Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Although the $5 price for the X52 fitting represents a substantial discount from the regular $7.50 price, the manager of the Brake Division believes the

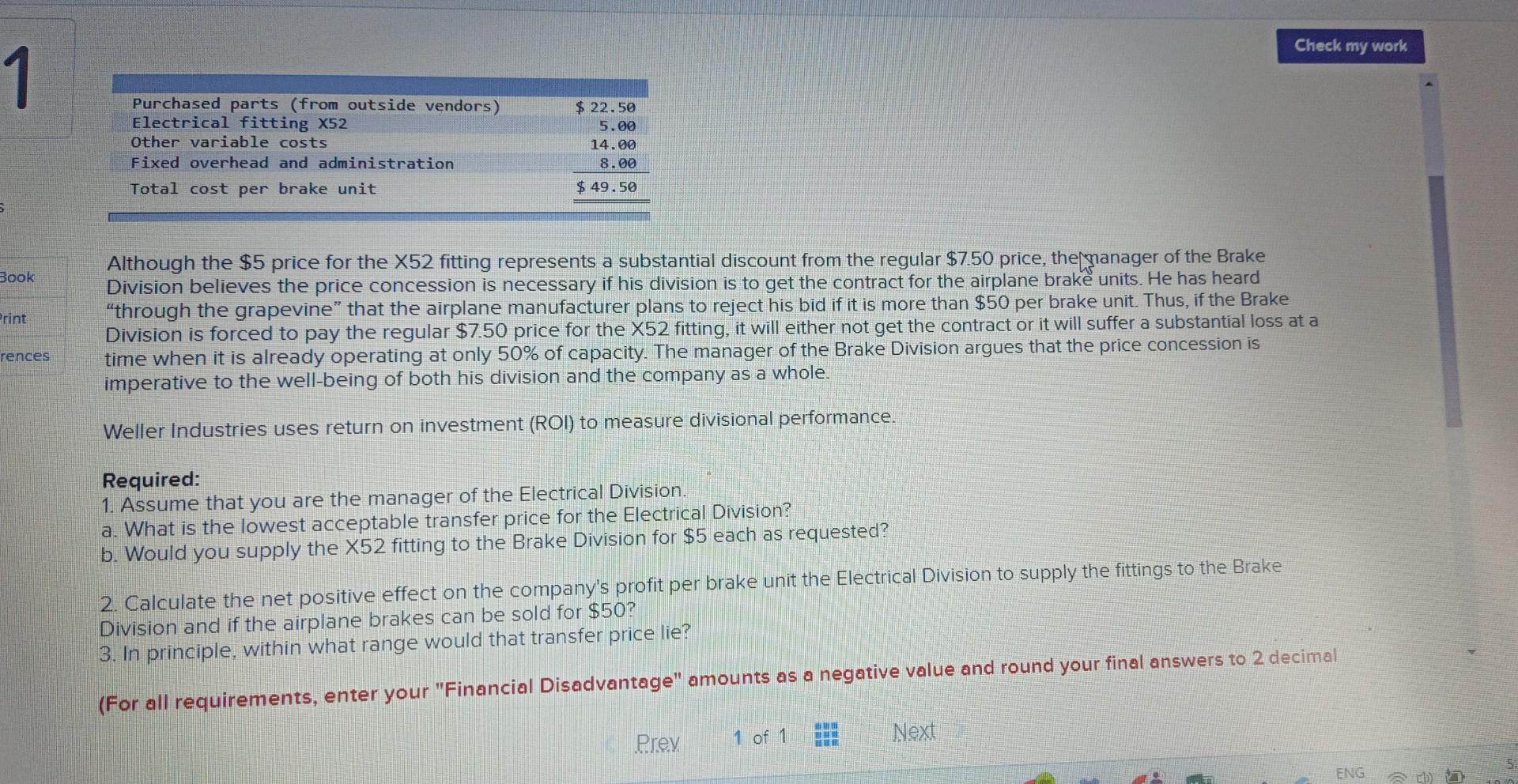

Although the $5 price for the X52 fitting represents a substantial discount from the regular $7.50 price, the manager of the Brake Division believes the price concession is necessary if his division is to get the contract for the airplane brake units. He has heard "through the grapevine" that the airplane manufacturer plans to reject his bid if it is more than $50 per brake unit. Thus, if the Brake Division is forced to pay the regular $7.50 price for the X52 fitting, it will either not get the contract or it will suffer a substantial loss at a time when it is already operating at only 50% of capacity. The manager of the Brake Division argues that the price concession is imperative to the well-being of both his division and the company as a whole. Weller Industries uses return on investment (ROI) to measure divisional performance. Required: 1. Assume that you are the manager of the Electrical Division. a. What is the lowest acceptable transfer price for the Electrical Division? b. Would you supply the X52 fitting to the Brake Division for $5 each as requested? 2. Calculate the net positive effect on the company's profit per brake unit the Electrical Division to supply the fittings to the Brake Division and if the airplane brakes can be sold for $50 ? 3. In principle, within what range would that transfer price lie? (For all requirements, enter your "Financial Disadvantage" amounts as a negative value and round your final answers to 2 decimal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started