Question

Amazon Echo and Google Home are two of the market leaders in the rapidly growing digital personal assistant product category. Ophelia is a brand manager

Amazon Echo and Google Home are two of the market leaders in the rapidly growing digital personal assistant product category. Ophelia is a brand manager for a smaller consumer electronics firm that has been competing for market share with its digital personal assistant, the Russell. While the product has not yet achieved the widespread success of the market leaders, sales for the Russell have increased by an average of 40 percent per year in recent years.

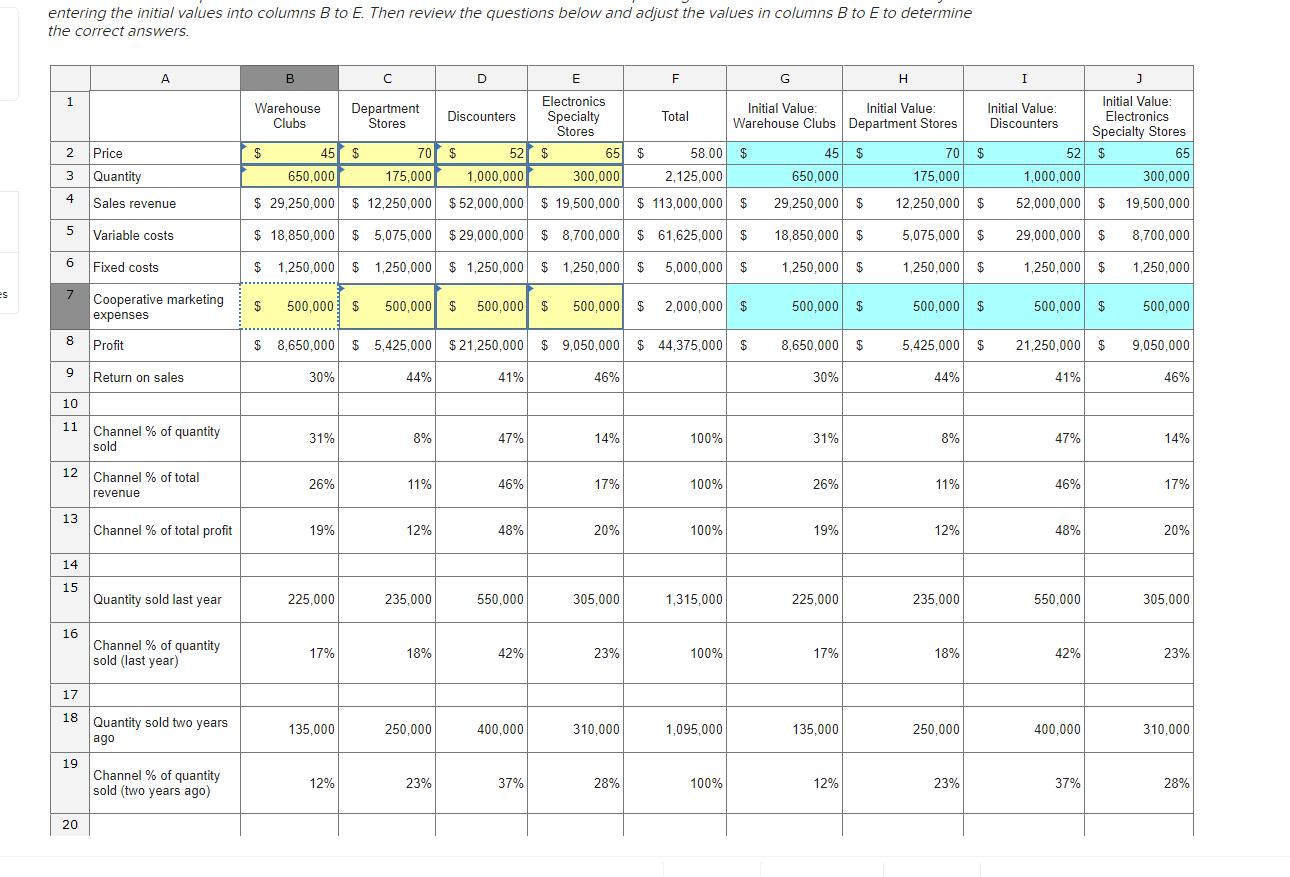

Ophelia's boss attributes the product's early success to his distribution strategy of making sure the Russell is readily available in wholesale clubs, department stores, discount stores, and specialty electronic stores. Traditionally, cooperative marketing funding has been split equally between the four distribution channels with each receiving $500,000 in support. Each of the four distributors pays a different price to the manufacturer based primarily on purchase volume and channel power.

Ophelia has been evaluating the Russell's distribution strategy and thinks that there is room for improvement. She knows that if she is going to convince her boss to change his strategy, she is going to have to speak his language—marketing metrics. To help her with the evaluation, she gathers data from the Russell's last three years of sales.

The goal of this activity is to understand how channel choice affects a firm's sales and profitability using sales and profitability data.

