Am I headed in the right direction for this sloving this problem?

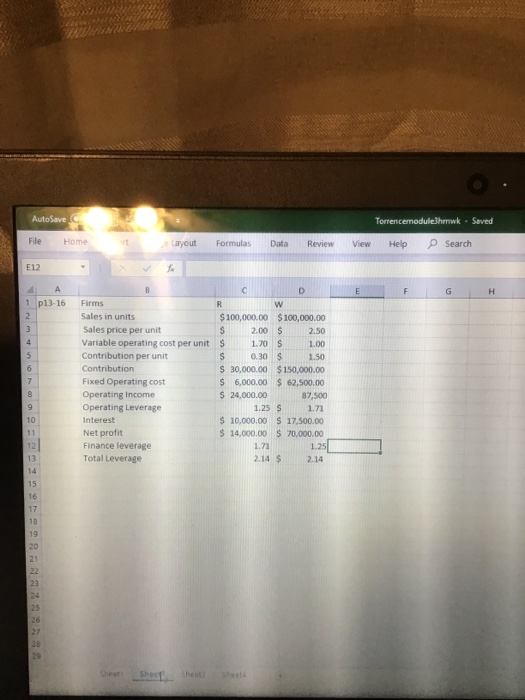

8 PART 6 Long-Term Financial Decisions Integrative: Multiple leverage measures Play-More Toys produces inflatable beach balls, selling 400,000 balls per year. Each ball produced has a variable op- erating cost of S0.84 and sells for $1.00. Fixed operating costs are $28,000. The firm has annual interest charges of $6,000, preferred dividends of $2,000, and a 40% tax rate P13-15 a. Calculate the operating breakeven point in units. b. Use the degree of operating leverage (DOL) formula to calculate DOL c. Use the degree of financial leverage (DFL) formula to calculate DFL.. d. Use the degree of total leverage (DTL) formula to calculate DTL. Compare this answer with the product of DOL and DFL calculated in parts b and c P13-16 Integrative: Leverage and risk Firm R has sales of 100,000 units at $2.00 per unit, variable operating costs of $1.70 per unit, and fixed operating costs of $6,000. Interest is $10,000 per year. Firm W has sales of 100,000 units at $2.50 per unit, variable operating costs of $1.00 per unit, and fixed operating costs of $62,500. Interest is $17,500 per year. Assume that both firms are in the 40% tax bracket. a. Compute the degree of operating, financial, and total leverage for firm R. b. Compute the degree of operating, financial, and total leverage for firm W. c. Compare the relative risks of the two firms. d. Discuss the principles of leverage that your answers illustrate. P13-17 Integrative: Multiple leverage measures and prediction Carolina Fastener, Inc., makes a patented marine bulkhead latch that wholesales for $6.00. Each latch has variable operating costs of $3.50. Fixed operating costs are $50,000 per year. The firm pays $13,000 interest and preferred dividends of $7,000 per year. At this point, the firm is selling 30,000 latches per year and is taxed at a rate of 40% a. Calculate Carolina Pastener's operating breakeven point. b. On the basis of the firm's current sales of 30,000 units per year and its interest Torrencemodule3hmwk Saved File Home ayout Formulas Data Review View Help Search E12 p13-16 Firms Sales in units $100,000.00 $100,000.00 2.00 s1.70 $0.30$ Sales price per unit 2.50 Variable operating cost per unit Contribution per unit 1.70 1.00 1.50 s 30,000.00 $150,000.00 S 6,000.00 $ 62,500.00 Contribution Fixed Operating cost Operating Income Operating Leverage $ 24,000.00 87,500 1.25 1.7 $ 10,000.00 S 17,500.00 $ 14,000.00 S 70,000.00 10 Interest Net profit Finance leverage 1.71 Total Leverage 2.14 $ 2.14 24 25