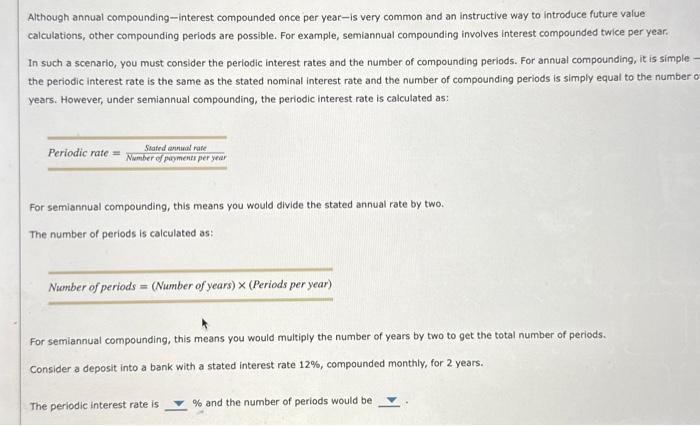

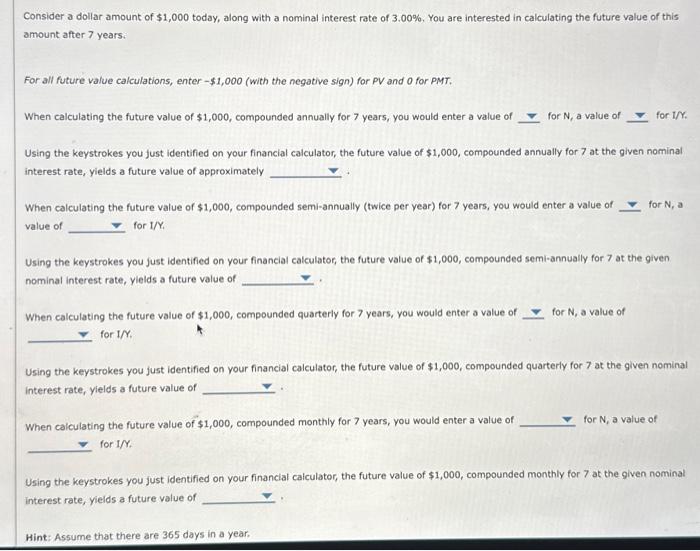

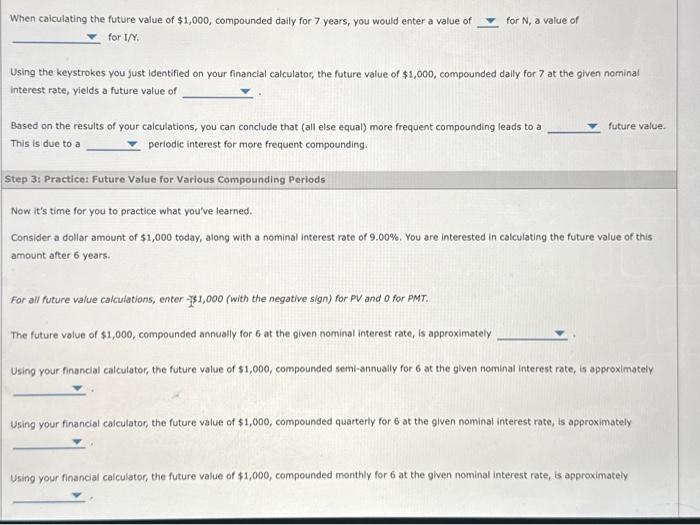

Although annual compounding-interest compounded once per year-is very common and an instructive way to introduce future value calculations, other compounding periods are possible. For example, semiannual compounding involves interest compounded twice per year. In such a scenario, you must consider the periodic interest rates and the number of compounding periods. For annual compounding, it is simple the periodic interest rate is the same as the stated nominal interest rate and the number of compounding periods is simply equal to the number o years. However, under semiannual compounding, the periodic interest rate is calculated as: For semiannual compounding, this means you would divide the stated annual rate by two. The number of periods is calculated as: Number of periods =( Number of years )( Periods per year ) For semiannual compounding, this means you would multiply the number of years by two to get the total number of periods. Consider a deposit into a bank with a stated interest rate 12%, compounded monthly, for 2 years. The periodic interest rate is % and the number of periods would be Consider a dollar amount of $1,000 today, along with a nominal interest rate of 3.00%, You are interested in calculating the future value of this amount after 7 years. For all future value calculations, enter $1,000 (with the negative sign) for PV and 0 for PMT. When calculating the future value of $1,000, compounded annually for 7 years, you would enter a value of for N, a value of for 1/Y. Using the keystrokes you just identified on your financial calculator, the future value of $1,000, compounded annually for 7 at the given nominal interest rate, yields a future value of approximately When calculating the future value of $1,000, compounded semi-annually (twice per year) for 7 years, you would enter a value of for N, a value of for 1/Y, Using the keystrokes you just identified on your financial calculator, the future value of $1,000, compounded semi-annually for 7 at the given nominal interest rate, yields a future value of When calculating the future value of $1,000, compounded quarterly for 7 years, you would enter a value of for N, a value of for 1/Y, Using the keystrokes you just identified on your financial calculator, the future value of $1,000, compounded quarterly for 7 at the given nominal interest rate, yields a future value of When calculating the future value of $1,000, compounded monthly for 7 years, you would enter a value of for N, a value of for 1/Y. Using the keystrokes you just identified on your financial calculator, the future value of $1,000, compounded monthly for 7 at the given nominal interest rate, yields a future value of When caiculating the future value of $1,000, compounded daily for 7 years, you would enter a value of for N, a value of for I/ Y, Using the keystrokes you just identified on your financial calculator, the future value of $1,000, compounded daily for 7 at the given nominal interest rate, yields a future value of Based on the results of your calculations, you can conclude that (all else equal) more frequent compounding leads to a future value. This is due to a periodic interest for more frequent compounding. Step 3: Practice: Future Value for Various Compounding Periods Now it's time for you to practice what you've learned. Consider a dollar amount of $1,000 today, along with a nominal interest rote of 9.00%. You are interested in calculating the future value of this amount after 6 years. For all future value calculations, enter - \$1,000 (with the negative sign) for PV and O for PMT. The future value of $1,000, compounded annualiy for 6 at the given nominal interest rate, is approximately Using your financial calculator, the future value of $1,000, compounded semi-annually for 6 at the given nominal interest rate, is approximately Using your financial calculator, the future value of $1,000, compounded quarterly for 6 at the given nominal interest rate, is approximately Using your financial calculator, the future value of $1,000, compounded monthly for 6 at the given nominal interest rate, is approximately Hint: Assume that there are 365 days in a year. Using your financial calculator, the future value of $1,000, compounded dally for 6 at the given nominal interest rate, is approximately