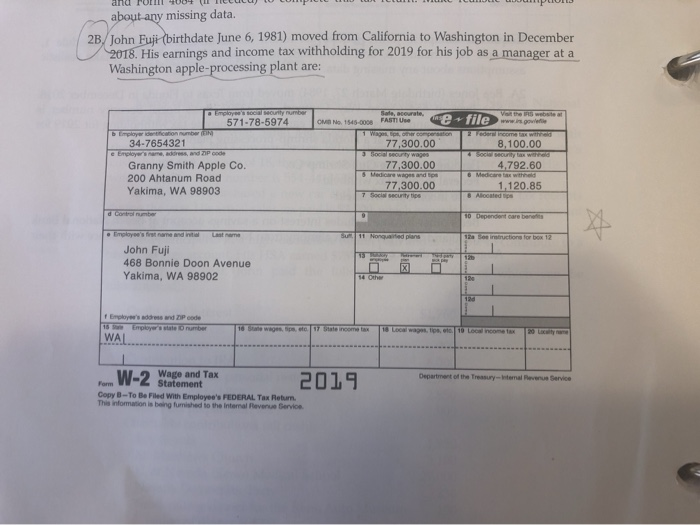

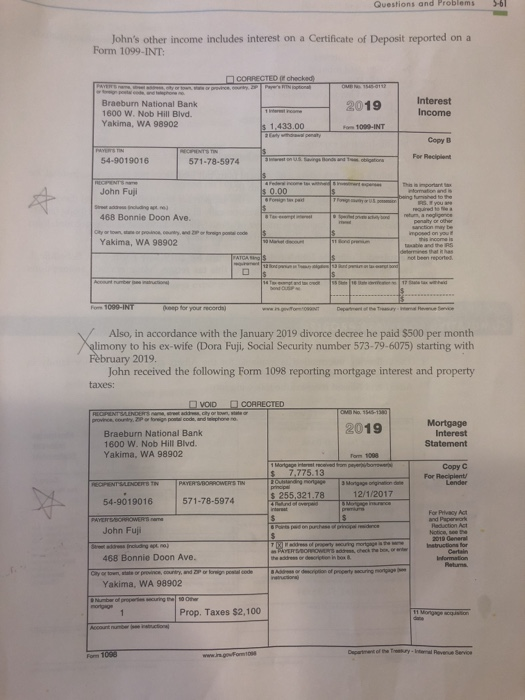

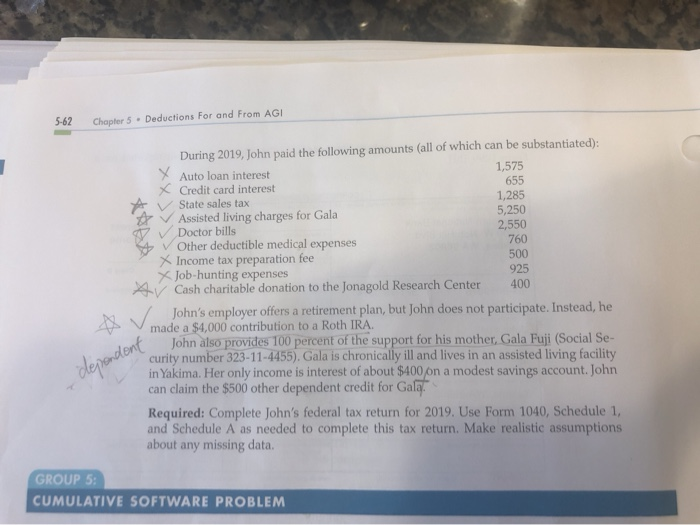

am rum about any missing data. 2B/John Fuji (birthdate June 6, 1981) moved from California to Washington in December 2018. His earnings and income tax withholding for 2019 for his job as a manager at a Washington apple-processing plant are: Vother website 571-78-5974 Sol, corte . OM N. 1545-0008 FAST. Me file 77,300.00 T. 34-7654321 8,100.00 4.792.60 Granny Smith Apple Co. 200 Ahtanum Road Yakima, WA 98903 77,300.00 77,300.00 1.120.85 Nongue pas John Fuji 468 Bonnie Doon Avenue Yakima, WA 98902 W-2 Wape and Tax 2019 Form 2 Statement Copy-To Be Fried With Employee's FEDERAL Tax Return This information is being furnished to the Internal Revenue Service Questions and Problems 561 John's other income includes interest on a Certificate of Deposit reported on a Form 1099-INT CORRECTED checked 2019 Braeburn National Bank 1600 W. Nob Hill Blvd. Yakima, WA 98902 Interest Income 1009-INT Copy For Recipient 54-9019016 571-78-5974 John Fuji 468 Bonnie Doon Ave. Yakima, WA 98902 For 1000-INT Also, in accordance with the January 2019 divorce decree he paid $500 per month alimony to his ex-wife (Dora Fuji, Social Security number 573-79-6075) starting with February 2019. John received the following Form 1098 reporting mortgage interest and property taxes: VOID CORRECTED 2019 Braeburn National Bank 1600 W. Nob Hill Blvd. Yakima, WA 98902 Mortgage Interest Statement Copy For Recipient $ 255,321.78 54-9019016 571-78-5974 John Fuji 468 Bonnie Doon Ave. Yakima, WA 98902 Prop. Taxes $2,100 5-62 Chapter 5 - Deductions For and From AGI During 2019, John paid the following amounts (all of which can be substantiated): 1,575 Auto loan interest X 655 Credit card interest 1,285 State sales tax 5,250 Assisted living charges for Gala Doctor bills 2,550 A V Other deductible medical expenses 760 X Income tax preparation fee 500 x Job-hunting expenses 925 A V Cash charitable donation to the Jonagold Research Center 400 John's employer offers a retirement plan, but John does not participate. Instead, he made a $4,000 contribution to a Roth IRA. ont John also provides 100 percent of the support for his mother, Gala Fuji (Social Se- curity number 323-11-4455). Gala is chronically ill and lives in an assisted living facility in Yakima. Her only income is interest of about $400 on a modest savings account. John can claim the $500 other dependent credit for Gala. Required: Complete John's federal tax return for 2019. Use Form 1040, Schedule 1, and Schedule A as needed to complete this tax return. Make realistic assumptions about