Answered step by step

Verified Expert Solution

Question

1 Approved Answer

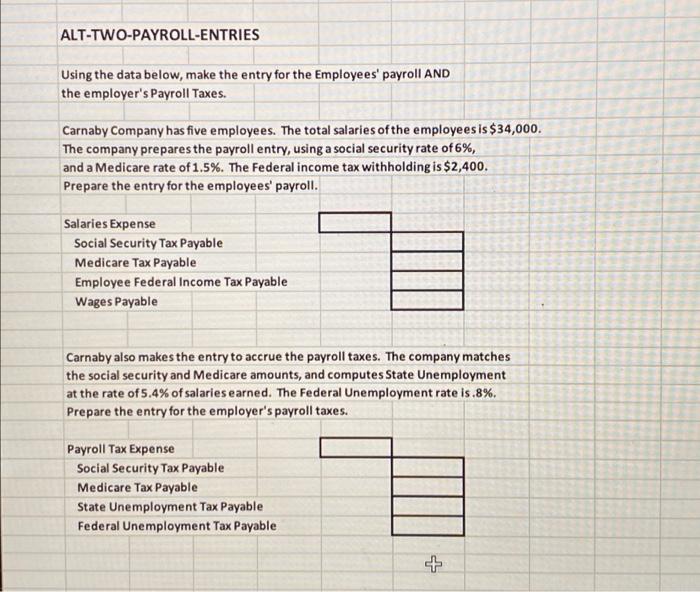

ALT-TWO-PAYROLL-ENTRIES Using the data below, make the entry for the Employees' payroll AND the employer's Payroll Taxes. Carnaby Company has five employees. The total salaries

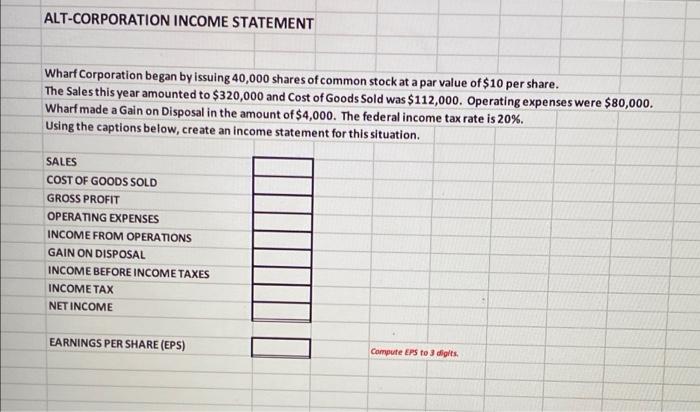

ALT-TWO-PAYROLL-ENTRIES Using the data below, make the entry for the Employees' payroll AND the employer's Payroll Taxes. Carnaby Company has five employees. The total salaries of the employees is $34,000. The company prepares the payroll entry, using a social security rate of 6%, and a Medicare rate of 1.5%. The Federal income tax withholding is $2,400. Prepare the entry for the employees' payroll. Salaries Expense Social Security Tax Payable Medicare Tax Payable Employee Federal Income Tax Payable Wages Payable Carnaby also makes the entry to accrue the payroll taxes. The company matches the social security and Medicare amounts, and computes State Unemployment at the rate of 5.4% of salaries earned. The Federal Unemployment rate is .8%. Prepare the entry for the employer's payroll taxes. Payroll Tax Expense Social Security Tax Payable Medicare Tax Payable State Unemployment Tax Payable Federal Unemployment Tax Payable + ALT-CORPORATION INCOME STATEMENT Wharf Corporation began by issuing 40,000 shares of common stock at a par value of $10 per share. The Sales this year amounted to $320,000 and Cost of Goods Sold was $112,000. Operating expenses were $80,000. Wharf made a Gain on Disposal in the amount of $4,000. The federal income tax rate is 20%. Using the captions below, create an income statement for this situation. SALES COST OF GOODS SOLD GROSS PROFIT OPERATING EXPENSES INCOME FROM OPERATIONS GAIN ON DISPOSAL INCOME BEFORE INCOME TAXES INCOME TAX NET INCOME EARNINGS PER SHARE (EPS) Compute EPS to 3 digits

ALT-TWO-PAYROLL-ENTRIES Using the data below, make the entry for the Employees' payroll AND the employer's Payroll Taxes. Carnaby Company has five employees. The total salaries of the employees is $34,000. The company prepares the payroll entry, using a social security rate of 6%, and a Medicare rate of 1.5%. The Federal income tax withholding is $2,400. Prepare the entry for the employees' payroll. Salaries Expense Social Security Tax Payable Medicare Tax Payable Employee Federal Income Tax Payable Wages Payable Carnaby also makes the entry to accrue the payroll taxes. The company matches the social security and Medicare amounts, and computes State Unemployment at the rate of 5.4% of salaries earned. The Federal Unemployment rate is .8%. Prepare the entry for the employer's payroll taxes. Payroll Tax Expense Social Security Tax Payable Medicare Tax Payable State Unemployment Tax Payable Federal Unemployment Tax Payable + ALT-CORPORATION INCOME STATEMENT Wharf Corporation began by issuing 40,000 shares of common stock at a par value of $10 per share. The Sales this year amounted to $320,000 and Cost of Goods Sold was $112,000. Operating expenses were $80,000. Wharf made a Gain on Disposal in the amount of $4,000. The federal income tax rate is 20%. Using the captions below, create an income statement for this situation. SALES COST OF GOODS SOLD GROSS PROFIT OPERATING EXPENSES INCOME FROM OPERATIONS GAIN ON DISPOSAL INCOME BEFORE INCOME TAXES INCOME TAX NET INCOME EARNINGS PER SHARE (EPS) Compute EPS to 3 digits Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started