Answered step by step

Verified Expert Solution

Question

1 Approved Answer

aly. A 1 Normal I No Spac... Heading 1 Heading 2 Title Paragraph QUESTION2 Styles 20 Marks Agrico is considering the acquisition of Thompson. Agrico

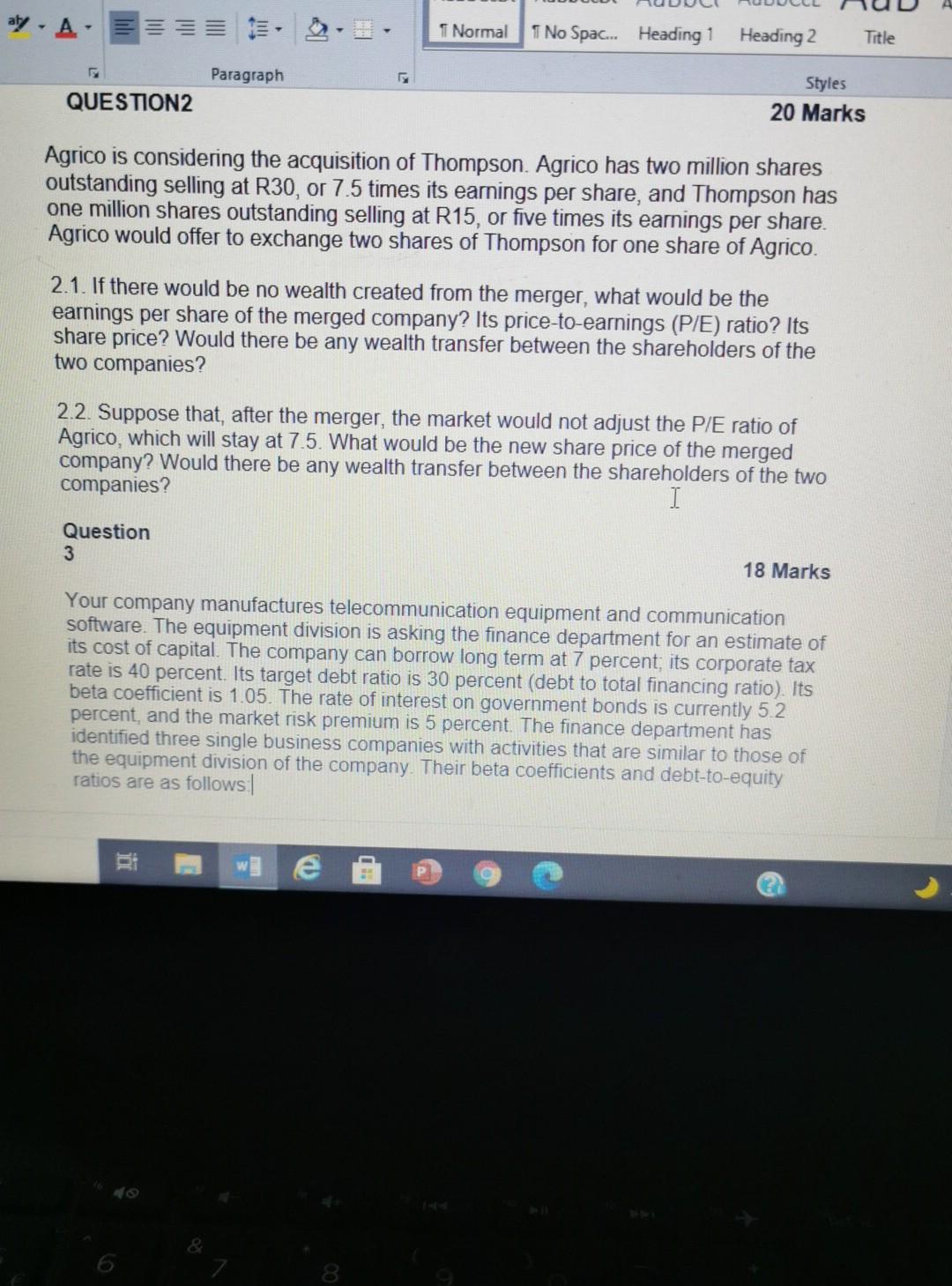

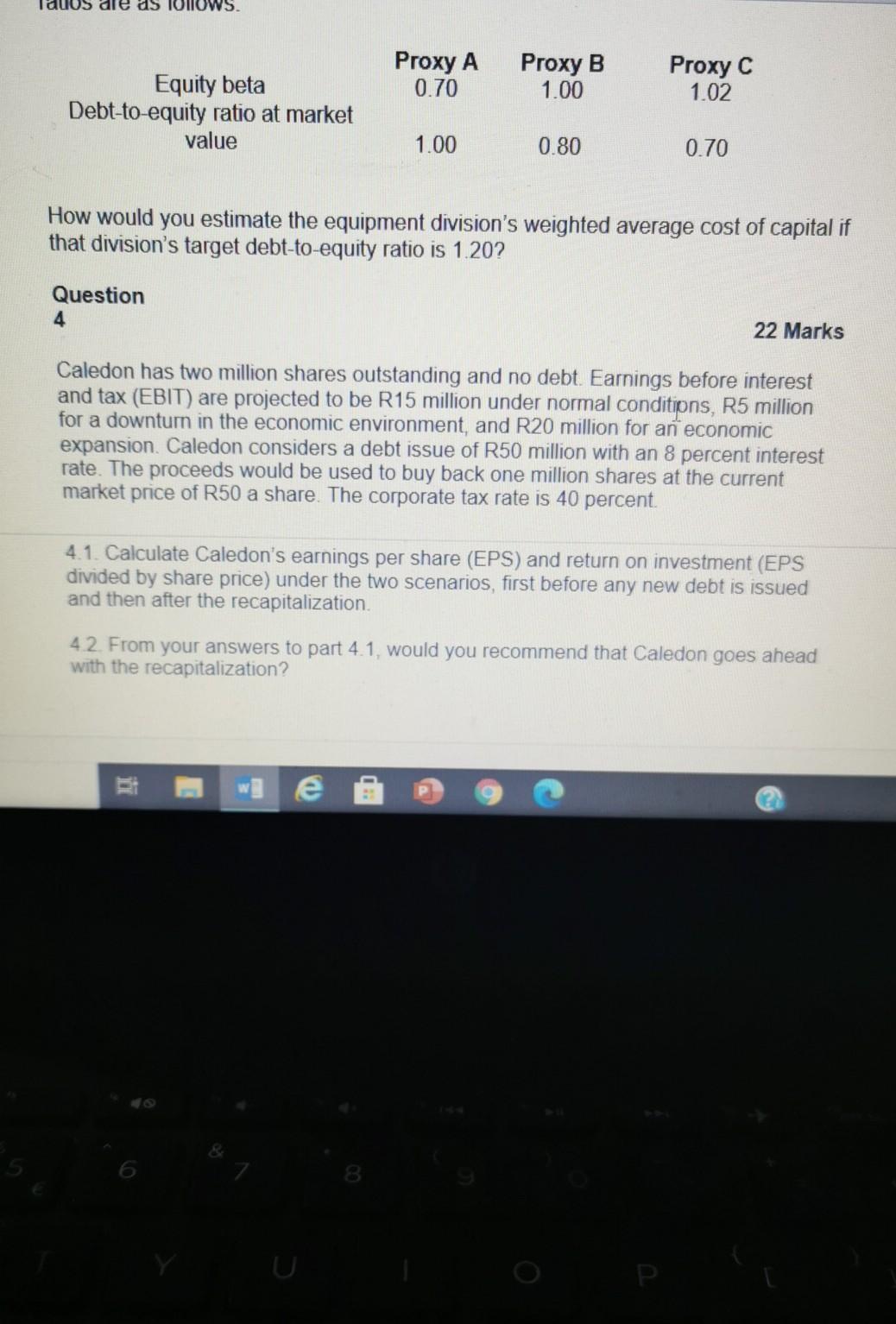

aly. A 1 Normal I No Spac... Heading 1 Heading 2 Title Paragraph QUESTION2 Styles 20 Marks Agrico is considering the acquisition of Thompson. Agrico has two million shares outstanding selling at R30, or 7.5 times its earnings per share, and Thompson has one million shares outstanding selling at R15, or five times its earnings per share. Agrico would offer to exchange two shares of Thompson for one share of Agrico. 2.1. If there would be no wealth created from the merger, what would be the earnings per share of the merged company? Its price-to-earnings (P/E) ratio? Its share price? Would there be any wealth transfer between the shareholders of the two companies? 2.2. Suppose that, after the merger, the market would not adjust the P/E ratio of Agrico, which will stay at 7.5. What would be the new share price of the merged company? Would there be any wealth transfer between the shareholders of the two companies? I Question 3 18 Marks Your company manufactures telecommunication equipment and communication software. The equipment division is asking the finance department for an estimate of its cost of capital. The company can borrow long term at 7 percent, its corporate tax rate is 40 percent. Its target debt ratio is 30 percent (debt to total financing ratio). Its beta coefficient is 1.05. The rate of interest on government bonds is currently 5.2 percent, and the market risk premium is 5 percent. The finance department has identified three single business companies with activities that are similar to those of the equipment division of the company. Their beta coefficients and debt-to-equity ratios