.25 coming 3 years from today. The dividend should grow rapidly at a rate of 40 per year-during Years 4 and 5; but after Year 5. growth should be a constant per year. If the required return on Computech 15, what is the value of the stock today? Round your answer to the nearest cent. Do not round your intermediate calculations Protem walkthrough CORPORATE VALUATION Brandtly Industries invests a large sum of money in R&D, as a result, it retains and reinvests all of its earnings. In other words, Brandtly does not pay any dividends, and it has no plans to pay dividends in the near future. A major pension fund is interested in purchasing Brandty's stock. The pension fund manager has estimated Brandtly's free cash flows for the next 4 years as follows: 54 million, 56 million, $12 milion, and $15 million. After the fourth year, free cash flow is projected to grow at a constant 6%. Brandtly's WACC IS 12%, the market value of its debt and preferred stock totals 568 million, and it has 25 million shares of common stock outstanding. Write out your answers completely. For example, 13 million should be entered as 13,000,000 3. What is the present value of the free cash flows projected during the next 4 years? Round your answer to the nearest cent. Do not round your intermediate calculations. b. What is the firm's horizon, or continuing, Value Round your answer to the nearest cent. c. What is the firm's total value today? Round your answer to the nearest cent. Do not round your intermediate calculations. d. What is an estimate of Brandtly's price per share? Round your answer to the nearest cent. Do not found your intermediate calculations Check My Work