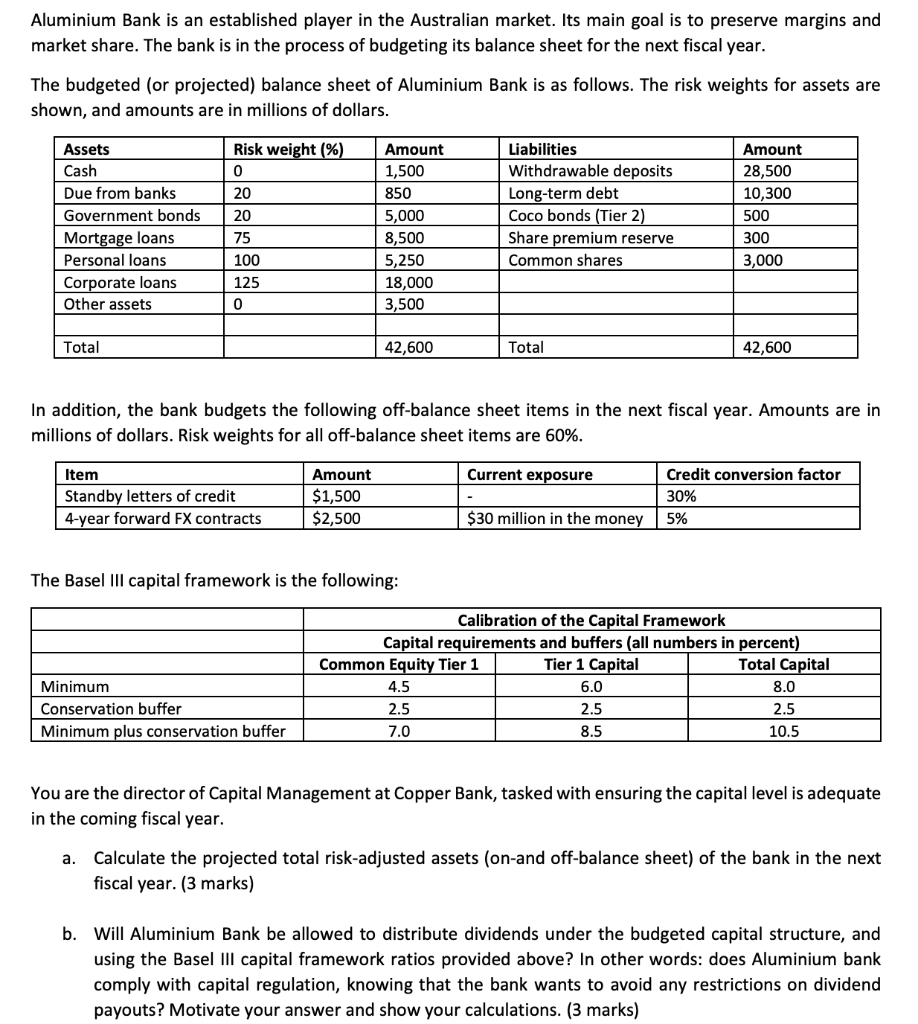

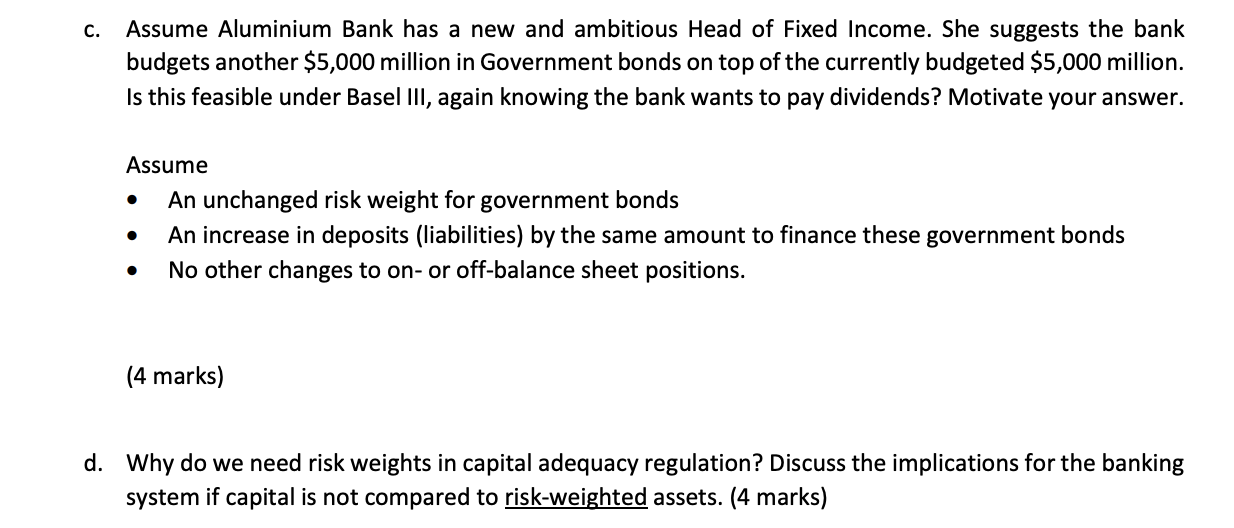

Aluminium Bank is an established player in the Australian market. Its main goal is to preserve margins and market share. The bank is in the process of budgeting its balance sheet for the next fiscal year. The budgeted (or projected) balance sheet of Aluminium Bank is as follows. The risk weights for assets are shown, and amounts are in millions of dollars. Risk weight (%) 0 Assets Cash Due from banks Government bonds Mortgage loans Personal loans Corporate loans Other assets 20 20 75 100 125 0 Amount 1,500 850 5,000 8,500 5,250 18,000 3,500 Liabilities Withdrawable deposits Long-term debt Coco bonds (Tier 2) Share premium reserve Common shares Amount 28,500 10,300 500 300 3,000 Total 42,600 Total 42,600 In addition, the bank budgets the following off-balance sheet items in the next fiscal year. Amounts are in millions of dollars. Risk weights for all off-balance sheet items are 60%. Current exposure Item Standby letters of credit 4-year forward FX contracts Amount $1,500 $2,500 Credit conversion factor 30% 5% $30 million in the money The Basel III capital framework is the following: Calibration of the Capital Framework Capital requirements and buffers (all numbers in percent) Common Equity Tier 1 Tier 1 Capital Total Capital 4.5 6.0 8.0 2.5 2.5 2.5 7.0 8.5 10.5 Minimum Conservation buffer Minimum plus conservation buffer You are the director of Capital Management at Copper Bank, tasked with ensuring the capital level is adequate in the coming fiscal year. a. Calculate the projected total risk-adjusted assets (on-and off-balance sheet) of the bank in the next fiscal year. (3 marks) b. Will Aluminium Bank be allowed to distribute dividends under the budgeted capital structure, and using the Basel III capital framework ratios provided above? In other words: does Aluminium bank comply with capital regulation, knowing that the bank wants to avoid any restrictions on dividend payouts? Motivate your answer and show your calculations. (3 marks) C. Assume Aluminium Bank has a new and ambitious Head of Fixed Income. She suggests the bank budgets another $5,000 million in Government bonds on top of the currently budgeted $5,000 million. Is this feasible under Basel III, again knowing the bank wants to pay dividends? Motivate your answer. . Assume An unchanged risk weight for government bonds An increase in deposits (liabilities) by the same amount to finance these government bonds No other changes to on- or off-balance sheet positions. . (4 marks) d. Why do we need risk weights in capital adequacy regulation? Discuss the implications for the banking system if capital is not