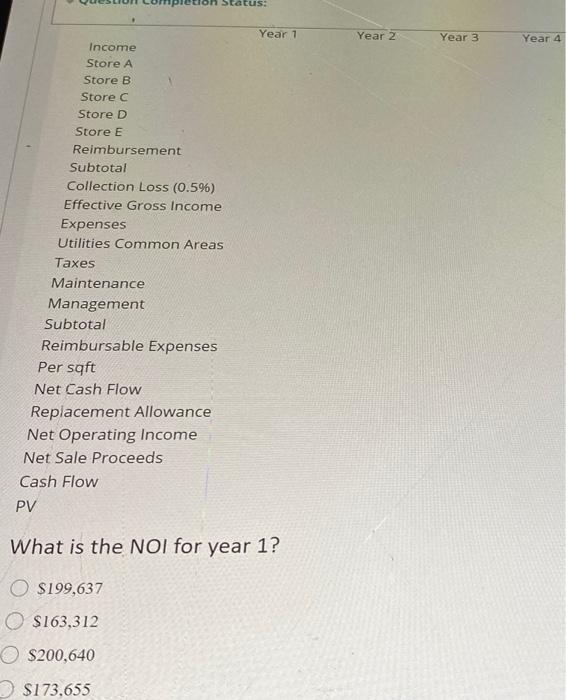

Also, what is the NOI for year 2, and the PV of the property cash flows?

The property be appraised is the leased interest in a mall strip shopping center consisting of five units of 2000 square feet each. The following Information is thered for the DCF analysis Markerrants are currently 122 per square foot per year, and the appraiser's analysis of market rents over the past five years teates that they have Increased at a compound rate of 2.5 per year and that the market expects that pattern to continue The Neon Store A will run for two more years at a rent or super square foot per month or 15.6 per foot per year. An interview with the tenant indicates that the tenant interids to renew the lease at the market rate when the lease expires. Store B has a 10 years frase with six years remaining. The rent is currently $1.56 per square foot per month and will increase at a rate of 3% per year one-half the change in the consumer price index (CPi whichever is higher The CPI expected to increase 4 per year over the next four years Store C. and I were recently leased for years. These leases and all new teases are set at market rent with provisions to keep the rents at market rates throughout the projection period. The landlord is responsible only for common area utilities real estate taxes, exterior maintenance management and capital items, but leases have expense stop of $16 per square foot. Tenants are responsible for all other expenses above the 51.6 per square foot Common area utilities for 56,600 per year and growing 2.5% per year. Taxes are currently $7,000 per year. The tax assessor reviews and reassesses properties every three years. The subject property was reviewed one year ago and taxes are expected to increase by about $800 with each subsequent review. There is a market expectation that the rate of change will probably remain the same over the next two reviews. Le, the period of the income and expense analysis General exterior maintenance, excluding clean-up and landscaping costs of $200 per month. This expected to increase each year by $15 per month Property management fees are set at 5% of the effective gross income. Management fees are not reimbursable. A nominal collection loss of 0.5% of scheduled rent is anticipated. The roof should be replaced during the second year at a cost of 535,000, but no other exterior repairs or replacements are expected during the projection period The terminal capitalization rate of 7% less a sales expense of 3% of the sale price and the discount rate is 8.5%. atus: Year 1 Year 2 Year 3 Year 4 Income Store A Store B Store C Store D Store E Reimbursement Subtotal Collection Loss (0.596) Effective Gross Income Expenses Utilities Common Areas Taxes Maintenance Management Subtotal Reimbursable Expenses Per sqft Net Cash Flow Replacement Allowance Net Operating Income Net Sale Proceeds Cash Flow PV What is the NOI for year 1? O $199,637 O $163,312 $200,640 $173,655 The property be appraised is the leased interest in a mall strip shopping center consisting of five units of 2000 square feet each. The following Information is thered for the DCF analysis Markerrants are currently 122 per square foot per year, and the appraiser's analysis of market rents over the past five years teates that they have Increased at a compound rate of 2.5 per year and that the market expects that pattern to continue The Neon Store A will run for two more years at a rent or super square foot per month or 15.6 per foot per year. An interview with the tenant indicates that the tenant interids to renew the lease at the market rate when the lease expires. Store B has a 10 years frase with six years remaining. The rent is currently $1.56 per square foot per month and will increase at a rate of 3% per year one-half the change in the consumer price index (CPi whichever is higher The CPI expected to increase 4 per year over the next four years Store C. and I were recently leased for years. These leases and all new teases are set at market rent with provisions to keep the rents at market rates throughout the projection period. The landlord is responsible only for common area utilities real estate taxes, exterior maintenance management and capital items, but leases have expense stop of $16 per square foot. Tenants are responsible for all other expenses above the 51.6 per square foot Common area utilities for 56,600 per year and growing 2.5% per year. Taxes are currently $7,000 per year. The tax assessor reviews and reassesses properties every three years. The subject property was reviewed one year ago and taxes are expected to increase by about $800 with each subsequent review. There is a market expectation that the rate of change will probably remain the same over the next two reviews. Le, the period of the income and expense analysis General exterior maintenance, excluding clean-up and landscaping costs of $200 per month. This expected to increase each year by $15 per month Property management fees are set at 5% of the effective gross income. Management fees are not reimbursable. A nominal collection loss of 0.5% of scheduled rent is anticipated. The roof should be replaced during the second year at a cost of 535,000, but no other exterior repairs or replacements are expected during the projection period The terminal capitalization rate of 7% less a sales expense of 3% of the sale price and the discount rate is 8.5%. atus: Year 1 Year 2 Year 3 Year 4 Income Store A Store B Store C Store D Store E Reimbursement Subtotal Collection Loss (0.596) Effective Gross Income Expenses Utilities Common Areas Taxes Maintenance Management Subtotal Reimbursable Expenses Per sqft Net Cash Flow Replacement Allowance Net Operating Income Net Sale Proceeds Cash Flow PV What is the NOI for year 1? O $199,637 O $163,312 $200,640 $173,655