Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Alto City properly records its financial transactions using both the Fund-Type basis (modified accrual) and the Government-Wide basis (full accrual) accounting methods. For each

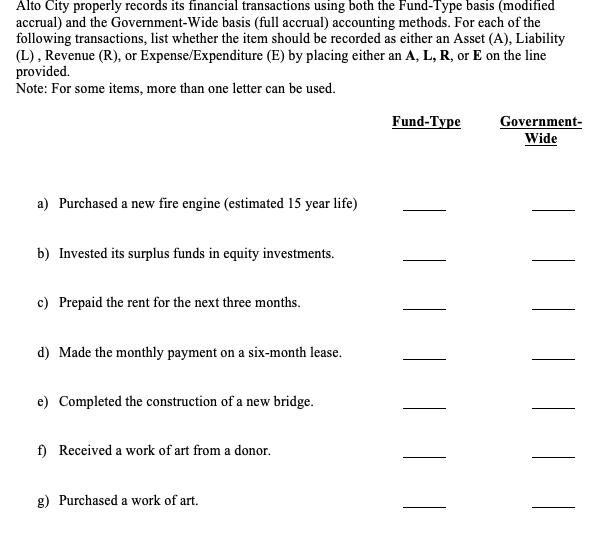

Alto City properly records its financial transactions using both the Fund-Type basis (modified accrual) and the Government-Wide basis (full accrual) accounting methods. For each of the following transactions, list whether the item should be recorded as either an Asset (A), Liability (L), Revenue (R), or Expense/Expenditure (E) by placing either an A, L, R, or E on the line provided. Note: For some items, more than one letter can be used. Fund-Type Government- Wide a) Purchased a new fire engine (estimated 15 year life) b) Invested its surplus funds in equity investments. c) Prepaid the rent for the next three months. d) Made the monthly payment on a six-month lease. e) Completed the construction of a new bridge. f) Received a work of art from a donor. g) Purchased a work of art.

Step by Step Solution

★★★★★

3.27 Rating (139 Votes )

There are 3 Steps involved in it

Step: 1

a The answer is Asset Purchase of a new fire engine comes under asset group The Its considered as a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started