Akha Ama Limited is a specialist manufacturer in the tea and coffee industry. It produces and sells two products: speciality Thai tea and Thai

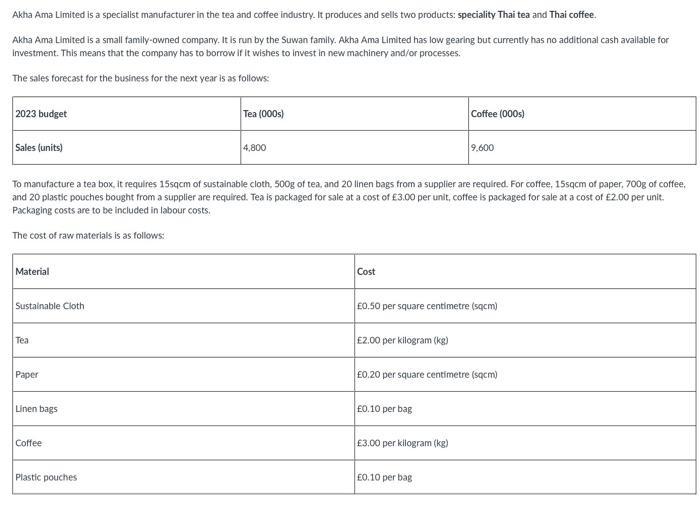

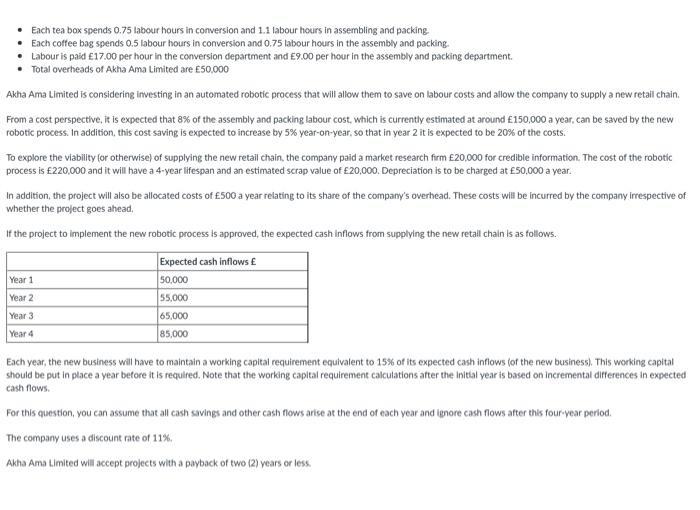

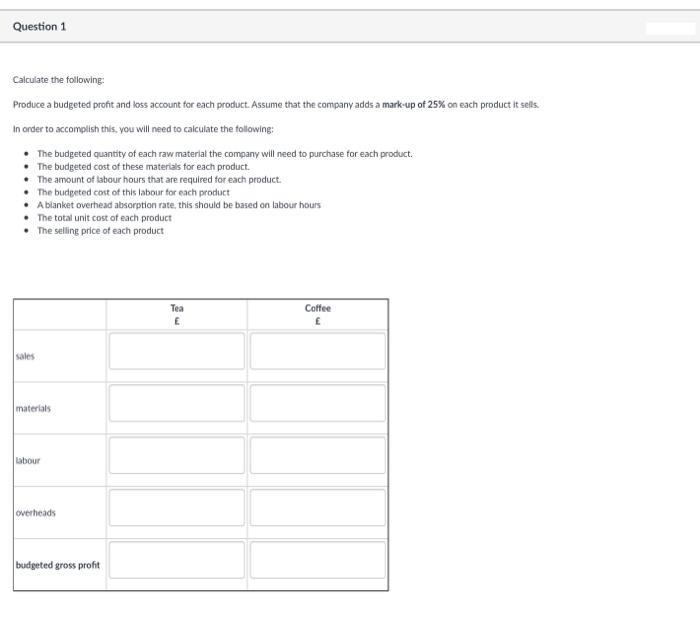

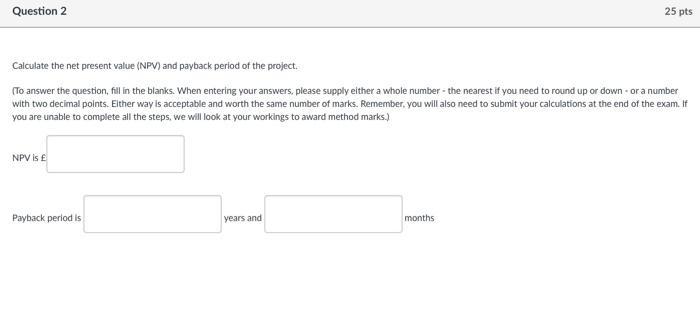

Akha Ama Limited is a specialist manufacturer in the tea and coffee industry. It produces and sells two products: speciality Thai tea and Thai coffee. Akha Ama Limited is a small family-owned company. It is run by the Suwan family. Akha Ama Limited has low gearing but currently has no additional cash available for Investment. This means that the company has to borrow if it wishes to invest in new machinery and/or processes. The sales forecast for the business for the next year is as follows: 2023 budget Sales (units) The cost of raw materials is as follows: Material Sustainable Cloth To manufacture a tea box, it requires 15sqcm of sustainable cloth, 500g of tea, and 20 linen bags from a supplier are required. For coffee, 15sqcm of paper, 700g of coffee, and 20 plastic pouches bought from a supplier are required. Tea is packaged for sale at a cost of 3.00 per unit, coffee is packaged for sale at a cost of 2.00 per unit. Packaging costs are to be included in labour costs. Tea Paper Linen bags Coffee Tea (000s) Plastic pouches 4,800 Cost 2.00 per kilogram (kg) 0.50 per square centimetre (sqcm) Coffee (000s) 0.10 per bag 9.600 0.20 per square centimetre (sqcm) 3.00 per kilogram (kg) EO.10 per bag Each tea box spends 0.75 labour hours in conversion and 1.1 labour hours in assembling and packing. Each coffee bag spends 0.5 labour hours in conversion and 0.75 labour hours in the assembly and packing. Labour is paid 17.00 per hour in the conversion department and 9.00 per hour in the assembly and packing department. Total overheads of Akha Ama Limited are 50,000 Akha Ama Limited is considering investing in an automated robotic process that will allow them to save on labour costs and allow the company to supply a new retail chain. From a cost perspective, it is expected that 8% of the assembly and packing labour cost, which is currently estimated at around 150,000 a year, can be saved by the new robotic process. In addition, this cost saving is expected to increase by 5% year-on-year, so that in year 2 it is expected to be 20% of the costs. To explore the viability (or otherwise) of supplying the new retail chain, the company paid a market research firm 20,000 for credible information. The cost of the robotic process is 220,000 and it will have a 4-year lifespan and an estimated scrap value of 20,000. Depreciation is to be charged at 50,000 a year. In addition, the project will also be allocated costs of 500 a year relating to its share of the company's overhead. These costs will be incurred by the company irrespective of whether the project goes ahead. If the project to implement the new robotic process is approved, the expected