Answered step by step

Verified Expert Solution

Question

1 Approved Answer

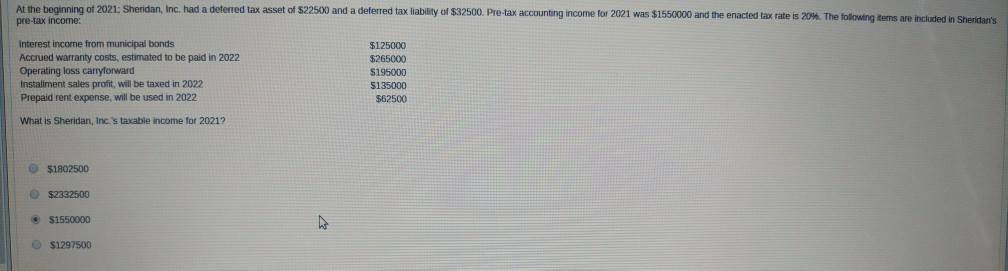

Althohoinning of 2021: Sheridan, Inc. had a deferred tax asset of $22500 and a deferred tax liability of 532500. Pre-tax accounting income for 2021 was

Althohoinning of 2021: Sheridan, Inc. had a deferred tax asset of $22500 and a deferred tax liability of 532500. Pre-tax accounting income for 2021 was $1550000 and the enacted tax rate is 2017. The following terms are included in Sheridan's pre-tax income: Interest income from municipal bonds Accrued warranty costs, estimated to be paid in 2022 Operating loss carryforward Installment sales profit, will be taxed in 2022 Prepaid rent expense, will be used in 2022 $125000 $265000 $195000 S135000 $62500 What is Sheridan, Inc.'s taxable income for 2021? $1802500 52332500 $1550000 $1297500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started