Use the spreadsheet provided to help answer the questions that follow. The spreadsheet fields highlighted in yellow can be changed in order to determine possible outcomes. You can find the initial values in the corresponding blue cells in columns G to J. Start by entering the initial values into columns B to E. Then review the questions below and adjust the values in columns B to E to determine the correct answers.

1. Ophelia begins her analysis by identifying which channel generated the most profit from sales of the Russell. Which distribution channel generated the most profit this year?

A. department store

B. electronics specality stores

C. discounters

D.warehouse clubs

E. all channels generate profit equally

2. As she digs deeper into the data, Ophelia realizes that while discounters do have a high profit level, discounters are quite low in terms of return on sales. How can this be explained?

A. Discounters only pay $52 for the Russell with a 41 percent return on sales.

B. Return on sales is calculated based on sales volume, not profit.

C. Discounters have larger fixed costs than the other channels.

D. The price that discounters pay for the Russell is lower than any other channel.

E. Discounters have proportionally higher variable costs.

3. Ophelia has begun to convince her boss that cooperative marketing support should not be allocated evenly across all four distribution channels. Her boss suggests that they allocate the largest proportion of the marketing support to electronics specialty stores. Do you agree with this recommendation?

A. Yes, because electronics specialty stores generate the largest percentage of the firm's revenue.

B. No, because electronics specialty stores fixed costs are too high.

C. Yes, because increasing cooperative marketing support will result in more sales.

D. No, because electronics specialty stores do not generate a sufficiently high return on sales.

E. No, because the proportion of sales generated from electronic specialty stores has been declining over the past three years.

4. Ophelia thinks they should reallocate $250,000 in cooperative marketing expense from both warehouse clubs and specialty stores to discounters, which she projects would result in a 30 percent sales increase in the discounter channel. Additionally, she feels they could charge a $60 price to discounters with the additional advertising. What would the new discounter channel percentage of total profit be after the change?

A. 47%

B. 54%

C. 42%

D. 56%

E. 62%

5. Starting with the initial values for the channels, assume that the current sales for warehouse clubs never reach 650,000 and only hit 500,000. The firm's goal is to achieve a 39 percent return on sales in each distribution channel. What modifications to price and marketing expense would help the firm reach its goal?

A. Keep the price at $45, but decrease the cooperative marketing expense to $250,000

B. Increase the price to $49 and decrease the cooperative marketing expense to $350,000

C. Increase the price to $53, but keep the cooperative marketing expense at $500,000

D. Increase the price to $54 and decrease the cooperative marketing expense to $200,000

E. Increase the price to $50 and decrease the cooperative marketing expense to $300,000

es entering the initial values into columns B to E. Then review the questions below and adjust the values in columns B to E to determine the correct answers. 1 2 Price 3 4 5 6 7 8 9 13 10 11 Channel % of quantity sold 14 15 12 Channel % of total revenue 16 A Quantity Sales revenue Variable costs 19 Fixed costs Cooperative marketing expenses Profit Return on sales 20 Channel % of total profit Quantity sold last year 17 18 Quantity sold two years ago Channel % of quantity sold (last year) Channel % of quantity sold (two years ago) B Warehouse Clubs $ 45 $ 30% 31% 26% 19% 52 $ 1,000,000 58.00 $ 2,125,000 650,000 $ 29,250,000 $12,250,000 $52,000,000 $19,500,000 $ 113,000,000 $ $ 18,850,000 $5,075,000 $29,000,000 $8,700,000 $ 61,625,000 $ $ 1,250,000 $1,250,000 $1,250,000 $1,250,000 $ 5,000,000 $ $ 500,000 $ 500,000 $ 500,000 $ 500,000 $ 225,000 17% Department Stores 135,000 12% 70 $ 175,000 $ 8,650,000 $5,425,000 $21,250,000 $9,050,000 $ 44,375,000 $ 44% 8% 11% 12% 235,000 18% D Discounters 250,000 23% 41% 47% 46% 48% 550,000 42% E Electronics Specialty Stores 400,000 37% 65 $ 300,000 46% 14% 17% 20% 305,000 23% F 310,000 Total 28% 2,000,000 $ 100% 100% 100% 1,315,000. 100% Initial Value: Warehouse Clubs 1,095,000 100% G 45 $ 650,000 29,250,000 $ 18,850,000 $ 1,250,000 $ 500,000 $ 8,650,000 $ 30% 31% 26% 19% 225,000 Initial Value: Department Stores 17% 135,000 12% H 70 $ 175,000 12,250,000 $ 5,075,000 $ 1,250,000 $ 500,000 $ 5,425,000 $ 44% 8% 11% 12% 235,000 18% 250,000 23% J Initial Value: Electronics Specialty Stores 52 $ 65 1,000,000 300,000 52,000,000 $ 19,500,000. 8,700,000. 29,000,000 $ 1,250,000 $ Initial Value: Discounters 500,000 $ 21,250,000 $ 41% 47% 46% 48% 550,000 42% 400,000 37% 1,250,000 500,000 9,050,000 46% 14% 17% 20% 305,000 23% 310,000 28%

Step by Step Solution

3.27 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below D warehouse clubs Warehouse clubs gener...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started