Answered step by step

Verified Expert Solution

Question

1 Approved Answer

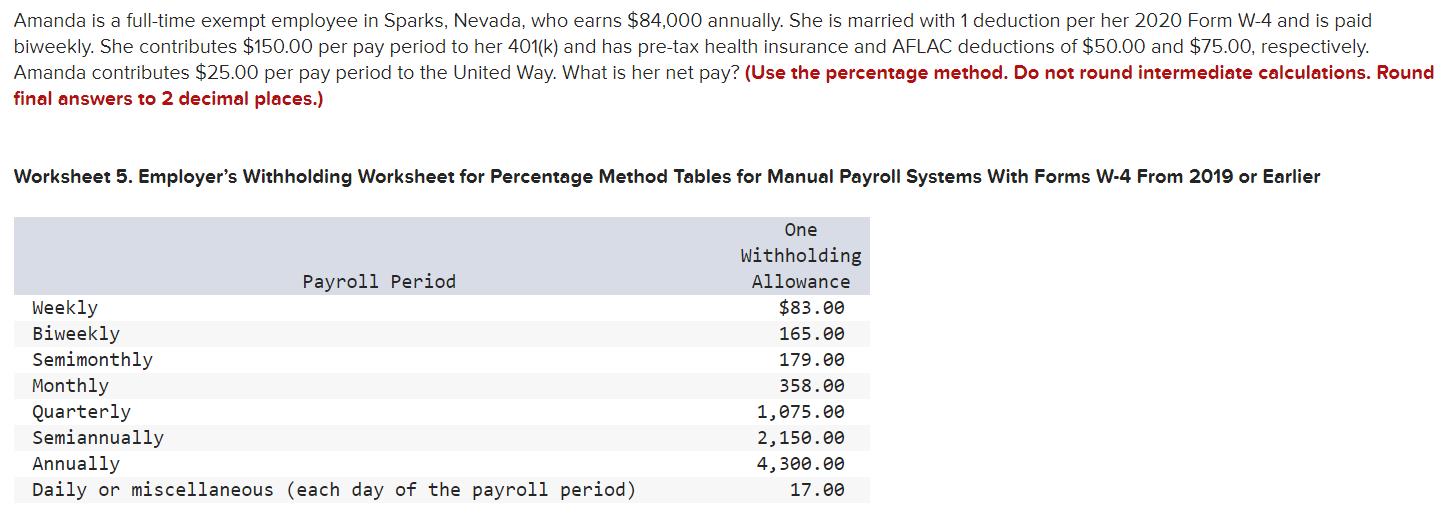

Amanda is a full-time exempt employee in Sparks, Nevada, who earns $84,000 annually. She is married with 1 deduction per her 2020 Form W-4

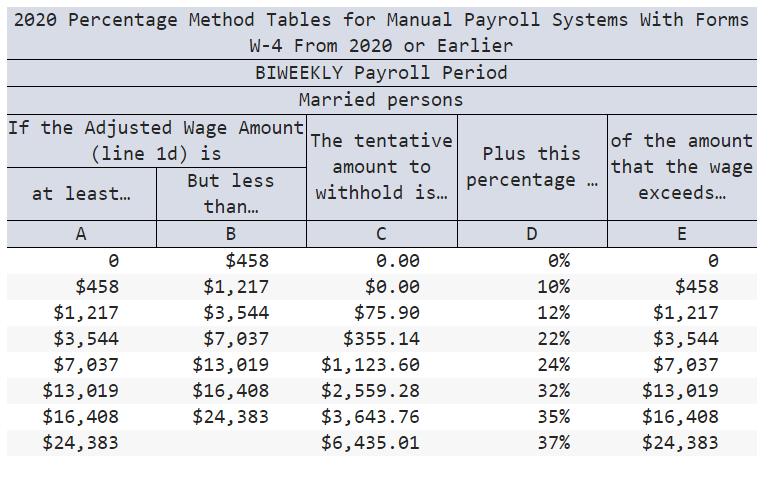

Amanda is a full-time exempt employee in Sparks, Nevada, who earns $84,000 annually. She is married with 1 deduction per her 2020 Form W-4 and is paid biweekly. She contributes $150.00 per pay period to her 401(k) and has pre-tax health insurance and AFLAC deductions of $50.00 and $75.00, respectively. Amanda contributes $25.00 per pay period to the United Way. What is her net pay? (Use the percentage method. Do not round intermediate calculations. Round final answers to 2 decimal places.) Worksheet 5. Employer's Withholding Worksheet for Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2019 or Earlier Weekly Biweekly Semimonthly Monthly Quarterly Semiannually Payroll Period Annually Daily or miscellaneous (each day of the payroll period) One Withholding Allowance $83.00 165.00 179.00 358.00 1,075.00 2,150.00 4,300.00 17.00 2020 Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2020 or Earlier BIWEEKLY Payroll Period Married persons The tentative amount to withhold is... If the Adjusted Wage Amount (line 1d) is at least... A 0 $458 $1,217 $3,544 $7,037 $13,019 $16,408 $24,383 But less than... B $458 $1,217 $3,544 $7,037 $13,019 $16,408 $24,383 C 0.00 $0.00 $75.90 $355.14 $1,123.60 $2,559.28 $3,643.76 $6,435.01 Plus this percentage D 0% 10% 12% 22% 24% 32% 35% 37% TH of the amount that the wage exceeds... E 0 $458 $1,217 $3,544 $7,037 $13,019 $16,408 $24,383

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Amanda 1 elemet employee Annual Salary 84000 Paid biweekly Contri...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started