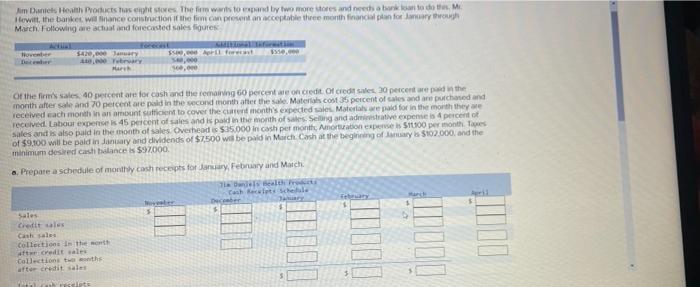

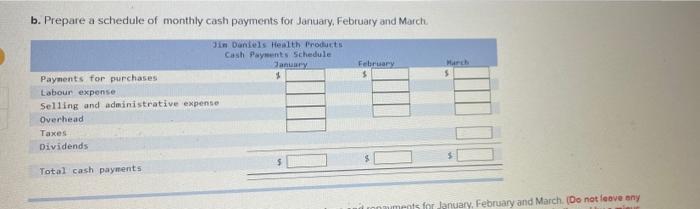

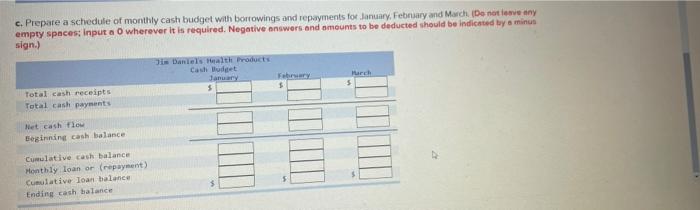

Am Daniel Health Products Tascht stores. The firm was to expand by two more ces and needs a bond MA Howitt, the banket will finance construction of the firm can presentan acceptable three month financial plan for January through March. Following are achat and forecasted sales figures Decor $420,000 January wary 340 00 0.000 of the firm's sales 40 percentare for cash and the remaining 60 percent of credit Of credit sales 30 percentare in the month after sale and 70 percentare paid in the second month after the sole Materials cost 35 percent of sales and are purchased and received each month in an amount suficient to cover the content month's expected sales Materials we paid for in the month they are received Labour expenses 45 percent of sales and is paid in the month of sales. Selling and administrative expenses 4 percent of sales and is also paid in the month of sales Overhead $35.000 in cash per mont, Amortation expenses $100 per month of $9,100 will be paid in January and dividends of $7500 will be paid in March. Cash at the beginning of any is $102.000, and the minimum desired castance & $92000. a. Prepare a schedule of monthly cash receipts for January February and March The dels altres $ $ Sales Credit sales Cash sales Collections in the credit sales Collections to the to credit sal este b. Prepare a schedule of monthly cash payments for January, February and March in Daniels Health Products Cash aynents Schedule January February March 5 Payments for purchases Labour expense Selling and administrative expense Overhead Taxes Dividends Total cash payments imrots for January February and March (Do not leave any c. Prepare a schedule of monthly cash budget with borrowings and repayments for January February and March. Do not leave any empty spaces: Input a O wherever it is required. Negative answers and amounts to be deducted should be indicated toys minus sign.) i Daniels Health Products Casi Budget January February $ $ Total cash receipts Total cash payments Het cash flow Beginning cash balance Cumulative cash balance Monthly loan or (repayment) Cumulative loan balance Ending cash balance Am Daniel Health Products Tascht stores. The firm was to expand by two more ces and needs a bond MA Howitt, the banket will finance construction of the firm can presentan acceptable three month financial plan for January through March. Following are achat and forecasted sales figures Decor $420,000 January wary 340 00 0.000 of the firm's sales 40 percentare for cash and the remaining 60 percent of credit Of credit sales 30 percentare in the month after sale and 70 percentare paid in the second month after the sole Materials cost 35 percent of sales and are purchased and received each month in an amount suficient to cover the content month's expected sales Materials we paid for in the month they are received Labour expenses 45 percent of sales and is paid in the month of sales. Selling and administrative expenses 4 percent of sales and is also paid in the month of sales Overhead $35.000 in cash per mont, Amortation expenses $100 per month of $9,100 will be paid in January and dividends of $7500 will be paid in March. Cash at the beginning of any is $102.000, and the minimum desired castance & $92000. a. Prepare a schedule of monthly cash receipts for January February and March The dels altres $ $ Sales Credit sales Cash sales Collections in the credit sales Collections to the to credit sal este b. Prepare a schedule of monthly cash payments for January, February and March in Daniels Health Products Cash aynents Schedule January February March 5 Payments for purchases Labour expense Selling and administrative expense Overhead Taxes Dividends Total cash payments imrots for January February and March (Do not leave any c. Prepare a schedule of monthly cash budget with borrowings and repayments for January February and March. Do not leave any empty spaces: Input a O wherever it is required. Negative answers and amounts to be deducted should be indicated toys minus sign.) i Daniels Health Products Casi Budget January February $ $ Total cash receipts Total cash payments Het cash flow Beginning cash balance Cumulative cash balance Monthly loan or (repayment) Cumulative loan balance Ending cash balance