Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Amanda, who is an executive on the Wall Street, earns $500,000 in annual income. Calculate Amanda's tax liability. 2. Mike works for an IT

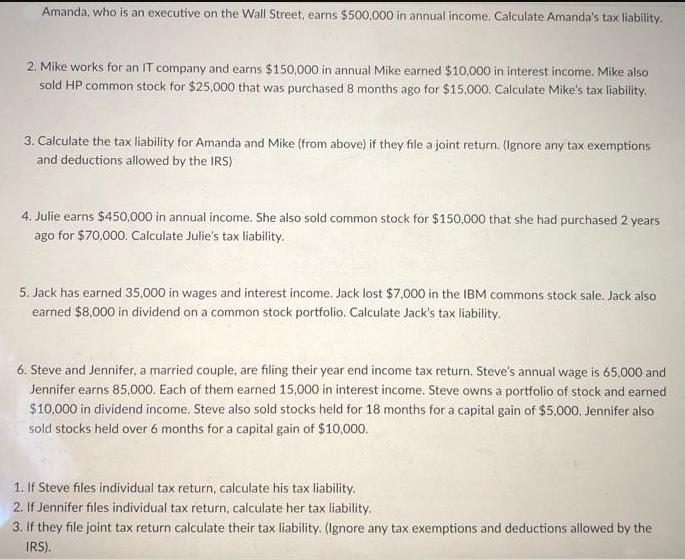

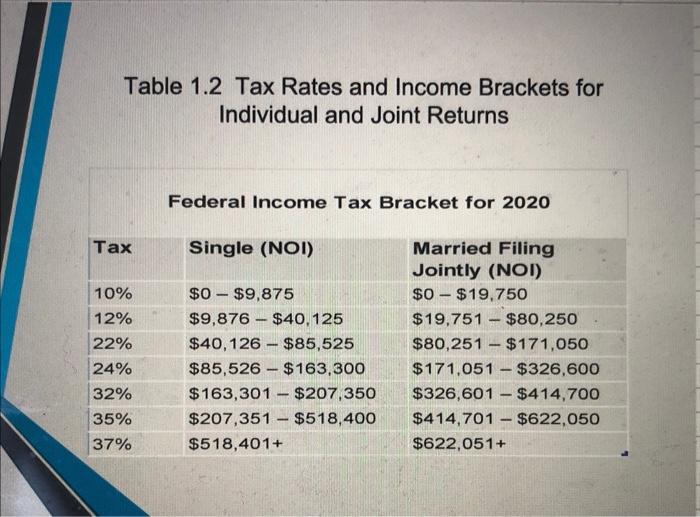

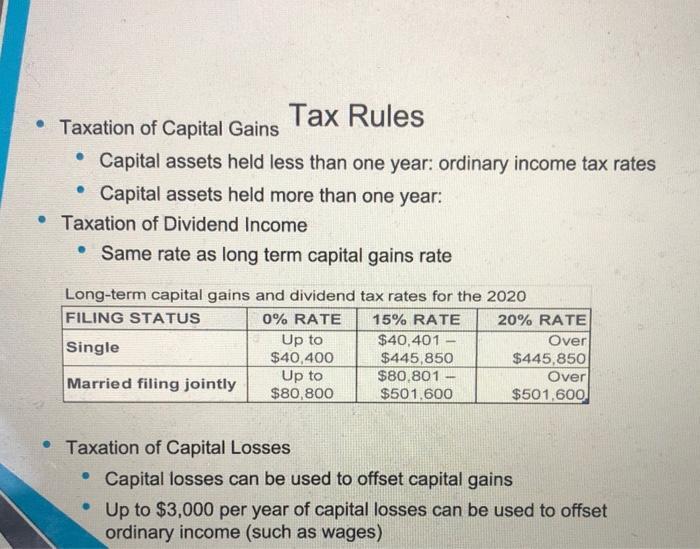

Amanda, who is an executive on the Wall Street, earns $500,000 in annual income. Calculate Amanda's tax liability. 2. Mike works for an IT company and earns $150,000 in annual Mike earned $10,000 in interest income. Mike also sold HP common stock for $25,000 that was purchased 8 months ago for $15,000. Calculate Mike's tax liability. 3. Calculate the tax liability for Amanda and Mike (from above) if they file a joint return. (Ignore any tax exemptions and deductions allowed by the IRS) 4. Julie earns $450,000 in annual income. She also sold common stock for $150,000 that she had purchased 2 years ago for $70,000. Calculate Julie's tax liability. 5. Jack has earned 35,000 in wages and interest income. Jack lost $7,000 in the IBM commons stock sale. Jack also earned $8,000 in dividend on a common stock portfolio. Calculate Jack's tax liability. 6. Steve and Jennifer, a married couple, are filing their year end income tax return. Steve's annual wage is 65,000 and Jennifer earns 85,000. Each of them earned 15,000 in interest income. Steve owns a portfolio of stock and earned $10,000 in dividend income. Steve also sold stocks held for 18 months for a capital gain of $5,000. Jennifer also sold stocks held over 6 months for a capital gain of $10,000. 1. If Steve files individual tax return, calculate his tax liability. 2. If Jennifer files individual tax return, calculate her tax liability. 3. If they file joint tax return calculate their tax liability. (Ignore any tax exemptions and deductions allowed by the IRS). Table 1.2 Tax Rates and Income Brackets for Individual and Joint Returns Tax 10% 12% 22% 24% 32% 35% 37% Federal Income Tax Bracket for 2020 Single (NOI) $0-$9,875 $9,876 $40,125 $40,126 $85,525 $85,526 $163,300 $163,301 $207,350 $207,351 $518,400 $518,401+ 1 - Married Filing Jointly (NOI) $0-$19,750 $19,751 - $80,250 $80,251 $171,050 $171,051 - $326,600 $326,601-$414,700 $414,701 $622,050 $622,051+ - Tax Rules Capital assets held less than one year: ordinary income tax rates Capital assets held more than one year: Taxation of Dividend Income Same rate as long term capital gains rate Taxation of Capital Gains Long-term capital gains and dividend tax rates for the 2020 FILING STATUS 15% RATE 0% RATE Up to $40,400 $40,401 - - Single $445,850 Up to $80.801- Married filing jointly $80,800 $501,600 20% RATE Over $445,850 Over $501,600 Taxation of Capital Losses Capital losses can be used to offset capital gains Up to $3,000 per year of capital losses can be used to offset ordinary income (such as wages)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started