Answered step by step

Verified Expert Solution

Question

1 Approved Answer

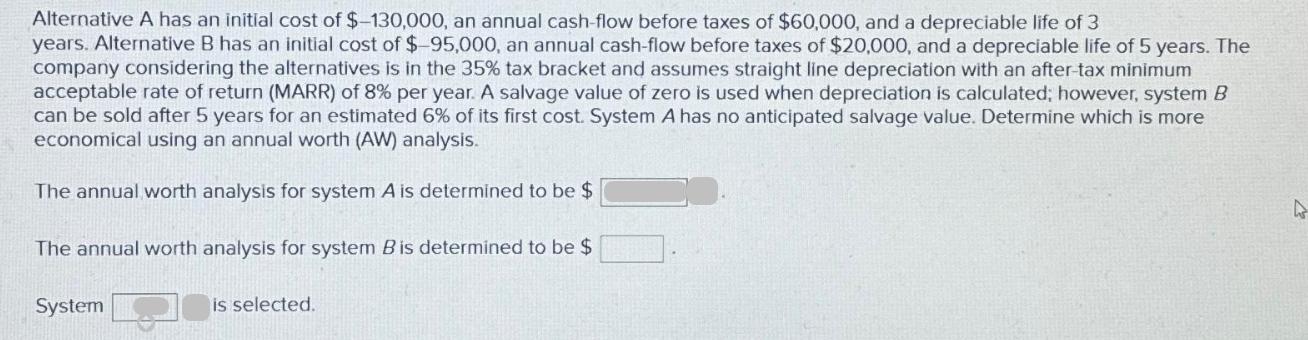

Alternative A has an initial cost of $-130,000, an annual cash-flow before taxes of $60,000, and a depreciable life of 3 years. Alternative B

Alternative A has an initial cost of $-130,000, an annual cash-flow before taxes of $60,000, and a depreciable life of 3 years. Alternative B has an initial cost of $ 95,000, an annual cash-flow before taxes of $20,000, and a depreciable life of 5 years. The company considering the alternatives is in the 35% tax bracket and assumes straight line depreciation with an after-tax minimum acceptable rate of return (MARR) of 8% per year. A salvage value of zero is used when depreciation is calculated; however, system B can be sold after 5 years for an estimated 6% of its first cost. System A has no anticipated salvage value. Determine which is more economical using an annual worth (AW) analysis. The annual worth analysis for system A is determined to be $ The annual worth analysis for system B is determined to be $ System is selected. 4

Step by Step Solution

★★★★★

3.37 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Lets calculate the annual worth AW for each alternative using the given information For Alternative ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started