Answered step by step

Verified Expert Solution

Question

1 Approved Answer

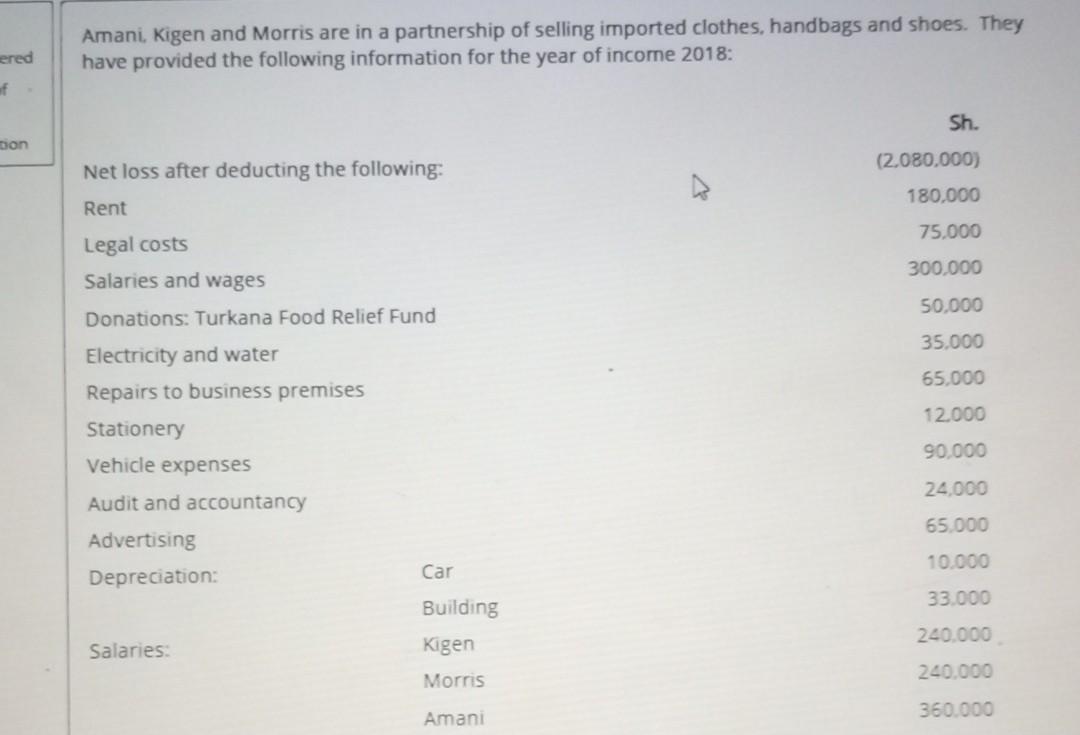

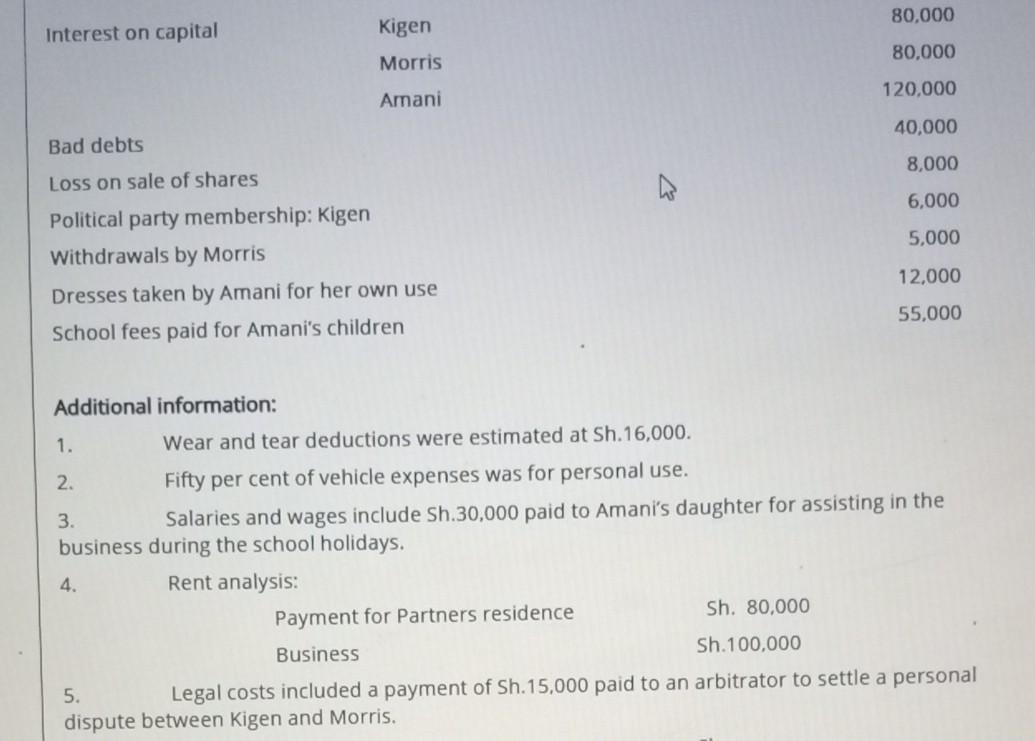

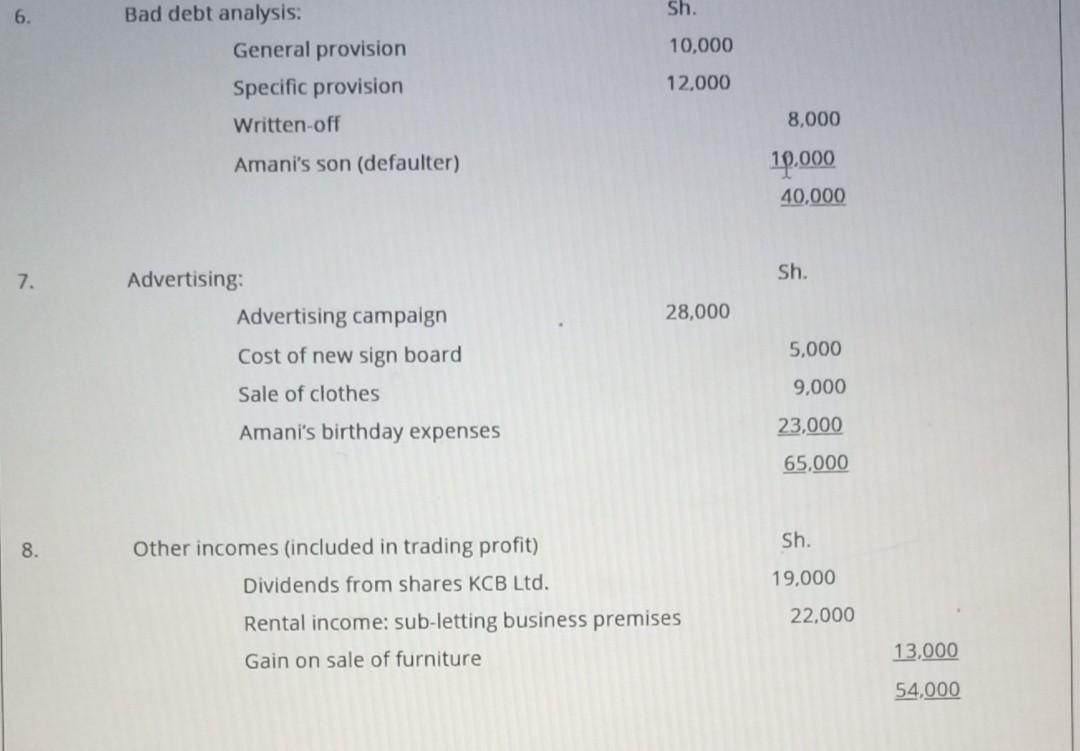

ered of tion Amani, Kigen and Morris are in a partnership of selling imported clothes, handbags and shoes. They have provided the following information

ered of tion Amani, Kigen and Morris are in a partnership of selling imported clothes, handbags and shoes. They have provided the following information for the year of income 2018: Net loss after deducting the following: Rent Legal costs Salaries and wages Donations: Turkana Food Relief Fund Electricity and water Repairs to business premises Stationery Vehicle expenses Audit and accountancy Advertising Depreciation: Salaries: Car Building Kigen Morris Amani Sh. (2,080,000) 180,000 75.000 300,000 50,000 35.000 65,000 12,000 90,000 24,000 65.000 10.000 33.000 240.000 240,000 360.000 Interest on capital Bad debts Loss on sale of shares Political party membership: Kigen Withdrawals by Morris Dresses taken by Amani for her own use School fees paid for Amani's children Additional information: Kigen Morris Amani 1. 2. 