Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Amalgamated Equipment Co., which provides equipment to motels and hotels, began operations in 2021. The following information applies to the year ending December 31,

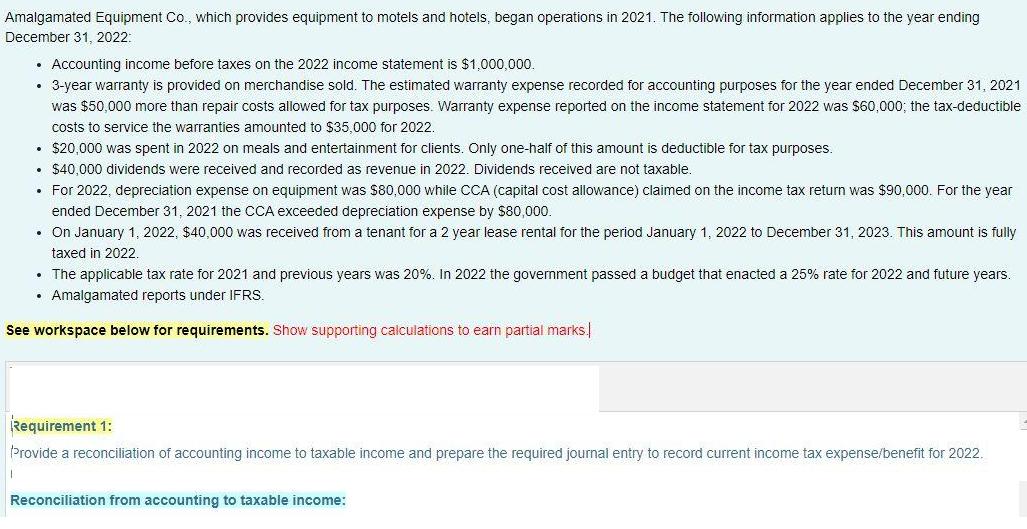

Amalgamated Equipment Co., which provides equipment to motels and hotels, began operations in 2021. The following information applies to the year ending December 31, 2022: Accounting income before taxes on the 2022 income statement is $1,000,000. 3-year warranty is provided on merchandise sold. The estimated warranty expense recorded for accounting purposes for the year ended December 31, 2021 was $50,000 more than repair costs allowed for tax purposes. Warranty expense reported on the income statement for 2022 was $60,000; the tax-deductible costs to service the warranties amounted to $35.000 for 2022. $20,000 was spent in 2022 on meals and entertainment for clients. Only one-half of this amount is deductible for tax purposes. $40,000 dividends were received and recorded as revenue in 2022. Dividends received are not taxable. For 2022, depreciation expense on equipment was S80,000 while CCA (capital cost allowance) claimed on the income tax return was $90,000. For the year ended December 31, 2021 the CCA exceeded depreciation expense by $80,000. On January 1, 2022, $40,000 was received from a tenant for a 2 year lease rental for the period January 1, 2022 to December 31, 2023. This amount is fully taxed in 2022. The applicable tax rate for 2021 and previous years was 20%. In 2022 the government passed a budget that enacted a 25% rate for 2022 and future years. Amalgamated reports under IFRS. See workspace below for requirements. Show supporting calculations to earn partial marks. Requirement 1: Provide a reconciliation of accounting income to taxable income and prepare the required journal entry to record current income tax expense/benefit for 2022. Reconciliation from accounting to taxable income:

Step by Step Solution

★★★★★

3.39 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Reconciliation of Accounting Income to Taxable Income Accounting income before taxes 1000000 Add Exc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started