any missing data. dependent GROUP 5: CUMULATIVE SOFTWARE PROBLEM am rum about any missing data. 2B/John Fuji (birthdate June 6, 1981) moved from California to Washington in December 2018. His earnings and income tax withholding for 2019 for his job as a manager at a Washington apple-processing plant are: Vother website 571-78-5974 Sol, corte . OM N. 1545-0008 FAST. Me file 77,300.00 T. 34-7654321 8,100.00 4.792.60 Granny Smith Apple Co. 200 Ahtanum Road Yakima, WA 98903 77,300.00 77,300.00 1.120.85 Nongue pas John Fuji 468 Bonnie Doon Avenue Yakima, WA 98902 W-2 Wape and Tax 2019 Form 2 Statement Copy-To Be Fried With Employee's FEDERAL Tax Return This information is being furnished to the Internal Revenue Service Questions and Problems 561 John's other income includes interest on a Certificate of Deposit reported on a Form 1099-INT CORRECTED checked 2019 Braeburn National Bank 1600 W. Nob Hill Blvd. Yakima, WA 98902 Interest Income 1009-INT Copy For Recipient 54-9019016 571-78-5974 John Fuji 468 Bonnie Doon Ave. Yakima, WA 98902 For 1000-INT Also, in accordance with the January 2019 divorce decree he paid $500 per month alimony to his ex-wife (Dora Fuji, Social Security number 573-79-6075) starting with February 2019. John received the following Form 1098 reporting mortgage interest and property taxes: VOID CORRECTED 2019 Braeburn National Bank 1600 W. Nob Hill Blvd. Yakima, WA 98902 Mortgage Interest Statement Copy For Recipient $ 255,321.78 54-9019016 571-78-5974 John Fuji 468 Bonnie Doon Ave. Yakima, WA 98902 Prop. Taxes $2,100 5-62 Chapter 5 - Deductions For and From AGI During 2019, John paid the following amounts (all of which can be substantiated): 1,575 Auto loan interest X 655 Credit card interest 1,285 State sales tax 5,250 Assisted living charges for Gala Doctor bills 2,550 A V Other deductible medical expenses 760 X Income tax preparation fee 500 x Job-hunting expenses 925 A V Cash charitable donation to the Jonagold Research Center 400 John's employer offers a retirement plan, but John does not participate. Instead, he made a $4,000 contribution to a Roth IRA. ont John also provides 100 percent of the support for his mother, Gala Fuji (Social Se- curity number 323-11-4455). Gala is chronically ill and lives in an assisted living facility in Yakima. Her only income is interest of about $400 on a modest savings account. John can claim the $500 other dependent credit for Gala. Required: Complete John's federal tax return for 2019. Use Form 1040, Schedule 1, and Schedule A as needed to complete this tax return. Make realistic assumptions about any missing data. dependent GROUP 5: CUMULATIVE SOFTWARE