Question

Amazon practice SEC tutoring example: 1.Read the Notes to the Financial Statements (FS) for your SEC 10-K company. 2.These notes are displayed after the financial

Amazon practice SEC tutoring example:

1.Read the Notes to the Financial Statements (FS) for your SEC 10-K company.

2.These "notes" are displayed after the financial statements.

3.Then make an example for practice and answer all of the following questions and do not cut and paste from the company SEC report.

Use the company Amazon for this practice. Below is the SEC link:

SEC Page: https://www.sec.gov/Archives/edgar/data/1018724/000101872419000004/amzn-20181231x10k.htm

Note 1includes accounting information. What is the fiscal year for your SEC 10-K Company? This may be June 30 each year, or it may be the Sunday closest to the last day of January, or some other description.

Inventory:How is Inventory described for your SEC 10-K company? LIFO, FIFO, and/or average cost? Relate your answer to topics in our course.

Income Statement:Is it a single-step or multi-step income statement?

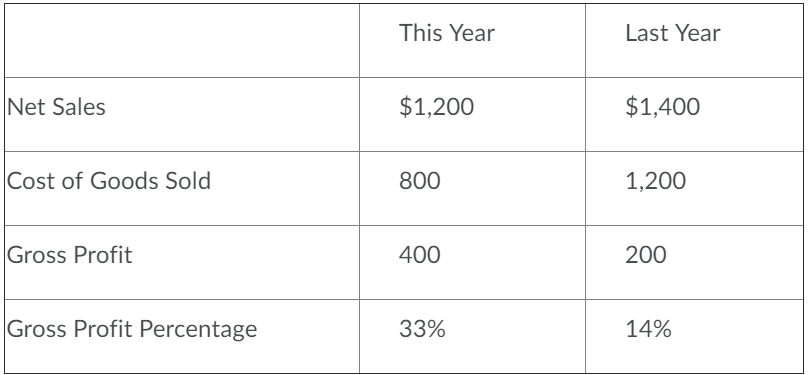

Calculate theGross Profitand theGross Profit Percentagefor this year and last year, creating a small table, such as the following in the attached picture.

In the example above, sales decreased, gross profit increased, and the gross profit percentage increased. Therefore, sales are more profitable. We made 33 cents of gross profit on every dollar of sales this year, but only 14 cents of gross profit on every dollar of sales last year. Sales decreased, but sales are actually generating more profit overall, both as an absolute dollar value and as a percentage.

2. Your description may be different, but these are comments you might make for this posting and in your SEC 10-K paper and project.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started