3. Wear and tear deductions were estimated at Sh.16,000. Fifty per cent of vehicle expenses was for personal use. Salaries and wages include Sh.30,000 paid to Amani's daughter for assisting in the business during the school holidays. Rent analysis: 4. 80,000 80,000 120,000 40,000 8,000 6,000 5,000 12,000 55,000 Payment for Partners residence Sh. 80,000 Business Sh.100,000 5. Legal costs included a payment of Sh.15,000 paid to an arbitrator to settle a personal dispute between Kigen and Morris. 6. 7. 8. Bad debt analysis: General provision Specific provision Written-off Amani's son (defaulter) Advertising: Advertising campaign Cost of new sign board Sale of clothes Amani's birthday expenses Other incomes (included in trading profit) Dividends from shares KCB Ltd. Sh. 10,000 12,000 28,000 Rental income: sub-letting business premises Gain on sale of furniture 8,000 10,000 40,000 Sh. 5,000 9,000 23,000 65,000 Sh. 19,000 22,000 13,000 54,000 Required: (a) Taxable income (loss) for the partnership business and distribution among the partners for 2018 if they share profits and losses in the ratio 2:1:1. (b) 1828 Determine the taxable income of each partner. B I

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

A Amani Kigen Morris Partnership Taxable Income loss for year 2018 Ksh Reported Net profit 208000000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started