Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Amazon is one of the largest companies in the world, but it has never paid a dividend. Netflix does not pay a dividend but

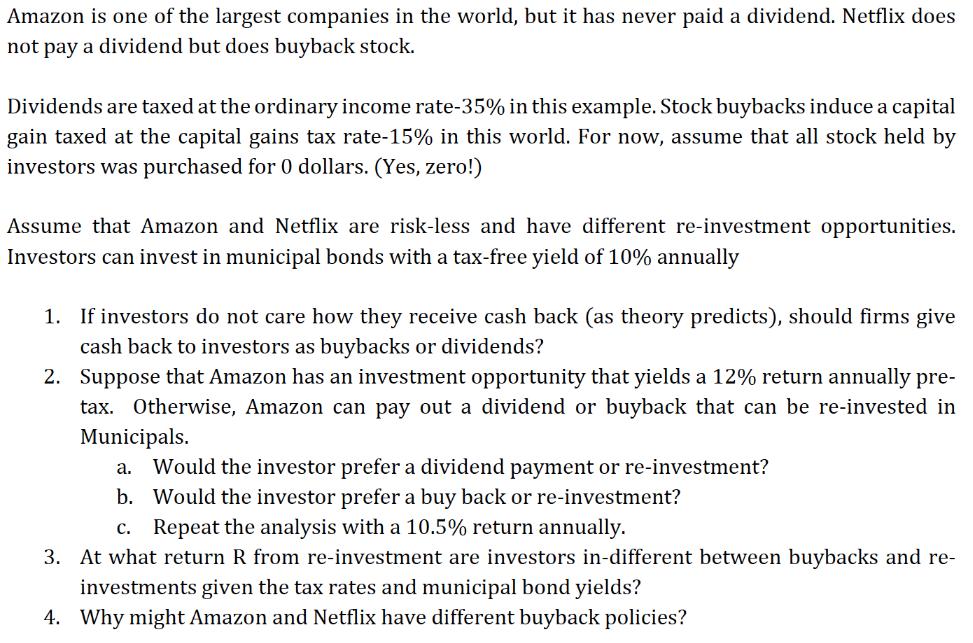

Amazon is one of the largest companies in the world, but it has never paid a dividend. Netflix does not pay a dividend but does buyback stock. Dividends are taxed at the ordinary income rate-35% in this example. Stock buybacks induce a capital gain taxed at the capital gains tax rate-15% in this world. For now, assume that all stock held by investors was purchased for 0 dollars. (Yes, zero!) Assume that Amazon and Netflix are risk-less and have different re-investment opportunities. Investors can invest in municipal bonds with a tax-free yield of 10% annually 1. If investors do not care how they receive cash back (as theory predicts), should firms give cash back to investors as buybacks or dividends? 2. Suppose that Amazon has an investment opportunity that yields a 12% return annually pre- tax. Otherwise, Amazon can pay out a dividend or buyback that can be re-invested in Municipals. a. Would the investor prefer a dividend payment or re-investment? b. Would the investor prefer a buy back or re-investment? c. Repeat the analysis with a 10.5% return annually. 3. At what return R from re-investment are investors in-different between buybacks and re- investments given the tax rates and municipal bond yields? 4. Why might Amazon and Netflix have different buyback policies?

Step by Step Solution

★★★★★

3.33 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Do stock repurchases boost dividends Instead of increasing dividend payments extra cash might be utilized to repurchase business stock allowing owners to defer capital gains as share prices rise Histo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started