Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Although investing requires the individual to bear risk, the risk can be controlled through the construction of diversified portfolios and by excluding any portfolio

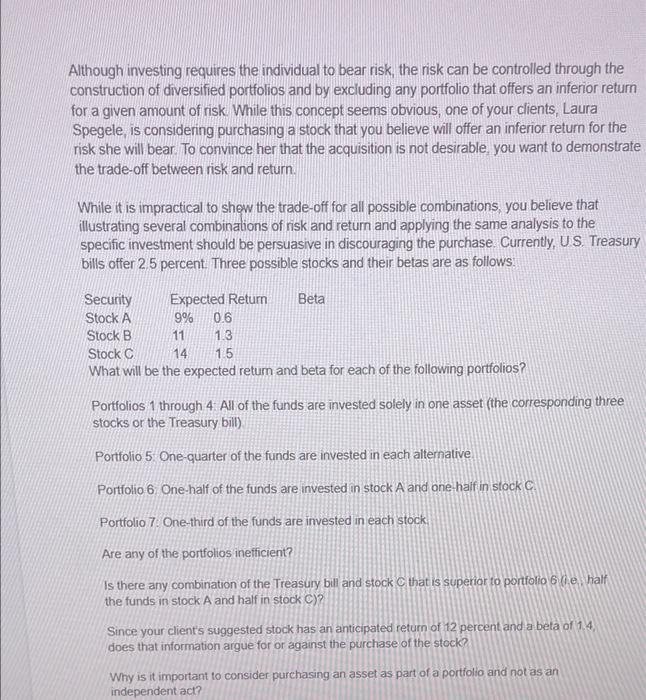

Although investing requires the individual to bear risk, the risk can be controlled through the construction of diversified portfolios and by excluding any portfolio that offers an inferior return for a given amount of risk. While this concept seems obvious, one of your clients, Laura Spegele, is considering purchasing a stock that you believe will offer an inferior return for the risk she will bear. To convince her that the acquisition is not desirable, you want to demonstrate the trade-off between risk and return. While it is impractical to shew the trade-off for all possible combinations, you believe that illustrating several combinations of risk and return and applying the same analysis to the specific investment should be persuasive in discouraging the purchase. Currently, US. Treasury bills offer 2.5 percent. Three possible stocks and their betas are as follows: Security Expected Return Beta Stock A 9% 0.6 Stock B 11 1.3 Stock C 14 1.5 What will be the expected return and beta for each of the following portfolios? Portfolios 1 through 4: All of the funds are invested solely in one asset (the corresponding three stocks or the Treasury bill) Portfolio 5 One-quarter of the funds are invested in each alternative Portfolio 6 One-half of the funds are invested in stock A and one-half in stock C Portfolio 7. One-third of the funds are invested in each stock Are any of the portfolios inefficient? Is there any combination of the Treasury bill and stock C that is superior to portfolio 6 (ie, half the funds in stock A and half in stock C)? Since your client's suggested stock has an anticipated return of 12 percent and a beta of 1.4, does that information argue for or against the purchase of the stock? Why is it important to consider purchasing an asset as part of a portfolio and not as an independent act?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started