Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Although entries have been recorded all year, adjusting entries have not been recorded since December 31, 2021 when the financial statements were last prepared.

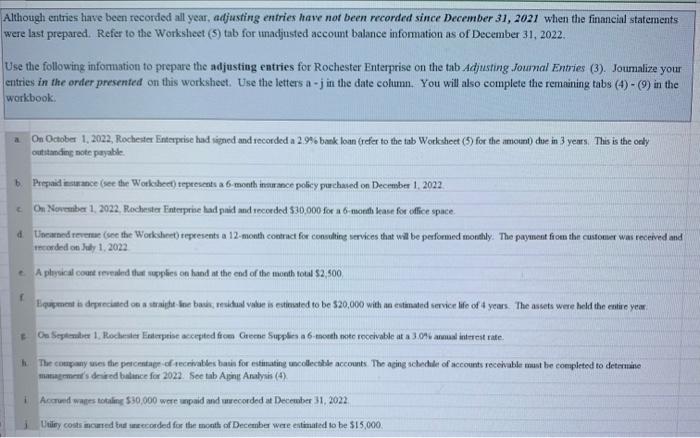

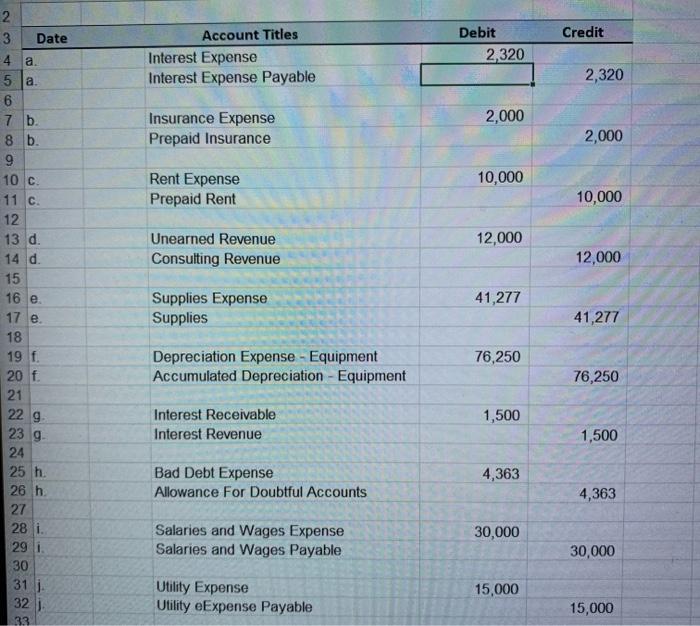

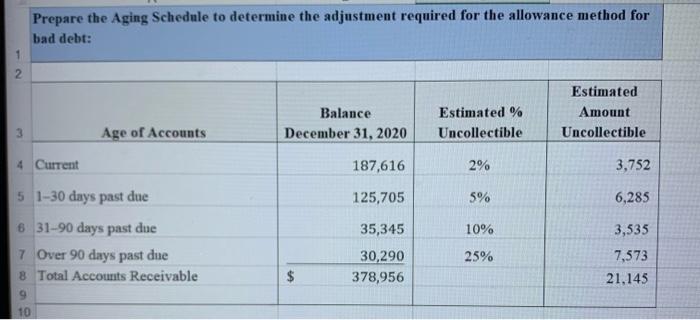

Although entries have been recorded all year, adjusting entries have not been recorded since December 31, 2021 when the financial statements were last prepared. Refer to the Worksheet (5) tab for unadjusted account balance information as of December 31, 2022. Use the following information to prepare the adjusting entries for Rochester Enterprise on the tab Adjusting Journal Entries (3). Joumalize your entries in the order presented on this worksheet. Use the letters a-j in the date column. You will also complete the remaining tabs (4) - (9) in the workbook. a On October 1, 2022, Rochester Enterprise had signed and recorded a 2.9% bank loan (refer to the tab Worksheet (5) for the amount) due in 3 years. This is the only outstanding note payable. b. Prepaid insurance (see the Worksheet) represents a 6-month insurance policy purchased on December 1, 2022 On November 1, 2022, Rochester Enterprise had paid and recorded $30,000 for a 6-month lease for office space. d. Unearned revenue (see the Worksheet) represents a 12-month contract for consulting services that will be performed monthly. The payment from the customer was received and recorded on July 1, 2022 f A physical count revealed that supplies on hand at the end of the month total $2,500, Equipment is depreciated on a straight-line basis, residual value is estimated to be $20,000 with an estimated service life of 4 years. The assets were held the entire year. On September 1, Rochester Enterprise accepted from Greene Supplies a 6-month note receivable at a 3.0% annual interest rate h. The company uses the percentage of receivables basis for estimating uncollectible accounts. The aging schedule of accounts receivable must be completed to determine management's desired balance for 2022. See tab Aging Analysis (4) Accrued wages totaling $30,000 were unpaid and unrecorded at December 31, 2022 Utility costs incurred but unrecorded for the month of December were estimated to be $15,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started