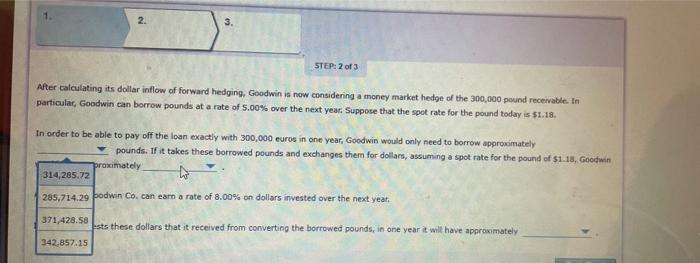

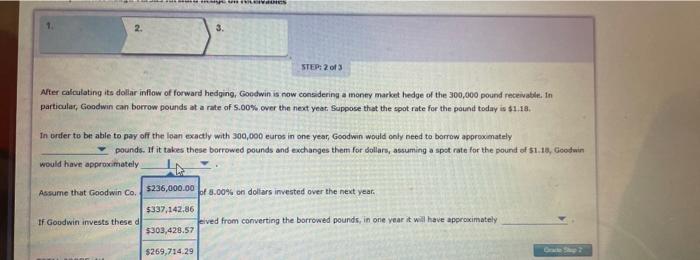

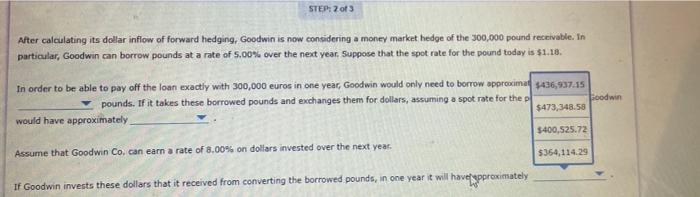

Alter calculating its dollar inflow of forward hedging, Goodwin is now considering a money market hedge of the 300,000 pound receivable. In particular, Goodwin can borrow pounds at a rate of 5.00% over the next year. Suppose that the spot rate for the pound today is $1.18, In order to be able to pay off the loan exactly with 300,000 euros in one year, Goodwin would only need to borrow approximately pounds. 1 it takes these borrowed pounds and exchanges them for dollars, assuming a spot rate for the pound of $1.18, Goodwin would have approximately a Assume that Goodwin Co. can earn a rate of 8.00% on dollars invested over the next year. if Goodwin invests these dollars that it received from converting the borrowed pounds, in one year it will have approximately 2. STEP: 2 of 3 After calculating its dollar inflow of forward hedging, Goodwin is now considering a money market hedge of the 300,000 pound receivable. In particular, Goodwin can borrow pounds at a rate of 5.00% over the next year. Suppose that the spot rate for the pound today is $1.18. 314,285.72 In order to be able to pay off the loan exactly with 300,000 euros in one year. Goodwin would only need to borrow approximately pounds. If it takes these borrowed pounds and exchanges them for dollars, assuming a spot rate for the pound of $1.18, Goodwin proximately tot 285,714.29 podwin Co. can eam a rate of 8.00% on dollars invested over the next year, 371,428.58 sts these dollars that it received from converting the borrowed pounds, in one year it will have approximately 342,857.15 2. STEP: 2 of 3 Alter calculating its dollar inflow of forward hedging, Goodwin is now considering a money market hedge of the 300,000 pound receivable in particular, Goodwin can borrow pounds at a rate of 5.00% over the next year. Suppose that the spot rate for the pound today is $1.18, In order to be able to pay off the loan exactly with 300,000 euros in one year, Goodwin would only need to borrow approximately pounds. If it takes these borrowed pounds and exchanges them for dollars, assuming a spot rate for the pound of 51.16, Goodwin would have approximately Assume that Goodwin Co. $236,000.00 pt 5.00% on dollars invested over the next year. $337, 142.86 eived from converting the borrowed pounds, in one year it will have approximately $303,428.57 If Goodwin invests these d $269,714,29 STEP 2 of 3 After calculating its dollar inflow of forward hedging, Goodwin is now considering a money market hedge of the 300,000 pound receivable. In particular, Goodwin can borrow pounds at a rate of 5.00% over the next year. Suppose that the spot rate for the pound today is $1.18. In order to be able to pay off the loan exactly with 300,000 euros in one year, Goodwin would only need to borrow approacimal 5436,937.15 pounds. If it takes these borrowed pounds and exchanges them for dollars, assuming a spot rate for the p oodwin $473,348.58 would have approximately $400,525.72 Assume that Goodwin Co, can earn a rate of 8,00% on dollars invested over the next year. $354,114.29 If Goodwin invests these dollars that it received from converting the borrowed pounds, in one year it will have approximately