are as follows: 6 8 Tauos ale as TONIOWS. Proxy A 0.70 Proxy 1.00 Proxy C 1.02 Equity beta Debt-to-equity ratio at market value 1.00 0.80 0.70 How would you estimate the equipment division's weighted average cost of capital if that division's target debt-to-equity ratio is 1.20? Question 4 22 Marks Caledon has two million shares outstanding and no debt. Earnings before interest and tax (EBIT) are projected to be R15 million under normal conditions, R5 million for a downturn in the economic environment, and R20 million for an economic expansion. Caledon considers a debt issue of R50 million with an 8 percent interest rate. The proceeds would be used to buy back one million shares at the current market price of R50 a share. The corporate tax rate is 40 percent. 4.1. Calculate Caledon's earnings per share (EPS) and return on investment (EPS divided by share price) under the two scenarios, first before any new debt is issued and then after the recapitalization. 42. From your answers to part 4.1, would you recommend that Caledon goes ahead with the recapitalization? iz wge O aly. A 1 Normal I No Spac... Heading 1 Heading 2 Title Paragraph QUESTION2 Styles 20 Marks Agrico is considering the acquisition of Thompson. Agrico has two million shares outstanding selling at R30, or 7.5 times its earnings per share, and Thompson has one million shares outstanding selling at R15, or five times its earnings per share. Agrico would offer to exchange two shares of Thompson for one share of Agrico. 2.1. If there would be no wealth created from the merger, what would be the earnings per share of the merged company? Its price-to-earnings (P/E) ratio? Its share price? Would there be any wealth transfer between the shareholders of the two companies? 