cash inflows from supplying the new retail chain is as follows. Expected cash inflows 50,000 55,000 65,000 85,000 Year 1 Year 2 Year 3 Year 4 Each year, the new business will have to maintain a working capital requirement equivalent to 15% of its expected cash inflows (of the new business). This working capital should be put in place a year before it is required. Note that the working capital requirement calculations after the initial year is based on incremental differences in expected cash flows. For this question, you can assume that all cash savings and other cash flows arise at the end of each year and ignore cash flows after this four-year period. The company uses a discount rate of 11%. Akha Ama Limited will accept projects with a payback of two (2) years or less. Question 1 Calculate the following: Produce a budgeted profit and loss account for each product. Assume that the company adds a mark-up of 25% on each product it sells. In order to accomplish this, you will need to calculate the following: The budgeted quantity of each raw material the company will need to purchase for each product. The budgeted cost of these materials for each product. The amount of labour hours that are required for each product. The budgeted cost of this labour for each product A blanket overhead absorption rate, this should be based on labour hours The total unit cost of each product The selling price of each product sales materials labour overheads budgeted gross profit Tea E Coffee Question 2 Calculate the net present value (NPV) and payback period of the project. (To answer the question, fill in the blanks. When entering your answers, please supply either a whole number - the nearest if you need to round up or down - or a number with two decimal points. Either way is acceptable and worth the same number of marks. Remember, you will also need to submit your calculations at the end of the exam. If you are unable to complete all the steps, we will look at your workings to award method marks.) NPV is Payback period is years and 25 pts months Question 3 Comment on whether the project should be accepted or not and provide reasons for your decision. Outline at least two limitations in making such decision. Question 4 In the context of the information given in the question, what are the main considerations that the company should take into account when deciding how to finance the purchase of the new robotics process? What advice would you give to the company? Question 5 As a further innovation, the company is thinking of redesigning their budgeting process. Outline at least 4 issues with budgets to reflect why they might not be suitable for a modern business.

Step by Step Solution

3.52 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

Ans A calculation for budgeted profit loss screenshot 2 BTo calculate the NPV net present value and payback period of the project we will consider the ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started