Answered step by step

Verified Expert Solution

Question

1 Approved Answer

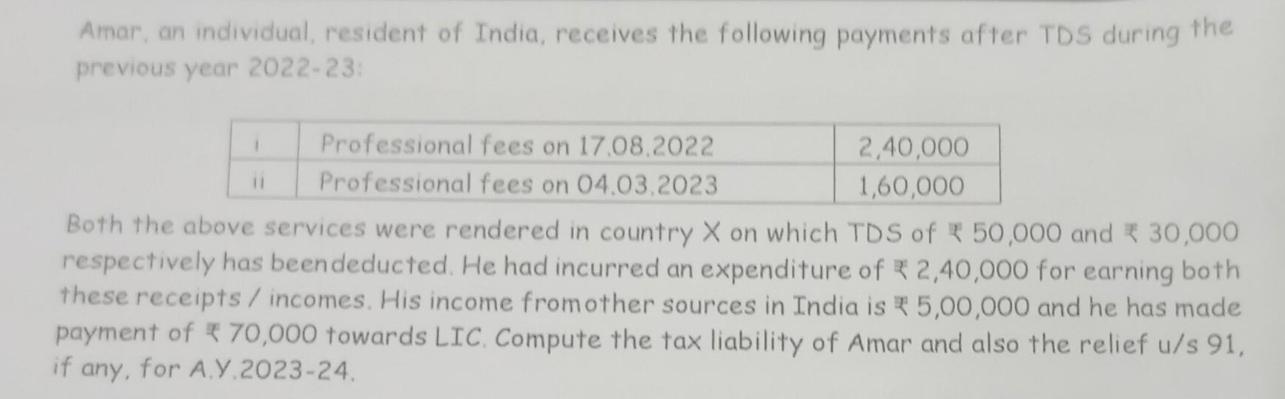

Amar, an individual, resident of India, receives the following payments after TDS during the previous year 2022-23: 11 Professional fees on 17.08.2022 Professional fees

Amar, an individual, resident of India, receives the following payments after TDS during the previous year 2022-23: 11 Professional fees on 17.08.2022 Professional fees on 04.03,2023 2,40,000 1,60,000 Both the above services were rendered in country X on which TDS of * 50,000 and 30,000 respectively has been deducted. He had incurred an expenditure of 2,40,000 for earning both these receipts/ incomes. His income from other sources in India is payment of 70,000 towards LIC. Compute the tax liability of Amar and also the relief u/s 91, if any, for A.Y.2023-24. 5,00,000 and he has made

Step by Step Solution

★★★★★

3.49 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

The image displays a question about computing the tax liability for a resident of India named Amar for the Assessment Year AY 202324 The question prov...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started