2.2. Suppose that, after the merger, the market would not adjust the P/E ratio of Agrico, which will stay at 7.5. What would be the new share price of the merged company? Would there be any wealth transfer between the shareholders of the two companies? I Question 3 18 Marks Your company manufactures telecommunication equipment and communication software. The equipment division is asking the finance department for an estimate of its cost of capital. The company can borrow long term at 7 percent, its corporate tax rate is 40 percent. Its target debt ratio is 30 percent (debt to total financing ratio). Its beta coefficient is 1.05. The rate of interest on government bonds is currently 5.2 percent, and the market risk premium is 5 percent. The finance department has identified three single business companies with activities that are similar to those of the equipment division of the company. Their beta coefficients and debt-to-equity ratios are as follows: 6 8 Tauos ale as TONIOWS. Proxy A 0.70 Proxy 1.00 Proxy C 1.02 Equity beta Debt-to-equity ratio at market value 1.00 0.80 0.70 How would you estimate the equipment division's weighted average cost of capital if that division's target debt-to-equity ratio is 1.20? Question 4 22 Marks Caledon has two million shares outstanding and no debt. Earnings before interest and tax (EBIT) are projected to be R15 million under normal conditions, R5 million for a downturn in the economic environment, and R20 million for an economic expansion. Caledon considers a debt issue of R50 million with an 8 percent interest rate. The proceeds would be used to buy back one million shares at the current market price of R50 a share. The corporate tax rate is 40 percent. 4.1. Calculate Caledon's earnings per share (EPS) and return on investment (EPS divided by share price) under the two scenarios, first before any new debt is issued and then after the recapitalization. 42. From your answers to part 4.1, would you recommend that Caledon goes ahead with the recapitalization? iz wge O

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started