compared to risk-weighted assets. (4 marks) Aluminium Bank is an established player in the Australian market. Its main goal is to preserve margins and market share. The bank is in the process of budgeting its balance sheet for the next fiscal year. The budgeted (or projected) balance sheet of Aluminium Bank is as follows. The risk weights for assets are shown, and amounts are in millions of dollars. Risk weight (%) 0 Assets Cash Due from banks Government bonds Mortgage loans Personal loans Corporate loans Other assets 20 20 75 100 125 0 Amount 1,500 850 5,000 8,500 5,250 18,000 3,500 Liabilities Withdrawable deposits Long-term debt Coco bonds (Tier 2) Share premium reserve Common shares Amount 28,500 10,300 500 300 3,000 Total 42,600 Total 42,600 In addition, the bank budgets the following off-balance sheet items in the next fiscal year. Amounts are in millions of dollars. Risk weights for all off-balance sheet items are 60%. Current exposure Item Standby letters of credit 4-year forward FX contracts Amount $1,500 $2,500 Credit conversion factor 30% 5% $30 million in the money The Basel III capital framework is the following: Calibration of the Capital Framework Capital requirements and buffers (all numbers in percent) Common Equity Tier 1 Tier 1 Capital Total Capital 4.5 6.0 8.0 2.5 2.5 2.5 7.0 8.5 10.5 Minimum Conservation buffer Minimum plus conservation buffer You are the director of Capital Management at Copper Bank, tasked with ensuring the capital level is adequate in the coming fiscal year. a. Calculate the projected total risk-adjusted assets (on-and off-balance sheet) of the bank in the next fiscal year. (3 marks) b. Will Aluminium Bank be allowed to distribute dividends under the budgeted capital structure, and using the Basel III capital framework ratios provided above? In other words: does Aluminium bank comply with capital regulation, knowing that the bank wants to avoid any restrictions on dividend payouts? Motivate your answer and show your calculations. (3 marks) C. Assume Aluminium Bank has a new and ambitious Head of Fixed Income. She suggests the bank budgets another $5,000 million in Government bonds on top of the currently budgeted $5,000 million. Is this feasible under Basel III, again knowing the bank wants to pay dividends? Motivate your answer. . Assume An unchanged risk weight for government bonds An increase in deposits (liabilities) by the same amount to finance these government bonds No other changes to on- or off-balance sheet positions. . (4 marks) d. Why do we need risk weights in capital adequacy regulation? Discuss the implications for the banking system if capital is not compared to risk-weighted assets. (4 marks)